Banking Services

... Loans (More money out than in) ◦ Lending helps economy function, money in hands of consumers increases demand, money in investors’ hands leads to more businesses ◦ Banks loose money if borrowers default on loans, do not pay back ...

... Loans (More money out than in) ◦ Lending helps economy function, money in hands of consumers increases demand, money in investors’ hands leads to more businesses ◦ Banks loose money if borrowers default on loans, do not pay back ...

sia perspectives - Stegner Investment Associates, Inc.

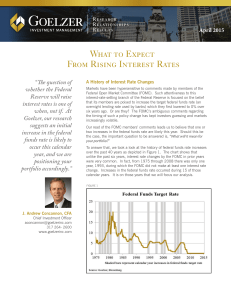

... The European Central Bank (ECB) announced a quantitative easing program in January and then launched its bond buying in early March. With this increased demand, prices moved higher and yields on European debt fell to all-time lows. In turn, the benchmark U.S. 10-year Treasury issue looked relatively ...

... The European Central Bank (ECB) announced a quantitative easing program in January and then launched its bond buying in early March. With this increased demand, prices moved higher and yields on European debt fell to all-time lows. In turn, the benchmark U.S. 10-year Treasury issue looked relatively ...

Enflasyon Faiz İlişksi Üzerine - EAF

... ◦ But this is obviously a partial analysis; not taking into consideration the other parts of the economy. Also, the firm may play with q or reduce profit (or profitability) level in response to increase in i. ...

... ◦ But this is obviously a partial analysis; not taking into consideration the other parts of the economy. Also, the firm may play with q or reduce profit (or profitability) level in response to increase in i. ...

Debt Market Monitor

... of 67 economists showed that all predicted that inflation would be higher in six months. In fact, rates fell sharply. At the onset of the financial crisis in 2007, the Fed’s official target rate was 5.25%. Recently, the board of governors’ median forecast for the Fed funds rate over the longer term ...

... of 67 economists showed that all predicted that inflation would be higher in six months. In fact, rates fell sharply. At the onset of the financial crisis in 2007, the Fed’s official target rate was 5.25%. Recently, the board of governors’ median forecast for the Fed funds rate over the longer term ...

GLOSSARY • Risk Assets Acceptance Criteria (RAAC)

... The difference in the total cost of the project and the loan amount sanctioned is the margin amount. This money has to be invested by the borrower of the property prior to the release of the loan amount in case of construction of a house. In case it is for purchase of a house, then the loan amount w ...

... The difference in the total cost of the project and the loan amount sanctioned is the margin amount. This money has to be invested by the borrower of the property prior to the release of the loan amount in case of construction of a house. In case it is for purchase of a house, then the loan amount w ...

Fractions and Decimals

... Money deposited into a bank account is called the principal. The bank pays interest on the money for as long as it is in the bank. Simple interest is calculated based on the principal. The formula used to calculate the amount of simple interest earned is I = prt. The interest is represented by I, p ...

... Money deposited into a bank account is called the principal. The bank pays interest on the money for as long as it is in the bank. Simple interest is calculated based on the principal. The formula used to calculate the amount of simple interest earned is I = prt. The interest is represented by I, p ...

Saving and Capital Formation

... with $ 25,000 profit) It will pay to build the second ($ 70,000 minus $ 55,000 interest costs leaves you with another $ 15,000 for $ 40,000 total profit from screens 1 and 2. The third will bring $ 5,000 more profit; but the fourth would require additional interest costs of $ 55,000 and would bring ...

... with $ 25,000 profit) It will pay to build the second ($ 70,000 minus $ 55,000 interest costs leaves you with another $ 15,000 for $ 40,000 total profit from screens 1 and 2. The third will bring $ 5,000 more profit; but the fourth would require additional interest costs of $ 55,000 and would bring ...

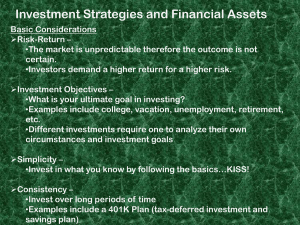

Investment Strategies and Financial Assets

... etc. •Different investments require one to analyze their own circumstances and investment goals Simplicity – •Invest in what you know by following the basics…KISS! Consistency – •Invest over long periods of time •Examples include a 401K Plan (tax-deferred investment and savings plan) ...

... etc. •Different investments require one to analyze their own circumstances and investment goals Simplicity – •Invest in what you know by following the basics…KISS! Consistency – •Invest over long periods of time •Examples include a 401K Plan (tax-deferred investment and savings plan) ...

The “Unknown Unknowns”: Risks of Higher Public Debt Levels in

... Armenio Fraga: “We are moving toward more complete markets. Presumably, this is a good thing... risk is going where it belongs.... Banks in the old days were paid to grow their loan books. I can’t think of a worse incentive.... Investment managers today, however risky their businesses may be, tend t ...

... Armenio Fraga: “We are moving toward more complete markets. Presumably, this is a good thing... risk is going where it belongs.... Banks in the old days were paid to grow their loan books. I can’t think of a worse incentive.... Investment managers today, however risky their businesses may be, tend t ...

2017 MSW BW Public EP - Credit

... When you take out a loan, you repay the principal, which is the amount borrowed, plus interest, the amount charged for lending you money. BOTTOM LINE: Those who know about interest, earn it; those who don’t, pay it ...

... When you take out a loan, you repay the principal, which is the amount borrowed, plus interest, the amount charged for lending you money. BOTTOM LINE: Those who know about interest, earn it; those who don’t, pay it ...

Discussion of External Constraints on Monetary Policy and the Financial Accelerator

... • Could compute just household welfare • The number is likely to be small (under 0.5%) • Paper only discusses output contractions. Output ...

... • Could compute just household welfare • The number is likely to be small (under 0.5%) • Paper only discusses output contractions. Output ...

Federal Reserve System

... people to borrow and spend money and banks to lend more. It increases consumption, which is part of how we measure the economy’s growth. ▫ it sets a basic interest rate that governs how much banks pay to borrow from the Fed. increasing federal spending and/or reducing taxes can promote more employ ...

... people to borrow and spend money and banks to lend more. It increases consumption, which is part of how we measure the economy’s growth. ▫ it sets a basic interest rate that governs how much banks pay to borrow from the Fed. increasing federal spending and/or reducing taxes can promote more employ ...

NEW YORK – I wrote at the beginning of January that economic

... medium-size enterprises (SMEs) that are willing to borrow couldn’t get access to credit before the ECB went negative, and they can’t now. Simply put, most firms – and especially SMEs – can’t borrow easily at the T-bill rate. They don’t borrow on capital markets. They borrow from banks. And there is ...

... medium-size enterprises (SMEs) that are willing to borrow couldn’t get access to credit before the ECB went negative, and they can’t now. Simply put, most firms – and especially SMEs – can’t borrow easily at the T-bill rate. They don’t borrow on capital markets. They borrow from banks. And there is ...

Chapter 8: Wages, Rent, Profit, and Interest

... The employer tactic of barring workers from the workplace ...

... The employer tactic of barring workers from the workplace ...

8.3 Credit Terms

... Credit Terms Annual Percentage Rate (APR) describe the interest rate for a whole year rather than a monthly interest rate on a loan. Credit Rating - evaluates the credit worthiness of an issuer of specific types of debt, specifically, debt issued by a business enterprise such as a corporation or ...

... Credit Terms Annual Percentage Rate (APR) describe the interest rate for a whole year rather than a monthly interest rate on a loan. Credit Rating - evaluates the credit worthiness of an issuer of specific types of debt, specifically, debt issued by a business enterprise such as a corporation or ...

Interest

Interest is money paid by a borrower to a lender for a credit or a similar liability. Important examples are bond yields, interest paid for bank loans, and returns on savings. Interest differs from profit in that it is paid to a lender, whereas profit is paid to an owner. In economics, the various forms of credit are also referred to as loanable funds.When money is borrowed, interest is typically calculated as a percentage of the principal, the amount owed to the lender. The percentage of the principal that is paid over a certain period of time (typically a year) is called the interest rate. Interest rates are market prices which are determined by supply and demand. They are generally positive because loanable funds are scarce.Interest is often compounded, which means that interest is earned on prior interest in addition to the principal. The total amount of debt grows exponentially, and its mathematical study led to the discovery of the number e. In practice, interest is most often calculated on a daily, monthly, or yearly basis, and its impact is influenced greatly by its compounding rate.