OnPoint—Strategies to benefit from rising rates

... Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index composed of securities from the Barclays Government/Corporate Bond Index, Mortgage-Backed Securities Index and the Asset-Backed Securities Index. Total return comprises price appreciation/depreciation and income as a percentage of th ...

... Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index composed of securities from the Barclays Government/Corporate Bond Index, Mortgage-Backed Securities Index and the Asset-Backed Securities Index. Total return comprises price appreciation/depreciation and income as a percentage of th ...

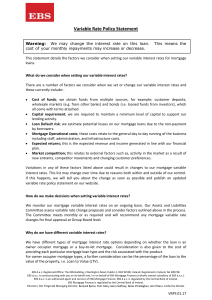

here - EBS

... Variations in any of these factors listed above could result in changes to our mortgage variable interest rates. This list may change over time due to reasons both within and outside of our control. If this happens, we will tell you about the change as soon as possible and publish an updated variabl ...

... Variations in any of these factors listed above could result in changes to our mortgage variable interest rates. This list may change over time due to reasons both within and outside of our control. If this happens, we will tell you about the change as soon as possible and publish an updated variabl ...

Common Error - Frost Middle School

... (d) Assume the United States trades with Japan. Draw a correctly labeled graph of the foreign exchange market for the United States dollar. Based on your indicated change in real output in part (b), show and explain how the supply of the United States dollar will be affected in the foreign exchange ...

... (d) Assume the United States trades with Japan. Draw a correctly labeled graph of the foreign exchange market for the United States dollar. Based on your indicated change in real output in part (b), show and explain how the supply of the United States dollar will be affected in the foreign exchange ...

8. Non-current liabilities- bonds

... the old bondholders don=t care about the bond=s book value; they demand consideration equal to its market value. The entry is: DR CR Old B/P - NBV ...

... the old bondholders don=t care about the bond=s book value; they demand consideration equal to its market value. The entry is: DR CR Old B/P - NBV ...

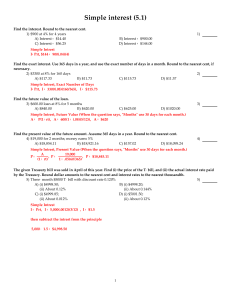

Simple interest (5.1)

... The given Treasury bill was sold in April of this year. Find (i) the price of the T-bill, and (ii) the actual interest rate paid by the Treasury. Round dollar amounts to the nearest cent and interest rates to the nearest thousandth. 5) Three-month $5000 T-bill with discount rate 0.120% ...

... The given Treasury bill was sold in April of this year. Find (i) the price of the T-bill, and (ii) the actual interest rate paid by the Treasury. Round dollar amounts to the nearest cent and interest rates to the nearest thousandth. 5) Three-month $5000 T-bill with discount rate 0.120% ...

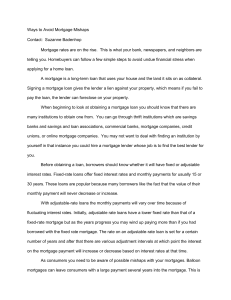

Mortgages

... Consumers who take a 15-year mortgage have higher monthly payments, but save money in total interest paid over the life of the mortgage. You will save the interest money you would have spent in that extra 15 years of payments. Compare terms and interest rates when shopping for a mortgage. It is usua ...

... Consumers who take a 15-year mortgage have higher monthly payments, but save money in total interest paid over the life of the mortgage. You will save the interest money you would have spent in that extra 15 years of payments. Compare terms and interest rates when shopping for a mortgage. It is usua ...

Lecture 6 Chapter 5 PPT

... Everything Else Remaining Equal (?) • Also, over time, can get a Price Level effect. A rise in the price level causes demand curve for money to shift to the right which will cause interest rates to rise. ...

... Everything Else Remaining Equal (?) • Also, over time, can get a Price Level effect. A rise in the price level causes demand curve for money to shift to the right which will cause interest rates to rise. ...

Word

... worsening of economic situation in the CR in years 2008 and 2009, where it basically remained till today. The share of non-performing loans did not decrease even in 2014 and 2015, when the economy was evidently flourishing. If we however study the detailed structure more, it becomes apparent, that a ...

... worsening of economic situation in the CR in years 2008 and 2009, where it basically remained till today. The share of non-performing loans did not decrease even in 2014 and 2015, when the economy was evidently flourishing. If we however study the detailed structure more, it becomes apparent, that a ...

Hedging Prepayment Risk on Retail Mortgages

... How to finance a mortgage and why is there prepayment risk? When a customer acquires a mortgage loan, he or she usually borrows money for a long period of time, say 10 years. Moreover he will have to pay a fixed interest rate for the entire period. In order to fund this mortgage the bank could issue ...

... How to finance a mortgage and why is there prepayment risk? When a customer acquires a mortgage loan, he or she usually borrows money for a long period of time, say 10 years. Moreover he will have to pay a fixed interest rate for the entire period. In order to fund this mortgage the bank could issue ...

NIH-SFI Disclosure Form

... proposed PHS-funded research and a conflict does not exist. A significant financial interest was disclosed and I will defer to the ORA to determine whether the SFI is a financial conflict of interest and if it is related to this project. ...

... proposed PHS-funded research and a conflict does not exist. A significant financial interest was disclosed and I will defer to the ORA to determine whether the SFI is a financial conflict of interest and if it is related to this project. ...

15 Mosec

... Outcome of Mosec I • Significant reduction in overall cost of funding: – Cost to MFI reduced between 200 to 500 bps. – As investors understand the sector better, rates are expected to drop even further. • Opening up new sources of funding: – The senior tranche was purchased by the treasury departme ...

... Outcome of Mosec I • Significant reduction in overall cost of funding: – Cost to MFI reduced between 200 to 500 bps. – As investors understand the sector better, rates are expected to drop even further. • Opening up new sources of funding: – The senior tranche was purchased by the treasury departme ...

YEARNING FOR YIELD

... The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful. Because of their narrow focus, specialty sector investing, such as healthcare, financials, or energy, will be subject to greater volatility tha ...

... The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful. Because of their narrow focus, specialty sector investing, such as healthcare, financials, or energy, will be subject to greater volatility tha ...

ECON 2105H

... 11 of Landsburg to explain why you should be indifferent between these two options for financing your automobile purchase. With each option, you end up with the same thing next year. If you borrow the money to buy the car, you must pay back $10,500 next year. But you will keep your $10,000 in your s ...

... 11 of Landsburg to explain why you should be indifferent between these two options for financing your automobile purchase. With each option, you end up with the same thing next year. If you borrow the money to buy the car, you must pay back $10,500 next year. But you will keep your $10,000 in your s ...

Stock Market Analysis and Personal Finance Mr. Bernstein Bonds

... maturity date. Face value = final payout ( ~ loan amount) Bonds are traded Over the Counter (OTC) – there is no meaningful exchange ...

... maturity date. Face value = final payout ( ~ loan amount) Bonds are traded Over the Counter (OTC) – there is no meaningful exchange ...

Less Than Zero: The Brave New World of Negative Interest Rates

... from Amazon. So I have a checking account, a credit card, a debit card. It’s possible interest rates could go a bit negative even at the retail level, and people would hold onto those accounts for convenience. In a sense, that’s already happening. People who open checking accounts today are getting ...

... from Amazon. So I have a checking account, a credit card, a debit card. It’s possible interest rates could go a bit negative even at the retail level, and people would hold onto those accounts for convenience. In a sense, that’s already happening. People who open checking accounts today are getting ...

So what does QE mean to me and my money?

... As I said earlier, inflation is usually seen when an economy is growing and this typically leads to market expectations of a rise in interest rates in the future. This expectation will normally lead to more demand for that currency, which means its price will go up and we see the resultant strength ...

... As I said earlier, inflation is usually seen when an economy is growing and this typically leads to market expectations of a rise in interest rates in the future. This expectation will normally lead to more demand for that currency, which means its price will go up and we see the resultant strength ...

Chapter 18

... These periods were characterized by at least one of two factors: (1) unusually stringent conditions across an array of financial markets, or; (2) deflationary worries associated with the zero bound (or zero floor) for interest rates. Since both factors apply to the most recent period, it is useful t ...

... These periods were characterized by at least one of two factors: (1) unusually stringent conditions across an array of financial markets, or; (2) deflationary worries associated with the zero bound (or zero floor) for interest rates. Since both factors apply to the most recent period, it is useful t ...

Assessment pdf

... ο Does the teen provide similarities and differences between banks and credit unions? Use the following descriptions as a guide: ♦ A bank is a for-profit company that is in the business of taking deposits, lending and providing other financial services. There are different kinds of banks, including ...

... ο Does the teen provide similarities and differences between banks and credit unions? Use the following descriptions as a guide: ♦ A bank is a for-profit company that is in the business of taking deposits, lending and providing other financial services. There are different kinds of banks, including ...

Ch27 Solations Brigham 10th E

... conduct transactions throughout Europe and the rest of the world. An international bond is any bond sold outside of the country of the borrower. There are two types of international bonds: Eurobonds and foreign bonds. A Eurobond is any bond sold in some country other than the one in whose currency t ...

... conduct transactions throughout Europe and the rest of the world. An international bond is any bond sold outside of the country of the borrower. There are two types of international bonds: Eurobonds and foreign bonds. A Eurobond is any bond sold in some country other than the one in whose currency t ...

We analyze the business-cycle dynamics of commercial bank

... increase during recessions and decrease during economic expansions—and the reason for this is that loan markups (over some benchmark interest rate) have a marked countercyclical component. The baseline hypothesis is based on the financial accelerator theory developed by Bernanke et al. (1996) and Ki ...

... increase during recessions and decrease during economic expansions—and the reason for this is that loan markups (over some benchmark interest rate) have a marked countercyclical component. The baseline hypothesis is based on the financial accelerator theory developed by Bernanke et al. (1996) and Ki ...

Bond Interest Payments Mason Company Investors

... payments) has the following effect on Mason’s financial statements: Assets ...

... payments) has the following effect on Mason’s financial statements: Assets ...

Recovered File 1

... There should be no problem. The interest rate may be calculated for any period of time. These periods usually range from a day (overnight) to multiple years (30 year loan). Each rate is calculated exactly the same. Example: I borrowed $100 from my son and have agreed to pay him $110 in exactly 3 mon ...

... There should be no problem. The interest rate may be calculated for any period of time. These periods usually range from a day (overnight) to multiple years (30 year loan). Each rate is calculated exactly the same. Example: I borrowed $100 from my son and have agreed to pay him $110 in exactly 3 mon ...

Banking

... …Financial Services Payment Services Checking Accounts Demand deposit $$$ you put into a checking account ...

... …Financial Services Payment Services Checking Accounts Demand deposit $$$ you put into a checking account ...

Interest

Interest is money paid by a borrower to a lender for a credit or a similar liability. Important examples are bond yields, interest paid for bank loans, and returns on savings. Interest differs from profit in that it is paid to a lender, whereas profit is paid to an owner. In economics, the various forms of credit are also referred to as loanable funds.When money is borrowed, interest is typically calculated as a percentage of the principal, the amount owed to the lender. The percentage of the principal that is paid over a certain period of time (typically a year) is called the interest rate. Interest rates are market prices which are determined by supply and demand. They are generally positive because loanable funds are scarce.Interest is often compounded, which means that interest is earned on prior interest in addition to the principal. The total amount of debt grows exponentially, and its mathematical study led to the discovery of the number e. In practice, interest is most often calculated on a daily, monthly, or yearly basis, and its impact is influenced greatly by its compounding rate.