Understanding Essential Economics Assignment

... 2.75, in what year is real GDP greater? By how much? How did you arrive at this conclusion? Show all work and fully explain your reasoning. Now consider the following information for the U.S.: During 2004, consumption expenditures increased by $13.5 billion, gross private domestic investment increas ...

... 2.75, in what year is real GDP greater? By how much? How did you arrive at this conclusion? Show all work and fully explain your reasoning. Now consider the following information for the U.S.: During 2004, consumption expenditures increased by $13.5 billion, gross private domestic investment increas ...

Monetary-Policy

... • The Bank of England buys bonds from private sector financial firms, such as pension funds, using money it has created electronically (it credits the seller’s account). Creating money increases the money supply. QE has 3 main effects: – The price of these bonds increases. This means yields fall whi ...

... • The Bank of England buys bonds from private sector financial firms, such as pension funds, using money it has created electronically (it credits the seller’s account). Creating money increases the money supply. QE has 3 main effects: – The price of these bonds increases. This means yields fall whi ...

The Federal Reserve and Monetary Policy

... Federal Reserve Bank serves as the CENTRAL bank for the United States. The Federal Reserve Bank is commonly called “the Fed.” ...

... Federal Reserve Bank serves as the CENTRAL bank for the United States. The Federal Reserve Bank is commonly called “the Fed.” ...

FedViews

... A strengthening labor market is a crucial underpinning for developing a strong, self-sustaining economic recovery. The March jobs report posted a healthy payroll employment gain of 192,000. Clearly, the job market has shrugged off the adverse effects of the winter weather. Averaging over the past si ...

... A strengthening labor market is a crucial underpinning for developing a strong, self-sustaining economic recovery. The March jobs report posted a healthy payroll employment gain of 192,000. Clearly, the job market has shrugged off the adverse effects of the winter weather. Averaging over the past si ...

Short Answers

... funds are then loaned out to retail borrowers or invested in financial instruments or deposited at the central bank. Wholesale banks take very large cash deposits and broker very large loans both for banks and other commercial companies. Wholesale banks are sometimes also referred to as investment b ...

... funds are then loaned out to retail borrowers or invested in financial instruments or deposited at the central bank. Wholesale banks take very large cash deposits and broker very large loans both for banks and other commercial companies. Wholesale banks are sometimes also referred to as investment b ...

Personal Finance CEP

... EDUCATION Higher levels of education equals increase in income, and a lower chance of being unemployed ...

... EDUCATION Higher levels of education equals increase in income, and a lower chance of being unemployed ...

Macro Last Minute Review Student Blank

... Bank T Accounts and Money Creation For each bank, assets must equal DD = RR = ER = Loans = To create new DDs in the banking system multiply ER times Phillips Curves During the normal business cycle, one moves points on If there is a supply shock, then move Phillips’ initial analysis assumed an inver ...

... Bank T Accounts and Money Creation For each bank, assets must equal DD = RR = ER = Loans = To create new DDs in the banking system multiply ER times Phillips Curves During the normal business cycle, one moves points on If there is a supply shock, then move Phillips’ initial analysis assumed an inver ...

Monetary Policy - ais

... RBA is altering its stance. The cash rate is the interest rate paid on funds in the overnight money market. The cash rate is determined by the supply of money and the demand for overnight money. ...

... RBA is altering its stance. The cash rate is the interest rate paid on funds in the overnight money market. The cash rate is determined by the supply of money and the demand for overnight money. ...

Harvey`s Investment Review

... Federal Reserve Act: is an Act of Congress that created and set up the Federal Reserve System, the central banking system of the United States of America, and granted it the legal authority to issue Federal Reserve Notes (now commonly known as the U.S. Dollar) and Federal Reserve Bank Notes as legal ...

... Federal Reserve Act: is an Act of Congress that created and set up the Federal Reserve System, the central banking system of the United States of America, and granted it the legal authority to issue Federal Reserve Notes (now commonly known as the U.S. Dollar) and Federal Reserve Bank Notes as legal ...

Canada`s Money Supply

... Interest rates influence money supply Commercial banks and other financial institutions provide most of the assets used as money through loans made to individuals and businesses. In that sense, financial institutions create, or can create money. The Bank of Canada manages the rate of money growth in ...

... Interest rates influence money supply Commercial banks and other financial institutions provide most of the assets used as money through loans made to individuals and businesses. In that sense, financial institutions create, or can create money. The Bank of Canada manages the rate of money growth in ...

ECON 404: Lecture on Deflation

... • Demand-led deflation: AD decreases, both real GDP and P decrease —> recession + disinflation or deflation • Supply-led deflation: LRAS increases, real GDP increases but P decreases. Depending on slope of SRAS, P may not fall much, and SRAS shifts down when expectations adjust. Inflation: • Inflati ...

... • Demand-led deflation: AD decreases, both real GDP and P decrease —> recession + disinflation or deflation • Supply-led deflation: LRAS increases, real GDP increases but P decreases. Depending on slope of SRAS, P may not fall much, and SRAS shifts down when expectations adjust. Inflation: • Inflati ...

personal finance - De Smet Jesuit High School

... and interest rates are low. b. Interest rate: the price you pay to borrow money. c. Investments do better during low inflation because people are spending money on investing; thus driving stock prices up. d. To project inflation issues the best weapon is knowledge i. Pay attention to financial news ...

... and interest rates are low. b. Interest rate: the price you pay to borrow money. c. Investments do better during low inflation because people are spending money on investing; thus driving stock prices up. d. To project inflation issues the best weapon is knowledge i. Pay attention to financial news ...

Chapter 19: Money Creation

... Interest Rates?” You will learn how the Fed controls the money supply using its tools: (1) open market operations, (2) discount rate, and (3) the required reserve ratio. ...

... Interest Rates?” You will learn how the Fed controls the money supply using its tools: (1) open market operations, (2) discount rate, and (3) the required reserve ratio. ...

module 31 - Dpatterson

... The nominal interest rates rises The nominal interest rates falls. The nominal interest rate does not change Transaction demand for money falls Transaction demand for money rises ...

... The nominal interest rates rises The nominal interest rates falls. The nominal interest rate does not change Transaction demand for money falls Transaction demand for money rises ...

WAY THE FINANCIAL CRISIS OF 2007

... • The economy begins to be confronted with capital outflow; even domestic investors increased their buying of long-term overseas securities. This was creating problems in financing the current account deficit reaching roughly $800 billion per year. The USA must attract about $70 billion per month of ...

... • The economy begins to be confronted with capital outflow; even domestic investors increased their buying of long-term overseas securities. This was creating problems in financing the current account deficit reaching roughly $800 billion per year. The USA must attract about $70 billion per month of ...

U.S. Economy Presentation

... Reinvestment and Recovery Act, passed by Congress in February 2009 (Stimulus Package of $787 billion in gov’t spending & tax cuts) ...

... Reinvestment and Recovery Act, passed by Congress in February 2009 (Stimulus Package of $787 billion in gov’t spending & tax cuts) ...

ECONOMICS PRE-TEST Matching: 1. Products where the use of

... 41. Compared to stocks, bonds are a safer investment because A) they offer a higher rate of return B) dividends are calculated on the mature value C) interest on stocks must always be paid D) they get paid more than stockholders E) interest on bonds must always be paid 42. Which of the following cor ...

... 41. Compared to stocks, bonds are a safer investment because A) they offer a higher rate of return B) dividends are calculated on the mature value C) interest on stocks must always be paid D) they get paid more than stockholders E) interest on bonds must always be paid 42. Which of the following cor ...

Spring 2007

... 7) There is a sharp fall in investment spending. It would be possible to maintain the economy at its current output level by using any of the following measures except __________ government spending and __________ taxes. a) raising, raising b) lowering, lowering c) raising, lowering d) lowering, rai ...

... 7) There is a sharp fall in investment spending. It would be possible to maintain the economy at its current output level by using any of the following measures except __________ government spending and __________ taxes. a) raising, raising b) lowering, lowering c) raising, lowering d) lowering, rai ...

Homework 4 - I can be contacted at

... Match the correct definition to the word or phrase below 1. The speed with which an asset can be converted to currency 2. Currency held at a financial institutions in order to manage the demand for cash flows 3. The percentage of bank deposits a bank must keep on hand as required by the Federal Rese ...

... Match the correct definition to the word or phrase below 1. The speed with which an asset can be converted to currency 2. Currency held at a financial institutions in order to manage the demand for cash flows 3. The percentage of bank deposits a bank must keep on hand as required by the Federal Rese ...

bworld12050603 - Bureau of the Treasury

... bonds is part of the government’s strategy to develop local markets by giving small investors access to higher-yielding securities as well as to raise funds to finance its budgetary needs for 2004. The government wants to seize the opportunity to borrow while it is still relatively cheap to sell bon ...

... bonds is part of the government’s strategy to develop local markets by giving small investors access to higher-yielding securities as well as to raise funds to finance its budgetary needs for 2004. The government wants to seize the opportunity to borrow while it is still relatively cheap to sell bon ...

John J. Hardy - A wild ride awaits currencies in 2015

... the ECB in 2011-‐2012 (weak Euro) to the anticipation and reality of the first phase of Abenomics, which was really the Bank of Japan’s Kurodanomics, from late 2012 to early 2014 (weak Japanese yen). ...

... the ECB in 2011-‐2012 (weak Euro) to the anticipation and reality of the first phase of Abenomics, which was really the Bank of Japan’s Kurodanomics, from late 2012 to early 2014 (weak Japanese yen). ...

Fiscal and Monetary Policy

... What to do with a Surplus 1. Pay off public debt Buy back bonds Puts $ back into the system, increases consumption • May offset contractionary policy that created the surplus ...

... What to do with a Surplus 1. Pay off public debt Buy back bonds Puts $ back into the system, increases consumption • May offset contractionary policy that created the surplus ...

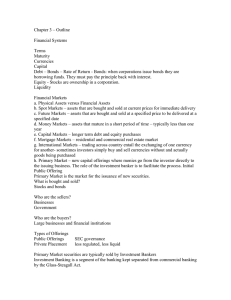

Chapter 3 – Outline

... Financial Markets a. Physical Assets versus Financial Assets b. Spot Markets – assets that are bought and sold at current prices for immediate delivery c. Future Markets – assets that are bought and sold at a specified price to be delivered at a specified date d. Money Markets – assets that mature i ...

... Financial Markets a. Physical Assets versus Financial Assets b. Spot Markets – assets that are bought and sold at current prices for immediate delivery c. Future Markets – assets that are bought and sold at a specified price to be delivered at a specified date d. Money Markets – assets that mature i ...

Government and our economy notes

... The Framers originally planned for the government to play a limited role in the country’s economy Framers established guidelines for a market economy ...

... The Framers originally planned for the government to play a limited role in the country’s economy Framers established guidelines for a market economy ...