What Are 401(k) Plans?

... Most investments offered under 401(k) plans today pool the money of a large number of individual investors. Pooling money makes it possible for individual participants to diversify investments, to benefit from economies of scale and to lower their transaction costs. These funds may invest in stocks, ...

... Most investments offered under 401(k) plans today pool the money of a large number of individual investors. Pooling money makes it possible for individual participants to diversify investments, to benefit from economies of scale and to lower their transaction costs. These funds may invest in stocks, ...

Diapositiva 1 - Springer Static Content Server

... • The client is met and products are sold • Sale order data is inserted in the computer system • The sale contract is printed and signed. Macro-process 4 – Post-sale assistance: • The market is monitored through periodic reports • The client is periodically contacted • The client’s anxiety is manage ...

... • The client is met and products are sold • Sale order data is inserted in the computer system • The sale contract is printed and signed. Macro-process 4 – Post-sale assistance: • The market is monitored through periodic reports • The client is periodically contacted • The client’s anxiety is manage ...

minutes - San Antonio Fire and Police Pension Fund

... year was 8.00%. As of December 31, 2006, the Lehman Brothers High Yield Index had a weighted-average coupon of 8.30%. Targeting a 8.00% return equates to essentially “clipping the coupon” in the asset class. Should spreads stay where they are (versus widen) and a modest default rate (normalized), in ...

... year was 8.00%. As of December 31, 2006, the Lehman Brothers High Yield Index had a weighted-average coupon of 8.30%. Targeting a 8.00% return equates to essentially “clipping the coupon” in the asset class. Should spreads stay where they are (versus widen) and a modest default rate (normalized), in ...

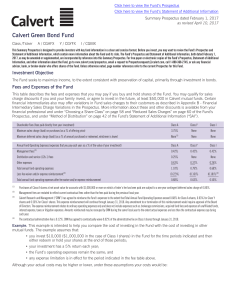

Calvert Green Bond Fund

... debt securities, as assessed at the time of purchase. A debt security is considered investment grade when assigned a credit quality rating of BBB- or higher by Standard & Poor’s Ratings Services (“Standard & Poor’s”) or an equivalent rating by another nationally recognized statistical rating organiz ...

... debt securities, as assessed at the time of purchase. A debt security is considered investment grade when assigned a credit quality rating of BBB- or higher by Standard & Poor’s Ratings Services (“Standard & Poor’s”) or an equivalent rating by another nationally recognized statistical rating organiz ...

OUR INVESTMENT PROCESS - RBC Wealth Management

... comprised of senior investment professionals, forecasts key macroeconomic variables, such as expected interest rate moves, economic growth, earnings growth, and prevailing valuations of equity markets. Through this analysis, the committee develops recommended over-weights and underweights for each o ...

... comprised of senior investment professionals, forecasts key macroeconomic variables, such as expected interest rate moves, economic growth, earnings growth, and prevailing valuations of equity markets. Through this analysis, the committee develops recommended over-weights and underweights for each o ...

Indexed Emerging Markets Equity Fund

... may fall as well as rise in value. The performance of contributions in any given year will depend on both the frequency and the duration of the contributions. Income may fluctuate in accordance with the market conditions and taxation arrangements. Simulated performance may not be a reliable guide to ...

... may fall as well as rise in value. The performance of contributions in any given year will depend on both the frequency and the duration of the contributions. Income may fluctuate in accordance with the market conditions and taxation arrangements. Simulated performance may not be a reliable guide to ...

Wells Real Estate Investment Trust, Inc.

... The complaint alleges, among other things, (i) that the consideration to be paid for the advisors as part of the proposed internalization transaction is excessive; (ii) that the proxy statement relating to the transaction violates Section 14(A), including Rule 14a-9 thereunder, and Section 20(A) of ...

... The complaint alleges, among other things, (i) that the consideration to be paid for the advisors as part of the proposed internalization transaction is excessive; (ii) that the proxy statement relating to the transaction violates Section 14(A), including Rule 14a-9 thereunder, and Section 20(A) of ...

File

... 2. You could lose money on a vacant lot or rental property that requires taxes and maintenance. You could make money on rental property where tenants pay rent each month. You pay the expenses and keep the difference as the profit. ...

... 2. You could lose money on a vacant lot or rental property that requires taxes and maintenance. You could make money on rental property where tenants pay rent each month. You pay the expenses and keep the difference as the profit. ...

ADDITIONAL RISK OF TRADING IN RENMINBI (RMB) SECURITIES

... Like any securities investment, the prices of RMB securities may fluctuate, sometimes dramatically. The price of a RMB security may move up or down, and may become valueless. It is as likely that losses will be incurred rather than profit made as a result of buying and selling RMB securities. Invest ...

... Like any securities investment, the prices of RMB securities may fluctuate, sometimes dramatically. The price of a RMB security may move up or down, and may become valueless. It is as likely that losses will be incurred rather than profit made as a result of buying and selling RMB securities. Invest ...

Phillip Securities Account Opening Application. (Only

... 1. I may from time to time have surplus funds in your possession or custody which you would generally be obliged to hold pursuant to Regulation 16 of the Securities and Futures (Licensing and Conduct of Business) Regulations ("Regulations"). While I understand that you will have some investment powe ...

... 1. I may from time to time have surplus funds in your possession or custody which you would generally be obliged to hold pursuant to Regulation 16 of the Securities and Futures (Licensing and Conduct of Business) Regulations ("Regulations"). While I understand that you will have some investment powe ...

Transcript Calculating CTR, Conversion Rate and ROI

... When measuring the success or limitations of digital or online campaigns (and offline for that matter), we have been studying the concept of KPIs or Key Performance Indicators. This has become a buzz words to mean specific goals to measure the effectiveness and success of a campaign. Like many phras ...

... When measuring the success or limitations of digital or online campaigns (and offline for that matter), we have been studying the concept of KPIs or Key Performance Indicators. This has become a buzz words to mean specific goals to measure the effectiveness and success of a campaign. Like many phras ...

OMB APPROVAL ------------------------------ OMB NUMBER: 3235

... year ended December 31, 1996, and the material in its Current Report on Form 8-K for May 5, 1997 (File No. 1-7377). ITEM 3: SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION: ------------------------------------------------The securities with respect to which this Amended Schedule 13D is filed were ...

... year ended December 31, 1996, and the material in its Current Report on Form 8-K for May 5, 1997 (File No. 1-7377). ITEM 3: SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION: ------------------------------------------------The securities with respect to which this Amended Schedule 13D is filed were ...

U.S. Treasury Department Unveils New Reporting Requirement for

... weekend or holiday) of the month following the report “as of” date. Importantly, once the Reporting Threshold is triggered for a given month, the reporting entity must submit a report for each remaining month in that calendar year, regardless of whether the Reporting Threshold is met in any subseque ...

... weekend or holiday) of the month following the report “as of” date. Importantly, once the Reporting Threshold is triggered for a given month, the reporting entity must submit a report for each remaining month in that calendar year, regardless of whether the Reporting Threshold is met in any subseque ...

Investment Promotion Manual

... Order No. 226, acts as the central investment promotion unit (IPU) with various agencies’ IPUs working in harmony to facilitate real investments in the different sectors. The Coordinating Council for Private Sector Participation (CCPSP) , on the other hand, is aimed at coordinating and monitoring pr ...

... Order No. 226, acts as the central investment promotion unit (IPU) with various agencies’ IPUs working in harmony to facilitate real investments in the different sectors. The Coordinating Council for Private Sector Participation (CCPSP) , on the other hand, is aimed at coordinating and monitoring pr ...

Resolution Amending Authorized Representatives

... (“participant”) is a local government of the state of texas and is empowered to delegate to a public funds investment pool the authority to invest funds and to act as custodian of investments purchased with local investment funds; and WHereas, it is in the best interest of the participant to invest ...

... (“participant”) is a local government of the state of texas and is empowered to delegate to a public funds investment pool the authority to invest funds and to act as custodian of investments purchased with local investment funds; and WHereas, it is in the best interest of the participant to invest ...

World Trust Global High Yield Bond Fund

... prices of the fund’s bond investments are likely to fall if interest rates rise. Bond investments also are subject to credit risk, which is the risk that the issuer of the bond may default on payment of interest or principal. Interest-rate risk is generally greater for longer-term bonds, and credit ...

... prices of the fund’s bond investments are likely to fall if interest rates rise. Bond investments also are subject to credit risk, which is the risk that the issuer of the bond may default on payment of interest or principal. Interest-rate risk is generally greater for longer-term bonds, and credit ...

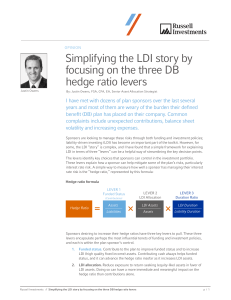

Simplifying the LDI story by focusing on the three DB hedge ratio

... I have met with dozens of plan sponsors over the last several years and most of them are weary of the burden their defined benefit (DB) plan has placed on their company. Common complaints include unexpected contributions, balance sheet volatility and increasing expenses. Sponsors are looking to mana ...

... I have met with dozens of plan sponsors over the last several years and most of them are weary of the burden their defined benefit (DB) plan has placed on their company. Common complaints include unexpected contributions, balance sheet volatility and increasing expenses. Sponsors are looking to mana ...

The Honorable Richard C. Shelby Chairman Committee on Banking

... The Honorable Michael D. Crapo, Chairman, Subcommittee on Securities, Insurance, and Investment, Committee on Banking, Housing, and Urban Affairs The Honorable Mark Warner, Ranking Member, Subcommittee on Securities, Insurance and Investment, Committee on Banking, Housing, and Urban Affairs The Hono ...

... The Honorable Michael D. Crapo, Chairman, Subcommittee on Securities, Insurance, and Investment, Committee on Banking, Housing, and Urban Affairs The Honorable Mark Warner, Ranking Member, Subcommittee on Securities, Insurance and Investment, Committee on Banking, Housing, and Urban Affairs The Hono ...

Short Duration Market Overview

... views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund. Past performance is no guarantee of future results. Investment return will fluc ...

... views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund. Past performance is no guarantee of future results. Investment return will fluc ...

CORPORATE FINANCE (5122) – DIEM

... a. Investment in one-year U.S. government securities yielding 5%. b. A loan to nephew Gerald, who has for years aspired to open a big Cajun restaurant in Duluth. Gerald has arranged a one-year bank loan for $900,000 at 10%, but asks for a $1 million loan from Norman at 9%. c. Investment in the stock ...

... a. Investment in one-year U.S. government securities yielding 5%. b. A loan to nephew Gerald, who has for years aspired to open a big Cajun restaurant in Duluth. Gerald has arranged a one-year bank loan for $900,000 at 10%, but asks for a $1 million loan from Norman at 9%. c. Investment in the stock ...

J0324 / Sistem e-Bisnis

... • Implementation issues in online financial transactions: – securing financial transactions – access to banks’ intranets by outsiders – using imaging systems – pricing online versus off-line services – risks ...

... • Implementation issues in online financial transactions: – securing financial transactions – access to banks’ intranets by outsiders – using imaging systems – pricing online versus off-line services – risks ...

TO THE COMISIÓN NACIONAL DEL MERCADO DE

... agreement signed on 8 June 2015 by Sacyr S.A. and MERLIN Properties Socimi S.A. ("MERLIN Properties") by which the latter will acquire a majority shareholding in the share capital of Testa Inmuebles en Renta, S.A. ("Testa") orchestrated in several phases, the 34,810,520 remaining shares of Testa own ...

... agreement signed on 8 June 2015 by Sacyr S.A. and MERLIN Properties Socimi S.A. ("MERLIN Properties") by which the latter will acquire a majority shareholding in the share capital of Testa Inmuebles en Renta, S.A. ("Testa") orchestrated in several phases, the 34,810,520 remaining shares of Testa own ...

Is investing in structured products a form of betting?

... Contrary to many people’s preconceptions, most investors do not use structured products for gambling. In fact, security is important to German structured products investors, and most of them are risk-averse and invest for the long term. This is backed up by the statistics: more than 60 percent of th ...

... Contrary to many people’s preconceptions, most investors do not use structured products for gambling. In fact, security is important to German structured products investors, and most of them are risk-averse and invest for the long term. This is backed up by the statistics: more than 60 percent of th ...

Repurchase Agreements – Benefits, Risks and Controls

... Repos generally are designed such that the fund takes possession of the collateral if a counterparty fails to meet its obligations under the repo. While counterparty selection and collateral requirements provide the fund protection, repos remain subject to counterparty risk. If a counterparty defaul ...

... Repos generally are designed such that the fund takes possession of the collateral if a counterparty fails to meet its obligations under the repo. While counterparty selection and collateral requirements provide the fund protection, repos remain subject to counterparty risk. If a counterparty defaul ...

RetireView - Principal Financial

... Attributes: this investor is more cautious; has sensitivity to short-term losses and/or a shorter time horizon; seeks investment stability, but still wants to beat inflation over the long term. Objective: to preserve capital while providing income potential; expects fluctuations in their portfolios ...

... Attributes: this investor is more cautious; has sensitivity to short-term losses and/or a shorter time horizon; seeks investment stability, but still wants to beat inflation over the long term. Objective: to preserve capital while providing income potential; expects fluctuations in their portfolios ...