Private Equity Investment in Latin America

... prominent law firm in Mexico City. Mayer Brown offers a broad range of services to clients conducting business in Latin America. We have extensive experience in private equity investments, joint ventures and mergers and acquisitions, debt and equity security offerings in the international capital ma ...

... prominent law firm in Mexico City. Mayer Brown offers a broad range of services to clients conducting business in Latin America. We have extensive experience in private equity investments, joint ventures and mergers and acquisitions, debt and equity security offerings in the international capital ma ...

Types of structured equity products

... documentary issues that should be borne in mind when structuring them. The structured equity products market has expanded significantly in recent years and indications are that this trend is likely to continue. It is difficult to provide precise figures as to the growth in the volume or value of suc ...

... documentary issues that should be borne in mind when structuring them. The structured equity products market has expanded significantly in recent years and indications are that this trend is likely to continue. It is difficult to provide precise figures as to the growth in the volume or value of suc ...

IN THE MATTER OF Yufeng Zhang – Settlement Accepted

... Click here to search and access all IIROC enforcement documents. ...

... Click here to search and access all IIROC enforcement documents. ...

International investment position

... engaged in domestic reform, regional cooperation or international policy dialogue aimed at creating an investment environment that is not only attractive to investors but enhances the benefits of investment. ...

... engaged in domestic reform, regional cooperation or international policy dialogue aimed at creating an investment environment that is not only attractive to investors but enhances the benefits of investment. ...

Powerpoint Chapter 6 - The Business

... • In general, the lower the interest rate, the more business firms will borrow • To know how much they will borrow and whether they will borrow, you need to compare the interest rate with the expected rate of profit • Even if they are investing their own money they need to make this ...

... • In general, the lower the interest rate, the more business firms will borrow • To know how much they will borrow and whether they will borrow, you need to compare the interest rate with the expected rate of profit • Even if they are investing their own money they need to make this ...

Chapter 5: Are Oil-Producers Rich

... the U.S. poverty line, even at $60 per barrel. At the average oil price for the last decade, the figure is well below the U.S. poverty level -- even for Saudi Arabia, one of the richest oilproducing countries in the world! Furthermore, and most importantly, this income, if used for consumption, is n ...

... the U.S. poverty line, even at $60 per barrel. At the average oil price for the last decade, the figure is well below the U.S. poverty level -- even for Saudi Arabia, one of the richest oilproducing countries in the world! Furthermore, and most importantly, this income, if used for consumption, is n ...

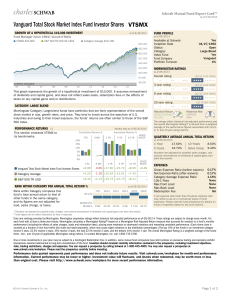

Vanguard Total Stock Market Index Fund Investor Shares

... Sector weightings for fund portfolios are determined using the Global Industry Classification Standard (GICS). GICS was developed by and is the exclusive property of Morgan Stanley Capital International Inc. and Standard & Poor's. GICS is a service mark of MSCI and S&P and has been licensed for use ...

... Sector weightings for fund portfolios are determined using the Global Industry Classification Standard (GICS). GICS was developed by and is the exclusive property of Morgan Stanley Capital International Inc. and Standard & Poor's. GICS is a service mark of MSCI and S&P and has been licensed for use ...

ASIC Class Order [CO 99/1225] - Federal Register of Legislation

... (ii) all income from the investment will be paid when it is due, having regard to all the circumstances including any relevant credit rating issued by a ratings agency. 3. The investment of scheme property or the keeping of scheme property invested, in a scheme in relation to which an exemption the ...

... (ii) all income from the investment will be paid when it is due, having regard to all the circumstances including any relevant credit rating issued by a ratings agency. 3. The investment of scheme property or the keeping of scheme property invested, in a scheme in relation to which an exemption the ...

12. Dealing in Tasmines`Securities

... Individuals who contravene the insider trading provisions of the Corporations Act are liable to prosecution or a civil penalty action by the Australian Securities and Investments Commission (ASIC). If you engage in insider trading, you may be sued by Tasmines or another party in a civil action for a ...

... Individuals who contravene the insider trading provisions of the Corporations Act are liable to prosecution or a civil penalty action by the Australian Securities and Investments Commission (ASIC). If you engage in insider trading, you may be sued by Tasmines or another party in a civil action for a ...

Koovs plc Koovs plc closes current round of capital raising at £26.2

... international institutional investors and one of India’s largest and most well-respected media groups. The funds raised provide a strong financial platform from which to deliver our growth plans as we continue to focus on building the Koovs business to become India’s number one western fashion desti ...

... international institutional investors and one of India’s largest and most well-respected media groups. The funds raised provide a strong financial platform from which to deliver our growth plans as we continue to focus on building the Koovs business to become India’s number one western fashion desti ...

United States-Japan Investment Initiative 2004 Report

... include triangular mergers and cash mergers as tools for foreign companies seeking to invest in Japan. In response to proposals from the Investment Initiative and requests from foreign companies in Japan, the Japanese Government implemented the Revised Industrial Revitalization Law in April 2003. Th ...

... include triangular mergers and cash mergers as tools for foreign companies seeking to invest in Japan. In response to proposals from the Investment Initiative and requests from foreign companies in Japan, the Japanese Government implemented the Revised Industrial Revitalization Law in April 2003. Th ...

Read the full article here

... banks to find a more efficient model for business operations, or introducing services and products that will produce bottom line earnings or create savings on existing business. When we find these partnerships and connect them with our bankers, the result is a “win-win” combination that benefits all ...

... banks to find a more efficient model for business operations, or introducing services and products that will produce bottom line earnings or create savings on existing business. When we find these partnerships and connect them with our bankers, the result is a “win-win” combination that benefits all ...

New Venture Financing

... exchange for equity in the new ventures. Usually take interest in management Popular source in the US – in 1996, estimated 250,000 angels investing $10-$20 billion in 30,000 firms each year Entrepreneurs and business angels are often connected through intermediary companies – Angel Networks Entrepre ...

... exchange for equity in the new ventures. Usually take interest in management Popular source in the US – in 1996, estimated 250,000 angels investing $10-$20 billion in 30,000 firms each year Entrepreneurs and business angels are often connected through intermediary companies – Angel Networks Entrepre ...

MT Crowdfunding Case Study 1.indd

... solutions. While most often considered for their ability to support the custody needs of a platform’s investors, many platforms themselves are also finding a need for a qualified custodian to provide key custody support to core business functions. For example, helping them to comply with the SEC’s a ...

... solutions. While most often considered for their ability to support the custody needs of a platform’s investors, many platforms themselves are also finding a need for a qualified custodian to provide key custody support to core business functions. For example, helping them to comply with the SEC’s a ...

research paper series Research Paper 2007/16

... The existing empirical literature on sources of financing and level of investment has tended to focus on the effects of a particular type of investment. A specific issue addressed is whether FDI crowds-in or crowds-out domestic investment in a developing country. Agosin and Mayer (2000) investigate ...

... The existing empirical literature on sources of financing and level of investment has tended to focus on the effects of a particular type of investment. A specific issue addressed is whether FDI crowds-in or crowds-out domestic investment in a developing country. Agosin and Mayer (2000) investigate ...

Risk free Rates, Risk Premiums and Betas

... instance, if you go back to 1928 (about 80 years of history) and you assume a standard deviation of 20% in annual stock returns, you arrive at a standard error of greater than 2%: Standard Error in Premium = 20%/√80 = 2.26% (An aside: The implied standard deviation in equities rose to almost 50% dur ...

... instance, if you go back to 1928 (about 80 years of history) and you assume a standard deviation of 20% in annual stock returns, you arrive at a standard error of greater than 2%: Standard Error in Premium = 20%/√80 = 2.26% (An aside: The implied standard deviation in equities rose to almost 50% dur ...

The Process of Portfolio Management

... 1) The investor considers prospects for the economy, given the stage of the business cycle, 2) Determines which industries are likely to fare well in the forecasted economic conditions, 3) Chooses particular companies within the favored ...

... 1) The investor considers prospects for the economy, given the stage of the business cycle, 2) Determines which industries are likely to fare well in the forecasted economic conditions, 3) Chooses particular companies within the favored ...

Applicable analyst/Author disclosure, and any additional information

... opportunity for APH, AVGO, and CDW. For the purposes of this analysis, RBC CM will assume most companies receive ~17.5% of their Europe/EMEA revenue in British Pounds and the balance in euros as most companies do not disclose a breakdown between GBP and EUR revenues (17.5% is the GDP % of UK vs. tot ...

... opportunity for APH, AVGO, and CDW. For the purposes of this analysis, RBC CM will assume most companies receive ~17.5% of their Europe/EMEA revenue in British Pounds and the balance in euros as most companies do not disclose a breakdown between GBP and EUR revenues (17.5% is the GDP % of UK vs. tot ...

FREE Sample Here

... Full file at http://testbanksite.eu/Investments-8th-Canadian-Edition-Test-Bank ...

... Full file at http://testbanksite.eu/Investments-8th-Canadian-Edition-Test-Bank ...

RIVERPARK INTRODUCES RIVERPARK LONG/SHORT

... The RiverPark Long/Short Opportunity Fund performance data quoted for periods prior to March 30, 2012 is that of the Predecessor Fund. The predecessor Fund inception date is 9/30/209. The Fund will be managed in a materially equivalent manner to its predecessor. The Predecessor Fund was not a regist ...

... The RiverPark Long/Short Opportunity Fund performance data quoted for periods prior to March 30, 2012 is that of the Predecessor Fund. The predecessor Fund inception date is 9/30/209. The Fund will be managed in a materially equivalent manner to its predecessor. The Predecessor Fund was not a regist ...

stock comparison - MBA Projects

... exchanges and performing analysis. As a consequence, these broker systems are quite large and complicated by themselves. This research aims to analysis Stock broker on the basis of their services, ...

... exchanges and performing analysis. As a consequence, these broker systems are quite large and complicated by themselves. This research aims to analysis Stock broker on the basis of their services, ...

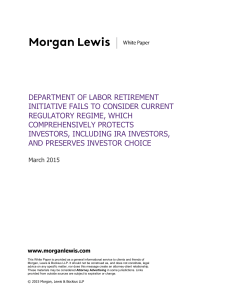

department of labor retirement initiative fails to consider current

... We have prepared this white paper to address errant claims made in the Council of Economic Advisers’ (CEA) report, “The Effects of Conflicted Advice on Retirement Savings” (CEA Report), regarding perceived inadequacies in the existing regulation of investment advice provided to individual retirement ...

... We have prepared this white paper to address errant claims made in the Council of Economic Advisers’ (CEA) report, “The Effects of Conflicted Advice on Retirement Savings” (CEA Report), regarding perceived inadequacies in the existing regulation of investment advice provided to individual retirement ...

Document

... If you die before age 75 than benefits paid to your surviving spouse / civil partner or other nominated beneficiaries will normally be free from tax (up to the Lifetime Allowance). If death occurs after age 75 then tax will become due at the beneficiaries marginal rate of tax. Investments Most types ...

... If you die before age 75 than benefits paid to your surviving spouse / civil partner or other nominated beneficiaries will normally be free from tax (up to the Lifetime Allowance). If death occurs after age 75 then tax will become due at the beneficiaries marginal rate of tax. Investments Most types ...

GIA(net) Portfolio Summary

... on additional investment risk in order to generate higher returns. You understand that this is fundamental to achieving superior long term returns and recognise that there will be a greater variability of returns in doing so. The particular choice of funds will be determined by the funds’ volatility ...

... on additional investment risk in order to generate higher returns. You understand that this is fundamental to achieving superior long term returns and recognise that there will be a greater variability of returns in doing so. The particular choice of funds will be determined by the funds’ volatility ...

![ASIC Class Order [CO 99/1225] - Federal Register of Legislation](http://s1.studyres.com/store/data/022958345_1-b59fff90bbffb692a02c1ec3f0acb47f-300x300.png)