What is an investment?

... • Disclosure of policy – any investment policy for charities over the statutory audit level must be disclosed – these charities are also required to state the extent to which environmental or ethical considerations are taken into account – this should apply to all charities as a matter of good pract ...

... • Disclosure of policy – any investment policy for charities over the statutory audit level must be disclosed – these charities are also required to state the extent to which environmental or ethical considerations are taken into account – this should apply to all charities as a matter of good pract ...

Research Guide: Personal Finance Find Books

... Find streaming videos on Business / Economics from here: http:// digital.films.com.lscsproxy.lonestar.edu/ PortalPlayLists.aspx? ...

... Find streaming videos on Business / Economics from here: http:// digital.films.com.lscsproxy.lonestar.edu/ PortalPlayLists.aspx? ...

james bromiley markets in financial instruments directive ii

... It has confirmed that, in its view, the current market practice where a broker agrees higher execution rates to enable the investment manager to receive higher value research falls within the scope of an inducement under MiFID II and therefore a Level 1 restriction applies (i.e. there is a conflict ...

... It has confirmed that, in its view, the current market practice where a broker agrees higher execution rates to enable the investment manager to receive higher value research falls within the scope of an inducement under MiFID II and therefore a Level 1 restriction applies (i.e. there is a conflict ...

Family Offices - SchulthessZimmermann Executive Search

... Advisors typically begin with a socalled «draw» from the family office to cover their costs including salary, which they spend several months earning back. Once the draw is worked off, advisors earn a cut as high as 50 percent of whatever fees they bring in, in a model which resembles that of U.S. ...

... Advisors typically begin with a socalled «draw» from the family office to cover their costs including salary, which they spend several months earning back. Once the draw is worked off, advisors earn a cut as high as 50 percent of whatever fees they bring in, in a model which resembles that of U.S. ...

lessons learnt in Lao - Land Info Working Group

... A local cemetery within the area of a Vietnamese investor’s plantation was violated by the company. According to the local people, the village’s cemetery, used to include 47 gravesites. The company flattened the whole area, leaving only one big tree still alive in the area that used to be the cemete ...

... A local cemetery within the area of a Vietnamese investor’s plantation was violated by the company. According to the local people, the village’s cemetery, used to include 47 gravesites. The company flattened the whole area, leaving only one big tree still alive in the area that used to be the cemete ...

Diversification. - Principal Financial Group

... through a group annuity contract with Principal Life Insurance Company. See the group annuity contract for the full name of the Separate Account. Principal Life Insurance Company reserves the right to defer payments or transfers from Principal Life Separate Accounts as permitted by the group annuity ...

... through a group annuity contract with Principal Life Insurance Company. See the group annuity contract for the full name of the Separate Account. Principal Life Insurance Company reserves the right to defer payments or transfers from Principal Life Separate Accounts as permitted by the group annuity ...

LEARNING FROM HISTORICAL FINANCIAL CRISES

... Stock market decline to trough Consumer price decline to trough ...

... Stock market decline to trough Consumer price decline to trough ...

Strategy sheet

... For your vested benefits capital you have selected a securities solution with an individually defined investment strategy. Investments by the PensFree Vested Benefits Foundation are made under an asset management mandate awarded by the Foundation to Julius Baer & Co. LTD, in accordance with the BVV2 ...

... For your vested benefits capital you have selected a securities solution with an individually defined investment strategy. Investments by the PensFree Vested Benefits Foundation are made under an asset management mandate awarded by the Foundation to Julius Baer & Co. LTD, in accordance with the BVV2 ...

Slide 1 - Prudent Investor Advisors

... in academic research that has withstood rigorous open review for many years, does not rely on analysts’ forecasts or opinions about financial markets, but instead incorporates the key factors that drive the long-run performance of these markets. Many participants in 401(k) plans as well as other inv ...

... in academic research that has withstood rigorous open review for many years, does not rely on analysts’ forecasts or opinions about financial markets, but instead incorporates the key factors that drive the long-run performance of these markets. Many participants in 401(k) plans as well as other inv ...

- CitiBank.cz

... in terms of the provision of investment services by Citibank Europe plc, regarding the business activities in the Czech Republic through its branch Citibank Europe plc, organizační složka ("Citibank"), it is our duty to inform you about the implementation of client categorization in accordance with ...

... in terms of the provision of investment services by Citibank Europe plc, regarding the business activities in the Czech Republic through its branch Citibank Europe plc, organizační složka ("Citibank"), it is our duty to inform you about the implementation of client categorization in accordance with ...

INCORPORATION OF A JOINT VENTURE COMPANY

... the “Group”) wishes to announce that its wholly owned subsidiary, Work Plus Store Pte. Ltd. (“WPS”), has together with Mr Low See Ching (“Mr Low”), an independent unrelated third party, jointly incorporated a new company, Work Plus Store (AMK) Pte. Ltd. (the “JV Co”) in Singapore on 23 October 2015. ...

... the “Group”) wishes to announce that its wholly owned subsidiary, Work Plus Store Pte. Ltd. (“WPS”), has together with Mr Low See Ching (“Mr Low”), an independent unrelated third party, jointly incorporated a new company, Work Plus Store (AMK) Pte. Ltd. (the “JV Co”) in Singapore on 23 October 2015. ...

25648 Demonstrate understanding of investment concepts

... of study leading to that assessment. Industry Training Organisations must be granted consent to assess against standards by NZQA before they can register credits from assessment against unit standards. Providers and Industry Training Organisations, which have been granted consent and which are asses ...

... of study leading to that assessment. Industry Training Organisations must be granted consent to assess against standards by NZQA before they can register credits from assessment against unit standards. Providers and Industry Training Organisations, which have been granted consent and which are asses ...

bworld12050603 - Bureau of the Treasury

... The Bureau of the Treasury announced yesterday it will increase the size of its local borrowing during the first quarter next year. In a memorandum to government securities eligible dealers, National Treasurer Sergio G. Edeza said the sate will hike the volume of its bimonthly Treasury Bill (TBill) ...

... The Bureau of the Treasury announced yesterday it will increase the size of its local borrowing during the first quarter next year. In a memorandum to government securities eligible dealers, National Treasurer Sergio G. Edeza said the sate will hike the volume of its bimonthly Treasury Bill (TBill) ...

Developed market equities

... assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own professional advisers, if any investment mentioned herein is believed to be suitable to their personal goals. Investors should ensure that they obtain all available relevant informati ...

... assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own professional advisers, if any investment mentioned herein is believed to be suitable to their personal goals. Investors should ensure that they obtain all available relevant informati ...

Job description Trusted Sources Emerging Markets Research and

... Job description Trusted Sources Emerging Markets Research and Consulting is an independent research provider of top-down macroeconomic and policy drivers, analysing challenges and opportunities in emerging markets. Clients include large investment funds and corporates. Trusted Sources is looking for ...

... Job description Trusted Sources Emerging Markets Research and Consulting is an independent research provider of top-down macroeconomic and policy drivers, analysing challenges and opportunities in emerging markets. Clients include large investment funds and corporates. Trusted Sources is looking for ...

Investment Objective - Marmot Library Network Information Center

... colleges. Marmot investment goals are unlike those of most nonprofit organizations: Marmot is not intended to grow an endowment fund; Marmot is neither a private foundation nor a public charity. Member libraries participate in internet services that include a shared catalog of library collections to ...

... colleges. Marmot investment goals are unlike those of most nonprofit organizations: Marmot is not intended to grow an endowment fund; Marmot is neither a private foundation nor a public charity. Member libraries participate in internet services that include a shared catalog of library collections to ...

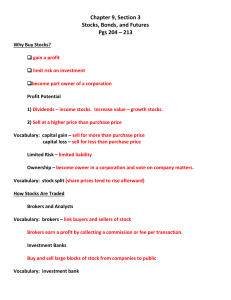

Chapter 9, Section 3 Stocks, Bonds, and Futures Pgs 204 – 213 Why

... From state/local taxes. Safest of all investments. Why Buy Futures? – High risk. Require knowledge of commodity. Traders accept investor’s money today in exchange for promise to deliver goods at a future date. Buyers and sellers make/lose money between price on contract date and price at delivery. V ...

... From state/local taxes. Safest of all investments. Why Buy Futures? – High risk. Require knowledge of commodity. Traders accept investor’s money today in exchange for promise to deliver goods at a future date. Buyers and sellers make/lose money between price on contract date and price at delivery. V ...

November

... Patrick Behr, André Güttler, Felix Miebs. There are two interesting portfolios on the efficient frontier: the tangency portfolio and the minimum-variance portfolio. The minimum-variance portfolio is interesting because it does not require computation of expected asset returns, but only of the covari ...

... Patrick Behr, André Güttler, Felix Miebs. There are two interesting portfolios on the efficient frontier: the tangency portfolio and the minimum-variance portfolio. The minimum-variance portfolio is interesting because it does not require computation of expected asset returns, but only of the covari ...

Investment Terminology and Concepts

... • Coupon Rate: the annual interest rate that is paid over the life of the bond • Maturity date: the date the investor receives the principal back back ...

... • Coupon Rate: the annual interest rate that is paid over the life of the bond • Maturity date: the date the investor receives the principal back back ...

Pakistan`s Investment Scenario and Capital Markets

... most pertinent indicator. Some of the large firms needing foreign exchange or having export oriented industries should take advantage of bench marks established by sovereign borrowing in Eurobond, Islamic Sukuk and US dollar bond markets by floating their own corporate paper in international capital ...

... most pertinent indicator. Some of the large firms needing foreign exchange or having export oriented industries should take advantage of bench marks established by sovereign borrowing in Eurobond, Islamic Sukuk and US dollar bond markets by floating their own corporate paper in international capital ...

Institutional Suitability Certificate

... waive any rights afforded under U.S. federal or state securities laws, including without limitation, any rights under Section 10(b) of the Securities Exchange Act of 1934, as amended, and the rules and regulations ...

... waive any rights afforded under U.S. federal or state securities laws, including without limitation, any rights under Section 10(b) of the Securities Exchange Act of 1934, as amended, and the rules and regulations ...