Outsourced investment management: what it offers the long

... because it is difficult to go from standard manager due diligence to aggregating position level data from multiple managers and quantitatively measuring portfolio risks on an ongoing basis. They also have to work with multiple client custodians, so there may be no unified approach to this important ...

... because it is difficult to go from standard manager due diligence to aggregating position level data from multiple managers and quantitatively measuring portfolio risks on an ongoing basis. They also have to work with multiple client custodians, so there may be no unified approach to this important ...

Emerging Markets Equity Corporate Class

... advisors and the strong partnership we have developed with them to create wealth and prosperity for Canadian families who entrust us with their affairs. CI Investments Inc. and Assante Wealth Management are wholly owned subsidiaries of CI Financial Corp., which is listed on the Toronto Stock Exchang ...

... advisors and the strong partnership we have developed with them to create wealth and prosperity for Canadian families who entrust us with their affairs. CI Investments Inc. and Assante Wealth Management are wholly owned subsidiaries of CI Financial Corp., which is listed on the Toronto Stock Exchang ...

Justin Byers - AP Scholar, 4

... diligently researching various industries, commodities, and currencies to understand their impact on world markets. This passion fueled my undergraduate studies at the University of Nebraska-Lincoln with a focus on analytical Finance and strategic Management. I plan to pursue the proper licenses aft ...

... diligently researching various industries, commodities, and currencies to understand their impact on world markets. This passion fueled my undergraduate studies at the University of Nebraska-Lincoln with a focus on analytical Finance and strategic Management. I plan to pursue the proper licenses aft ...

Northern Trust

... Amid banking crisis, capital markets have become the main channel of monetary transmission in the economy ...

... Amid banking crisis, capital markets have become the main channel of monetary transmission in the economy ...

Pioneer Funds – US Dollar Short-Term I USD

... The Sub-Fund may not be registered for sale with the relevant authorities in your jurisdiction. Where unregistered, the Sub-Fund may not be sold or offered except in the circumstances permitted by law. The Fund may not be regulated or supervised by any governmental or similar authority in your juris ...

... The Sub-Fund may not be registered for sale with the relevant authorities in your jurisdiction. Where unregistered, the Sub-Fund may not be sold or offered except in the circumstances permitted by law. The Fund may not be regulated or supervised by any governmental or similar authority in your juris ...

Production Incentive

... characterised by inclusive growth and development, decent employment and equity, built on the full potential of all citizens". Health ...

... characterised by inclusive growth and development, decent employment and equity, built on the full potential of all citizens". Health ...

III.11 Guidelines on Spread Requirements

... investments in B in the illustrative examples are still required to comply with section 2(1) of Schedule 1 to the Regulation. For the avoidance of doubt, a covered put warrant, which can only be used for hedging purposes under the MPF legislation, needs not be aggregated for the purposes of section ...

... investments in B in the illustrative examples are still required to comply with section 2(1) of Schedule 1 to the Regulation. For the avoidance of doubt, a covered put warrant, which can only be used for hedging purposes under the MPF legislation, needs not be aggregated for the purposes of section ...

Click here to review it - Private Client Group Asset Management

... The client acknowledges that the information provided in the client summary is accurate to the best of his/her knowledge. The client agrees that the information accurately represents his/her investment goals and objectives, and attitude towards the investment risk. The information given by the clien ...

... The client acknowledges that the information provided in the client summary is accurate to the best of his/her knowledge. The client agrees that the information accurately represents his/her investment goals and objectives, and attitude towards the investment risk. The information given by the clien ...

BY SIGNING, I CONFIRM THAT: Order Execution Only

... 1. All of the information in this application is complete and accurate and I will promptly send written notice to ScotiaMcLeod Direct Investing of any significant changes in this information. I verify that all photocopies of identification submitted with this application are true copies of identific ...

... 1. All of the information in this application is complete and accurate and I will promptly send written notice to ScotiaMcLeod Direct Investing of any significant changes in this information. I verify that all photocopies of identification submitted with this application are true copies of identific ...

Stock Market Simulation Debriefing

... chart” for the last 3 months. Interpret the graph by analyzing the activity over time. What conclusions or assumptions can you make about the company based off of this information? PARAGRAPH 2: INVESTMENT STRATEGY What were your investment strategies? Did you participate in short selling and day t ...

... chart” for the last 3 months. Interpret the graph by analyzing the activity over time. What conclusions or assumptions can you make about the company based off of this information? PARAGRAPH 2: INVESTMENT STRATEGY What were your investment strategies? Did you participate in short selling and day t ...

Egypt - IDB Group Business Forum

... Suez Canal Corridor project aims at development of Suez region with total investment of over $100bn over 20 years East Portsaid Port ...

... Suez Canal Corridor project aims at development of Suez region with total investment of over $100bn over 20 years East Portsaid Port ...

KSE crossed all time high owing to 12 year low inflation figure

... interested in selected banking, cement and fertilizer stocks ahead of corporate result announcements and potential gain from expected discount rate cut. Furthermore, World Bank appreciation regarding Government's effort to uplift the economy boosted investors' sentiments. According to the Managing D ...

... interested in selected banking, cement and fertilizer stocks ahead of corporate result announcements and potential gain from expected discount rate cut. Furthermore, World Bank appreciation regarding Government's effort to uplift the economy boosted investors' sentiments. According to the Managing D ...

THE COMING FINANCIAL CLIMATE

... for listed investment trusts (or ‘yieldcos’) for clean energy finance. Central banks can also target their monetary operations at the green economy, as the Bangladesh Bank is doing with its refinancing mechanisms. Improved reporting frameworks of sustainability and climate factors are also critical ...

... for listed investment trusts (or ‘yieldcos’) for clean energy finance. Central banks can also target their monetary operations at the green economy, as the Bangladesh Bank is doing with its refinancing mechanisms. Improved reporting frameworks of sustainability and climate factors are also critical ...

Chase Perlen

... • Worked with the Global Capital Markets (GCM) strats team in generating actionable capital market strategies, intelligence, and applications for both institutional clients and other GCM teams • Analyzed GCM/investment banking fees using regression and time series methods and presented my findings t ...

... • Worked with the Global Capital Markets (GCM) strats team in generating actionable capital market strategies, intelligence, and applications for both institutional clients and other GCM teams • Analyzed GCM/investment banking fees using regression and time series methods and presented my findings t ...

Investment Philosophy - St. Croix Valley Foundation

... individual managers. At each level, benchmarks have been established that represent the returns and risks that could be achieved through passive management. Performance at all levels of the investment program is always expressed net of all fees and expenses. Performance of the benchmarks is reported ...

... individual managers. At each level, benchmarks have been established that represent the returns and risks that could be achieved through passive management. Performance at all levels of the investment program is always expressed net of all fees and expenses. Performance of the benchmarks is reported ...

SEB Företagsinvest

... KTH Seed Capital invests in early stage high-tech companies relating Research and Development at Royal Institute of Technology (KTH). Develops and sells a software platform to telecom operators to help in their process of trading, pricing and ...

... KTH Seed Capital invests in early stage high-tech companies relating Research and Development at Royal Institute of Technology (KTH). Develops and sells a software platform to telecom operators to help in their process of trading, pricing and ...

DRAFT Investment Policy Jan 22 2016(word doc)

... authorized investment instruments other than certificates of deposit until such time compliance has been achieved. The District shall not exceed fifty percent (50%) of the District’s total investment portfolio in any one (1) authorized investment type, with the exception of the following; LAIF and C ...

... authorized investment instruments other than certificates of deposit until such time compliance has been achieved. The District shall not exceed fifty percent (50%) of the District’s total investment portfolio in any one (1) authorized investment type, with the exception of the following; LAIF and C ...

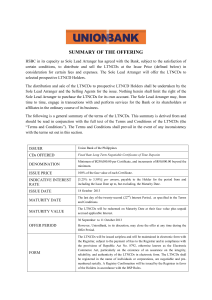

summary of the offering

... The LTNCDs will be redeemed on Maturity Date at their face value plus unpaid accrued applicable Interest. 30 September to 11 October 2013 ...

... The LTNCDs will be redeemed on Maturity Date at their face value plus unpaid accrued applicable Interest. 30 September to 11 October 2013 ...

Local Leaders in South East Europe: Lead for Change – LL SEE

... - Public Utility Companies: Upper and middle management staff 15 pilots municipalities / WSS PUs ...

... - Public Utility Companies: Upper and middle management staff 15 pilots municipalities / WSS PUs ...

Prospect Theory as an explanation of risky choice by professional

... risk to be a multidimensional construct with possible downside returns playing the dominant role. This result has also been found for professional decision makers in other domains (Slovic, 1987). Therefore, the first survey was conducted to focus more closely on potential risk attributes. Table 1 pr ...

... risk to be a multidimensional construct with possible downside returns playing the dominant role. This result has also been found for professional decision makers in other domains (Slovic, 1987). Therefore, the first survey was conducted to focus more closely on potential risk attributes. Table 1 pr ...

1 Hong Kong / Singapore, 19 August 2014 SOCIETE GENERALE

... Societe Generale has been playing a vital role in the economy for 150 years. With more than 148,000 employees, based in 76 countries, we accompany 32 million clients throughout the world on a daily basis. Societe Generale’s teams offer advice and services to individual, corporate and institutional c ...

... Societe Generale has been playing a vital role in the economy for 150 years. With more than 148,000 employees, based in 76 countries, we accompany 32 million clients throughout the world on a daily basis. Societe Generale’s teams offer advice and services to individual, corporate and institutional c ...

Problem Set 5 - University of Notre Dame

... The University of Notre Dame Professor Sims Instructions: You may work in groups of up to four students. Please make sure to include the names of all group members, and please write legibly (better yet, type your answers!). This problem set is due at the beginning of class on Wednesday October 28 (1 ...

... The University of Notre Dame Professor Sims Instructions: You may work in groups of up to four students. Please make sure to include the names of all group members, and please write legibly (better yet, type your answers!). This problem set is due at the beginning of class on Wednesday October 28 (1 ...

Solution Key: Homework 2

... a) First find the equilibrium levels of the interest rate, investment and consumption for the economy described for the equations above. (Assume a closed economy: Y = C + I + G). b) Discuss the effects on the economy of lowering the level of T by 10%. You should compute the new equilibrium values of ...

... a) First find the equilibrium levels of the interest rate, investment and consumption for the economy described for the equations above. (Assume a closed economy: Y = C + I + G). b) Discuss the effects on the economy of lowering the level of T by 10%. You should compute the new equilibrium values of ...

Exam review solutions ch-1

... b) 232 months, or 19 years 4 months c) The regular payment investment is worth about $5000. The single payment investment has doubled to $7200, so it is worth more. 2. a) He would need 9.607… or 9.61% annual interest compounded every 2 weeks. b) i) $66.51 ii) $812.22 c) It would take 10.4 years, or ...

... b) 232 months, or 19 years 4 months c) The regular payment investment is worth about $5000. The single payment investment has doubled to $7200, so it is worth more. 2. a) He would need 9.607… or 9.61% annual interest compounded every 2 weeks. b) i) $66.51 ii) $812.22 c) It would take 10.4 years, or ...