First Israel Turnaround Fund

... Often the existing shareholders and debt-holders (including the major banks) do not posses the necessary skills nor the financial resources to correct the situation ...

... Often the existing shareholders and debt-holders (including the major banks) do not posses the necessary skills nor the financial resources to correct the situation ...

Class Outline - Villanova University

... – 1. Buying long-term bonds because you feel interest rates will fall – 2. Buying a stock because you feel its price will increase due to a takeover attempt – 3. Buying stocks you believe are “undervalued” by the ...

... – 1. Buying long-term bonds because you feel interest rates will fall – 2. Buying a stock because you feel its price will increase due to a takeover attempt – 3. Buying stocks you believe are “undervalued” by the ...

CHAPTER 1 An Overview of Financial Management

... No free lunch (the world of risk and return, CAPM, APT) Prices do not instantaneously adjust to all new information (random price path irrationality) ...

... No free lunch (the world of risk and return, CAPM, APT) Prices do not instantaneously adjust to all new information (random price path irrationality) ...

Mini Case (p.45) A. Why is corporate finance important to all

... P. Briefly explain mortgage securitization and how it contributed to the global economic crisis. The global economic crisis can be broken into three parts just like anything: (1) beginning, (2) middle, and (3) end. First sub-prime standards were established in the mid-1990s allowing for less than cr ...

... P. Briefly explain mortgage securitization and how it contributed to the global economic crisis. The global economic crisis can be broken into three parts just like anything: (1) beginning, (2) middle, and (3) end. First sub-prime standards were established in the mid-1990s allowing for less than cr ...

PDF Download

... a threat to financial stability because bailout guarantees according to the too-big-to-fail doctrine provide an incentive for them to grow excessively, take on excessive risk, and become too leveraged. Unless these guarantees can be eliminated completely – which is ...

... a threat to financial stability because bailout guarantees according to the too-big-to-fail doctrine provide an incentive for them to grow excessively, take on excessive risk, and become too leveraged. Unless these guarantees can be eliminated completely – which is ...

Schedule LRA 3 Proposed Plan for Project Financing (DOC, 91KB)

... financial reports to cover the balance of time to date. ...

... financial reports to cover the balance of time to date. ...

4Q16 Firm Overview.ind.indd

... Wells Fargo Asset Management (WFAM) is a trade name used by the asset management businesses of Wells Fargo & Company. WFAM includes but is not limited to Analytic Investors, LLC; ECM Asset Management Ltd.; First International Advisors, LLC; Galliard Capital Management, Inc.; Golden Capital Managemen ...

... Wells Fargo Asset Management (WFAM) is a trade name used by the asset management businesses of Wells Fargo & Company. WFAM includes but is not limited to Analytic Investors, LLC; ECM Asset Management Ltd.; First International Advisors, LLC; Galliard Capital Management, Inc.; Golden Capital Managemen ...

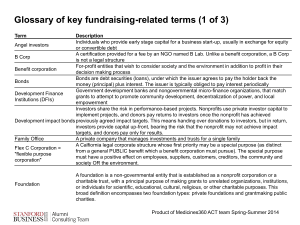

presentation - European Corporate Governance Institute

... EVCA developed and promoted a range of guidelines for the professional conduct of PE/VC fund managers In respect of the management of their activities And in their relationships with investors and portfolio ...

... EVCA developed and promoted a range of guidelines for the professional conduct of PE/VC fund managers In respect of the management of their activities And in their relationships with investors and portfolio ...

PART 1 - ADFIP

... - An unconditional promise to pay to the holder of the note a fixed amount (face value) at a fixed date (maturity date). Defined more fully in the Bills of Exchange act as: "an unconditional promise in writing by one person to another, signed by the maker, engaging to pay on demand or at a fixed or ...

... - An unconditional promise to pay to the holder of the note a fixed amount (face value) at a fixed date (maturity date). Defined more fully in the Bills of Exchange act as: "an unconditional promise in writing by one person to another, signed by the maker, engaging to pay on demand or at a fixed or ...

Presentation - Federal Reserve Bank of Atlanta

... – Are emerging markets going to pay through inflation? – Is there going to be an adjustment of consumption? ...

... – Are emerging markets going to pay through inflation? – Is there going to be an adjustment of consumption? ...

Job Description Job title Senior Investment Manager, Northern

... information, and taking action where necessary to ensure the best possible outcome of these investments for the fund; ...

... information, and taking action where necessary to ensure the best possible outcome of these investments for the fund; ...

i̇mkb at a glance

... * Value date of outright purchases and sales transactions vary between 0-90 days for government debt securities, 0-30 days for other securities, while the beginning value date of repo/reverse repo transactions vary between 0-7 days. ** Value date for outright purchases and sales transactions of Fore ...

... * Value date of outright purchases and sales transactions vary between 0-90 days for government debt securities, 0-30 days for other securities, while the beginning value date of repo/reverse repo transactions vary between 0-7 days. ** Value date for outright purchases and sales transactions of Fore ...

Bloomberg 101

... Bloomberg Help: 8 BU

Example: Type beta in the search box

Bloomberg Search: SEAR

Type a word at the blue cursor in the upper left

Sector Help:

SECTOR KEY then

then

Go further within the sector menu and

press

E-mail the Bloomberg Help D ...

... Bloomberg Help: 8 BU

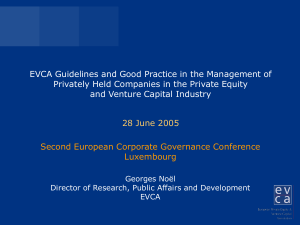

Chapter 1: Goals and Governance of the Firm

... Do managers maximize shareholder wealth? Mangers have many constituencies “stakeholders” “Agency Problems” represent the conflict of interest between management and owners ...

... Do managers maximize shareholder wealth? Mangers have many constituencies “stakeholders” “Agency Problems” represent the conflict of interest between management and owners ...

here

... – established in 1960 as the World Bank’s agency for concessional financial assistance to the poorest of the developing countries – grants to poorest countries ...

... – established in 1960 as the World Bank’s agency for concessional financial assistance to the poorest of the developing countries – grants to poorest countries ...

OrbiMed Advisors Offers `One-Stop Shop` for Health

... place in Japan, China, Taiwan and South Korea, and will earn milestone payments if Pfizer gains regulatory approval in this patient population in the Asia region. OrbiMed expects to consider more of these structured-finance investments. Firms pursuing similar deals include Abingworth and Clarus Ven ...

... place in Japan, China, Taiwan and South Korea, and will earn milestone payments if Pfizer gains regulatory approval in this patient population in the Asia region. OrbiMed expects to consider more of these structured-finance investments. Firms pursuing similar deals include Abingworth and Clarus Ven ...

Lecture 6

... rB be the required return to the debt rs be the required return to the firm's equity ro be the discount rate applied to the business risk of the firm ...

... rB be the required return to the debt rs be the required return to the firm's equity ro be the discount rate applied to the business risk of the firm ...

مشروع المنتجات المالية في الفقه الإسلام

... Pressure on wealth base accumulates Crash is imminent to restore balance ...

... Pressure on wealth base accumulates Crash is imminent to restore balance ...

Nigerian earnings growth contributes to Sustainable Capital`s

... Based on 2012 estimated company earnings, dividends and book value, he believes the price earnings, price-to-book and dividend yield of companies are at the same levels or lower than in 2011, before the recent stockmarket rally, which supports Sustainable Capital’s value-based approach to investing. ...

... Based on 2012 estimated company earnings, dividends and book value, he believes the price earnings, price-to-book and dividend yield of companies are at the same levels or lower than in 2011, before the recent stockmarket rally, which supports Sustainable Capital’s value-based approach to investing. ...

Title: Senior Credit Analyst (Distressed) (DM0004-017

... Compensation: Commensurate with experience Summary: Boutique investment manager seeks senior analyst to join an absolute return credit strategy team. Ideal candidate will be a seasoned credit analyst with demonstrated technical competency and at least five years of relevant work experience in financ ...

... Compensation: Commensurate with experience Summary: Boutique investment manager seeks senior analyst to join an absolute return credit strategy team. Ideal candidate will be a seasoned credit analyst with demonstrated technical competency and at least five years of relevant work experience in financ ...

Speech by Secretary for Financial Services

... Following is the speech (English only) by the Secretary for Financial Services, Mr Stephen Ip, at the signing ceremony of the Airport Authority's issue of retail bonds today (March 19): David, Raymond, Distinguished Guests, Ladies and Gentlemen, It is a great pleasure to be here today to witness the ...

... Following is the speech (English only) by the Secretary for Financial Services, Mr Stephen Ip, at the signing ceremony of the Airport Authority's issue of retail bonds today (March 19): David, Raymond, Distinguished Guests, Ladies and Gentlemen, It is a great pleasure to be here today to witness the ...

financial engineer / front office quantitative researcher

... At Raiffeisen Centrobank, the equity house of Raiffeisen Bank International Group, we focus on equity trading and sales, structured products and company research – working closely together for the benefit of our clients. That makes us one of the leading investment banks in Austria and CEE. ...

... At Raiffeisen Centrobank, the equity house of Raiffeisen Bank International Group, we focus on equity trading and sales, structured products and company research – working closely together for the benefit of our clients. That makes us one of the leading investment banks in Austria and CEE. ...

Leveraged buyout

A leveraged buyout (LBO) is a transaction when a company or single asset (e.g., a real estate property) is purchased with a combination of equity and significant amounts of borrowed money, structured in such a way that the target's cash flows or assets are used as the collateral (or ""leverage"") to secure and repay the borrowed money. Since the debt (be it senior or mezzanine) has a lower cost of capital (until bankruptcy risk reaches a level threatening to the lender[s]) than the equity, the returns on the equity increase as the amount of borrowed money does until the perfect capital structure is reached. As a result, the debt effectively serves as a lever to increase returns-on-investment.The term LBO is usually employed when a financial sponsor acquires a company. However, many corporate transactions are partially funded by bank debt, thus effectively also representing an LBO. LBOs can have many different forms such as management buyout (MBO), management buy-in (MBI), secondary buyout and tertiary buyout, among others, and can occur in growth situations, restructuring situations, and insolvencies. LBOs mostly occur in private companies, but can also be employed with public companies (in a so-called PtP transaction – Public to Private).As financial sponsors increase their returns by employing a very high leverage (i.e., a high ratio of debt to equity), they have an incentive to employ as much debt as possible to finance an acquisition. This has, in many cases, led to situations, in which companies were ""over-leveraged"", meaning that they did not generate sufficient cash flows to service their debt, which in turn led to insolvency or to debt-to-equity swaps in which the equity owners lose control over the business and the debt providers assume the equity.