here

... After extensive consultation and preparation, the private sector U.S. National Advisory Board to the Social Impact Investing Taskforce – born out of the 2013 G8 process – issued their new report, Private Capital, Public Good: How Smart Federal Policy Can Galvanize Impact Investing – and Why It’s Urg ...

... After extensive consultation and preparation, the private sector U.S. National Advisory Board to the Social Impact Investing Taskforce – born out of the 2013 G8 process – issued their new report, Private Capital, Public Good: How Smart Federal Policy Can Galvanize Impact Investing – and Why It’s Urg ...

FREE Sample Here

... economic units consider when they have to choose among different sources of funds? Answer: For any economic unit the principal alternatives for raising funds include: (1) accumulate savings (internal financing), (2) sell off existing assets, (3) borrowing, or (4) issue new stock. Accumulate saving a ...

... economic units consider when they have to choose among different sources of funds? Answer: For any economic unit the principal alternatives for raising funds include: (1) accumulate savings (internal financing), (2) sell off existing assets, (3) borrowing, or (4) issue new stock. Accumulate saving a ...

FREE Sample Here

... economic units consider when they have to choose among different sources of funds? Answer: For any economic unit the principal alternatives for raising funds include: (1) accumulate savings (internal financing), (2) sell off existing assets, (3) borrowing, or (4) issue new stock. Accumulate saving a ...

... economic units consider when they have to choose among different sources of funds? Answer: For any economic unit the principal alternatives for raising funds include: (1) accumulate savings (internal financing), (2) sell off existing assets, (3) borrowing, or (4) issue new stock. Accumulate saving a ...

Strategic Value Dividend (MA) Select UMA

... portfolios that diversify among a broad range of sectors. Investing in securities entails risks, including: When investing in value securities, the market may not necessarily have the same value assessment as the manager, and, therefore, the performance of the securities may decline. Value investing ...

... portfolios that diversify among a broad range of sectors. Investing in securities entails risks, including: When investing in value securities, the market may not necessarily have the same value assessment as the manager, and, therefore, the performance of the securities may decline. Value investing ...

NOTE: You may request shares in Macy`s, Inc. be issued in

... To contact Computershare by phone: 1-866-337-3311 (U.S. and Canada) 1-201-680-6685 (Outside U.S. and Canada) Dividend Reinvestment Options ...

... To contact Computershare by phone: 1-866-337-3311 (U.S. and Canada) 1-201-680-6685 (Outside U.S. and Canada) Dividend Reinvestment Options ...

Complaint Form - IMT Financial Advisors AG

... The complainant has the additional possibility to take the matter to the Conciliation Board, the address of which is stated below. It is recommended, however, that the complainant should wait for a reply from IMT Asset Management AG before approaching the Conciliation Board. Conciliation Board of Li ...

... The complainant has the additional possibility to take the matter to the Conciliation Board, the address of which is stated below. It is recommended, however, that the complainant should wait for a reply from IMT Asset Management AG before approaching the Conciliation Board. Conciliation Board of Li ...

CLDA flyer for website.indd

... used as a complete analysis of any companies, securities or topics discussed herein. Additional information is available upon request. This is not, however, an offer or solicitation of the securities discussed. Any opinions or estimates in this announcement are subject to change without notice. An i ...

... used as a complete analysis of any companies, securities or topics discussed herein. Additional information is available upon request. This is not, however, an offer or solicitation of the securities discussed. Any opinions or estimates in this announcement are subject to change without notice. An i ...

An explanation of some basic concepts for Ratios and Analysis for

... Sum of dividends over a period (usually 1 year) Special, one time dividends Shares outstanding for the period ...

... Sum of dividends over a period (usually 1 year) Special, one time dividends Shares outstanding for the period ...

OCTAGON 88 RESOURCES, INC.

... We are currently negotiating funding for continuing operations and we are assisting in sourcing funding for the oil and gas company in which we hold an interest. At our current stage of operations, we anticipate incurring operating losses as we implement our business plan. Basis of presentation - Th ...

... We are currently negotiating funding for continuing operations and we are assisting in sourcing funding for the oil and gas company in which we hold an interest. At our current stage of operations, we anticipate incurring operating losses as we implement our business plan. Basis of presentation - Th ...

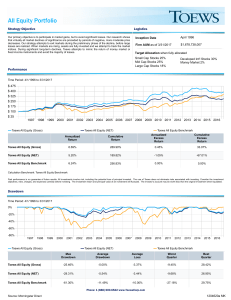

All Equity Portfolio

... The Russell 1000 Growth index measures the performance of the Russell 1000’s growth segment, which includes firms whose share prices have higher price to book ratios and higher expected earnings growth rates. The Russell Midcap Growth index measures the performance of the mid capitalization growth s ...

... The Russell 1000 Growth index measures the performance of the Russell 1000’s growth segment, which includes firms whose share prices have higher price to book ratios and higher expected earnings growth rates. The Russell Midcap Growth index measures the performance of the mid capitalization growth s ...

Brokerage Accounts, Transferring Stocks, and Handling Bonds

... It is not uncommon for a decedent to hold an interest in brokerage accounts, stock certificates, or government bonds at death. If these investments are a part of the probate estate, the PR has a duty to marshal these investments and either liquidate or distribute them prior to closing the Estate. A. ...

... It is not uncommon for a decedent to hold an interest in brokerage accounts, stock certificates, or government bonds at death. If these investments are a part of the probate estate, the PR has a duty to marshal these investments and either liquidate or distribute them prior to closing the Estate. A. ...

Trade Reporting Notice - 12/21/11

... the change is within the allowable variance to which the parties previously agreed. For example, when there is a change in the final delivery amount that is within the allowable variance, and the parties adjust the final price to maintain the yield agreed upon on the date of execution, a firm is not ...

... the change is within the allowable variance to which the parties previously agreed. For example, when there is a change in the final delivery amount that is within the allowable variance, and the parties adjust the final price to maintain the yield agreed upon on the date of execution, a firm is not ...

Lesson 16 - Mr. Wilson

... Investment banks can help a company raise capital through equity financing. With equity financing, money is raised by selling stock, or a share of ownership in the company. The selling of stocks generally begins with an IPO (initial public offering), where stock of the company is first introduced to ...

... Investment banks can help a company raise capital through equity financing. With equity financing, money is raised by selling stock, or a share of ownership in the company. The selling of stocks generally begins with an IPO (initial public offering), where stock of the company is first introduced to ...

DOC - Investor Relations

... guidance for 2015, which we announced in early September of this year. Mr. Wagner also discussed the company’s August follow-on offering, which raised $163 million and brought a good group of new institutional investors into the stock. He noted that the new equity issuance had resulted in an increas ...

... guidance for 2015, which we announced in early September of this year. Mr. Wagner also discussed the company’s August follow-on offering, which raised $163 million and brought a good group of new institutional investors into the stock. He noted that the new equity issuance had resulted in an increas ...

Oct 2013 Micro Cap WP.indd

... This confluence of factors makes the micro cap universe an extremely attractive investment class where managers can generate high risk-adjusted rates of return. Source: Mutual Fund Data - Bloomberg Criteria: U.S. Focused, Equity Mutual Funds ...

... This confluence of factors makes the micro cap universe an extremely attractive investment class where managers can generate high risk-adjusted rates of return. Source: Mutual Fund Data - Bloomberg Criteria: U.S. Focused, Equity Mutual Funds ...

Achieving Your Target Return

... are taken into consideration. There are many likely causes for why professional money managers fail to add value. While some of these causes are beyond the control of the investors, such as the long-term efficiency of capital markets, there are some that are within the control the investors. Investo ...

... are taken into consideration. There are many likely causes for why professional money managers fail to add value. While some of these causes are beyond the control of the investors, such as the long-term efficiency of capital markets, there are some that are within the control the investors. Investo ...

Renewable Energy Financing and Climate Policy Effectiveness

... 3. Different investor types – debt, equity, mezzanine finance, and venture capital – have specialized investment criteria and differ in their response to policy. The effects of policy also change across the stages of project development, construction, and operations. While all investors make decisio ...

... 3. Different investor types – debt, equity, mezzanine finance, and venture capital – have specialized investment criteria and differ in their response to policy. The effects of policy also change across the stages of project development, construction, and operations. While all investors make decisio ...

GRAY ROCK RESOURCES LTD.

... Gray Rock is in the exploration stage and has not yet determined whether the property contains ore reserves which are economically recoverable. The underlying carrying value of the mineral property interest and related exploration and evaluation assets is dependent upon the existence of economically ...

... Gray Rock is in the exploration stage and has not yet determined whether the property contains ore reserves which are economically recoverable. The underlying carrying value of the mineral property interest and related exploration and evaluation assets is dependent upon the existence of economically ...

Emerging Markets still High Flyers – Austria also on Long

... over the long term as well as in the short term. Growth, which is a basic condition for long-term investment success, is seen mainly in those markets. For investors it does not make much sense to invest in stagnating markets when there are others offering the potential of much higher returns over th ...

... over the long term as well as in the short term. Growth, which is a basic condition for long-term investment success, is seen mainly in those markets. For investors it does not make much sense to invest in stagnating markets when there are others offering the potential of much higher returns over th ...

File - Skagit Community Foundation

... the Board of Directors for approval regarding changes to asset allocation target and range percentages. The Committee may terminate investment advisors who do not adequately discharge their duties, including, but not limited to, failure to meet the investment objectives, failure to adhere to the ...

... the Board of Directors for approval regarding changes to asset allocation target and range percentages. The Committee may terminate investment advisors who do not adequately discharge their duties, including, but not limited to, failure to meet the investment objectives, failure to adhere to the ...

FIRST ASSET CANADIAN DIVIDEND LOW VOLATILITY INDEX ETF

... • Lower historical share price volatility relative to the S&P/TSX Composite Index with better risk-adjusted returns than the broader Canadian equity market • Considerably higher dividend yield relative to the market • In order to be selected for inclusion, securities must score well from both a low ...

... • Lower historical share price volatility relative to the S&P/TSX Composite Index with better risk-adjusted returns than the broader Canadian equity market • Considerably higher dividend yield relative to the market • In order to be selected for inclusion, securities must score well from both a low ...

Private Real Estate Co-Investing Today

... financial crisis has made institutional investors more selective and they are increasingly looking for durable long-term track records. Moreover, investors are often opting to invest more money with fewer, larger managers. ...

... financial crisis has made institutional investors more selective and they are increasingly looking for durable long-term track records. Moreover, investors are often opting to invest more money with fewer, larger managers. ...

NBER WORKING PAPER SERIES QUALITATIVE EASING: Roger E.A. Farmer

... ipants and those yet to be born. I will argue here, that that assumption is not a good characterization of the way that QuaE operates, and that QuaE is effective precisely because it alters the distribution of resources by effecting Pareto improving trades that agents are unable to carry out for them ...

... ipants and those yet to be born. I will argue here, that that assumption is not a good characterization of the way that QuaE operates, and that QuaE is effective precisely because it alters the distribution of resources by effecting Pareto improving trades that agents are unable to carry out for them ...

guide to absolute return investing

... information in this document is correct at the time of compilation, but no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors or omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers and e ...

... information in this document is correct at the time of compilation, but no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors or omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers and e ...

Main Title Goes Here - hsuaf

... Unemployment has fallen to 6.1% Inflation remains low (2.1%) The Federal Reserve has reduced their Quantitative Easing program Stocks posted double-digit returns during the fiscal year, outperforming non-U.S. equities Interest rates remain near historic lows The real estate market continues to recov ...

... Unemployment has fallen to 6.1% Inflation remains low (2.1%) The Federal Reserve has reduced their Quantitative Easing program Stocks posted double-digit returns during the fiscal year, outperforming non-U.S. equities Interest rates remain near historic lows The real estate market continues to recov ...

Leveraged buyout

A leveraged buyout (LBO) is a transaction when a company or single asset (e.g., a real estate property) is purchased with a combination of equity and significant amounts of borrowed money, structured in such a way that the target's cash flows or assets are used as the collateral (or ""leverage"") to secure and repay the borrowed money. Since the debt (be it senior or mezzanine) has a lower cost of capital (until bankruptcy risk reaches a level threatening to the lender[s]) than the equity, the returns on the equity increase as the amount of borrowed money does until the perfect capital structure is reached. As a result, the debt effectively serves as a lever to increase returns-on-investment.The term LBO is usually employed when a financial sponsor acquires a company. However, many corporate transactions are partially funded by bank debt, thus effectively also representing an LBO. LBOs can have many different forms such as management buyout (MBO), management buy-in (MBI), secondary buyout and tertiary buyout, among others, and can occur in growth situations, restructuring situations, and insolvencies. LBOs mostly occur in private companies, but can also be employed with public companies (in a so-called PtP transaction – Public to Private).As financial sponsors increase their returns by employing a very high leverage (i.e., a high ratio of debt to equity), they have an incentive to employ as much debt as possible to finance an acquisition. This has, in many cases, led to situations, in which companies were ""over-leveraged"", meaning that they did not generate sufficient cash flows to service their debt, which in turn led to insolvency or to debt-to-equity swaps in which the equity owners lose control over the business and the debt providers assume the equity.