Will Big Four Audit Firms Survive in a World of Unlimited Liability

... The alternative of government auditors is an unattractive one. The quality of the audits would be suspect, if only because of the difficulty in attracting good auditors at government pay, and political influence could be a problem. Consider the way technology companies got the House of Representativ ...

... The alternative of government auditors is an unattractive one. The quality of the audits would be suspect, if only because of the difficulty in attracting good auditors at government pay, and political influence could be a problem. Consider the way technology companies got the House of Representativ ...

Business Structure

... sustain progress and keep alive the pioneering spirit that originally brought the Cooperative into being. The Board of Directors is responsible for determining policy and providing direction for the management team. Day -to-day business operations are handled by the professionals that make up the Co ...

... sustain progress and keep alive the pioneering spirit that originally brought the Cooperative into being. The Board of Directors is responsible for determining policy and providing direction for the management team. Day -to-day business operations are handled by the professionals that make up the Co ...

Arts Council England announces £150000 cultural

... The region boasts an excellent combination of traditional, heritage and contemporary culture. From the major modern city of Bristol with a growing international airport and the well-known world heritage brand of Bath, to the engineering genius of South Gloucestershire and the regeneration of WestonS ...

... The region boasts an excellent combination of traditional, heritage and contemporary culture. From the major modern city of Bristol with a growing international airport and the well-known world heritage brand of Bath, to the engineering genius of South Gloucestershire and the regeneration of WestonS ...

FACTORS AFFECTING RELATIONS DEVELOPMENT IN THE

... formation of the concepts of partnership relations. Nowdays, the trend towards cooperation, partnership and constant search for the most effective partnerships and relations is relevant. Partnerships enable the company to achieve, maintain and strengthen its competitive advantage. A partnership in b ...

... formation of the concepts of partnership relations. Nowdays, the trend towards cooperation, partnership and constant search for the most effective partnerships and relations is relevant. Partnerships enable the company to achieve, maintain and strengthen its competitive advantage. A partnership in b ...

Sole Proprietorship

... Limited liability for owners Unlimited life Raising capital is easier (access to resources) Hire professional managers to run company Easy to transfer ownership of company ...

... Limited liability for owners Unlimited life Raising capital is easier (access to resources) Hire professional managers to run company Easy to transfer ownership of company ...

352.1-352.2 New York State Partnership for Long Term Care

... For persons who utilize the required amount of benefits under a Partnership insurance policy, Medicaid eligibility is determined without regard to resources. This is called Medicaid Extended Coverage. Therefore, it is not necessary to collect and/or document information on an individual’s resources ...

... For persons who utilize the required amount of benefits under a Partnership insurance policy, Medicaid eligibility is determined without regard to resources. This is called Medicaid Extended Coverage. Therefore, it is not necessary to collect and/or document information on an individual’s resources ...

6.3 How to hold real estate

... partnership in proportion to their partnership interest. Under the Canadian Income Tax Act, a partnership is not a separate taxable entity and all revenues and expenses, assets and liabilities of the partnership are passed through to each individual partner with the single exception of capital cost ...

... partnership in proportion to their partnership interest. Under the Canadian Income Tax Act, a partnership is not a separate taxable entity and all revenues and expenses, assets and liabilities of the partnership are passed through to each individual partner with the single exception of capital cost ...

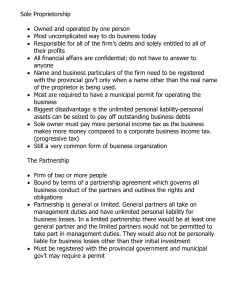

Sole Proprietorship - hrsbstaff.ednet.ns.ca

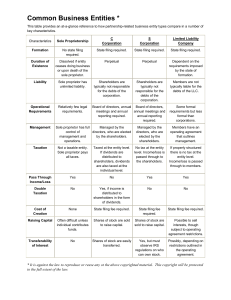

... Still a very common form of business organization The Partnership Firm of two or more people Bound by terms of a partnership agreement which governs all business conduct of the partners and outlines the rights and obligations Partnership is general or limited. General partners all take on ma ...

... Still a very common form of business organization The Partnership Firm of two or more people Bound by terms of a partnership agreement which governs all business conduct of the partners and outlines the rights and obligations Partnership is general or limited. General partners all take on ma ...

business organizations

... • Managerial resources • Lack of special taxes (usually only a special schedule) • Economic capital • Efficiencies are easier to accomplish • Talent easier to attract ...

... • Managerial resources • Lack of special taxes (usually only a special schedule) • Economic capital • Efficiencies are easier to accomplish • Talent easier to attract ...

Types of Businesses

... Partners must share profits Partnership must be reorganized if one partner quits Partners share unlimited liability—all partners share the responsibility of a bad decision made by one partner (including debts) ...

... Partners must share profits Partnership must be reorganized if one partner quits Partners share unlimited liability—all partners share the responsibility of a bad decision made by one partner (including debts) ...

CHAPTER6 Business Ownership and Operations Analytical

... Analytical Skills 2: Types of Business Ownership DIRECTIONS: Fill in the table below to describe the characteristics of each type of business. Some blocks have been started for you for examples. ...

... Analytical Skills 2: Types of Business Ownership DIRECTIONS: Fill in the table below to describe the characteristics of each type of business. Some blocks have been started for you for examples. ...