Regulating Financial Markets

... between financial intermediation and regulation, including (but not limited to): ...

... between financial intermediation and regulation, including (but not limited to): ...

The Subprime Crisis And The Yin and Yang of Financial

... Securitization is a financial innovation that has made the capital more accessible, the associated markets more competitive and more flexible On the other hand, some financial products have become overly complex and less transparent, which will affect market efficiency in the long run. Years of beni ...

... Securitization is a financial innovation that has made the capital more accessible, the associated markets more competitive and more flexible On the other hand, some financial products have become overly complex and less transparent, which will affect market efficiency in the long run. Years of beni ...

New Financial Regulation HEC, Paris, February 2011 Petr Blizkovsky

... Petr Blizkovsky The views expressed in this presentation are those of the author and do not in any way reflect the opinion of the CSG of the EU ...

... Petr Blizkovsky The views expressed in this presentation are those of the author and do not in any way reflect the opinion of the CSG of the EU ...

Turkey Presentation - Wharton Finance Department

... Banks were severely affected Currency risk Interest risk Maturity risk ...

... Banks were severely affected Currency risk Interest risk Maturity risk ...

What is a Systemically Important Financial Institution?

... a principal components analysis becomes concentrated in a single factor. A modification of this approach by Reyngold, Shnyra, and Stein (2013) denoted Credit Absorption Ratio (CAR) extends AR to default risk data. And Carciente, Kenett, Avakia, Stanley, and Havlin (2015) undertake systemic stress te ...

... a principal components analysis becomes concentrated in a single factor. A modification of this approach by Reyngold, Shnyra, and Stein (2013) denoted Credit Absorption Ratio (CAR) extends AR to default risk data. And Carciente, Kenett, Avakia, Stanley, and Havlin (2015) undertake systemic stress te ...

The Evolution of the Finance

... Greenspan (1999) told Congress that policy should ‘mitigate the fallout when it occurs’ role of the central bank is to mop up after the bubble bursts. Bernanke (2002) said ‘“leaning against the bubble” is unlikely to be productive in practice’ The danger of false positives – tightening when there ...

... Greenspan (1999) told Congress that policy should ‘mitigate the fallout when it occurs’ role of the central bank is to mop up after the bubble bursts. Bernanke (2002) said ‘“leaning against the bubble” is unlikely to be productive in practice’ The danger of false positives – tightening when there ...

commercial text 1 2010

... The report made it clear that there will be no early resolution to the global financial crisis. "The financial shock that erupted in August 2007, as the US sub-prime mortgage market was derailed by the reversal of the housing boom, has spread quickly and unpredictably to inflict extensive damage on ...

... The report made it clear that there will be no early resolution to the global financial crisis. "The financial shock that erupted in August 2007, as the US sub-prime mortgage market was derailed by the reversal of the housing boom, has spread quickly and unpredictably to inflict extensive damage on ...

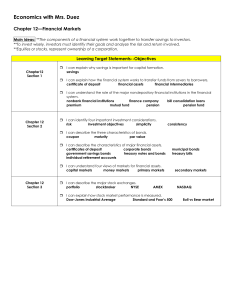

government - Humble ISD

... Economics with Mrs. Duez Chapter 12—Financial Markets Main Ideas: **The components of a financial system work together to transfer savings to investors. **To invest wisely, investors must identify their goals and analyze the risk and return involved. **Equities or stocks, represent ownership of a co ...

... Economics with Mrs. Duez Chapter 12—Financial Markets Main Ideas: **The components of a financial system work together to transfer savings to investors. **To invest wisely, investors must identify their goals and analyze the risk and return involved. **Equities or stocks, represent ownership of a co ...

Estrategias para manejar la volatilidad de los ingresos

... ◦ Long-term fiscal pressures/risks and contingent liabilities ...

... ◦ Long-term fiscal pressures/risks and contingent liabilities ...

Global Bargain Hunting

... The Future 10-Year Returns When Stocks are Purchased at Different D/P in Hong Kong ...

... The Future 10-Year Returns When Stocks are Purchased at Different D/P in Hong Kong ...

Systemic risk in European Economies: Deciphering Leading

... • We depart from the premise that uncertainty boils down to risk if information about the likelihood of events to happen is known (Knight, 1921) • Systemic risk is a special case but we still need knowledge about probability distributions (though almost always deviating from the Gaussian one) to est ...

... • We depart from the premise that uncertainty boils down to risk if information about the likelihood of events to happen is known (Knight, 1921) • Systemic risk is a special case but we still need knowledge about probability distributions (though almost always deviating from the Gaussian one) to est ...

Credit cycle and systemic risk

... credit spreads, etc..). • The leverage can be approximated by credit-to-GDP ratio: • increases until the financial cycle turns over; normally the turnover happens in an orderly way (a case of cycle without a crisis in Chart) without a need for an extra policy action. • sometimes the turn is disorder ...

... credit spreads, etc..). • The leverage can be approximated by credit-to-GDP ratio: • increases until the financial cycle turns over; normally the turnover happens in an orderly way (a case of cycle without a crisis in Chart) without a need for an extra policy action. • sometimes the turn is disorder ...

Connecting the Dots: i d i l

... Excess credit/leverage is solvency issue—consider tools to limit insolvency Runs in wholesale funding markets is a liquidity issue—consider tools to limit illiquidity ...

... Excess credit/leverage is solvency issue—consider tools to limit insolvency Runs in wholesale funding markets is a liquidity issue—consider tools to limit illiquidity ...

Short Readings 1

... larger banks may have contributed to economic volatility. It is possible that large mergers in the industry might create banks which are too large? Explain the regulatory worries associated with a single bank controlling too much of the market. What reasons for regulation that we discussed in class ...

... larger banks may have contributed to economic volatility. It is possible that large mergers in the industry might create banks which are too large? Explain the regulatory worries associated with a single bank controlling too much of the market. What reasons for regulation that we discussed in class ...

... demonstratively successful research program. This program, however, has been more qualitative than quantitative in nature. In the crisis, policy-makers have had to fall back on qualitative models of systemic failure, such as the well-known Diamond-Dybvig model of bank runs. While these models have p ...

3rd Biennial International Conference on Business, Banking & Finance Panel Discussion:

... and non-financial • Group is usually headed by a non-financial entity that is not regulated by a financial services regulator • Financial companies are imbedded within the structure ...

... and non-financial • Group is usually headed by a non-financial entity that is not regulated by a financial services regulator • Financial companies are imbedded within the structure ...