Chapter 2: A Further Look at Financial Statements

... Long-term investments are generally investments in debt and equity of other corporations that are normally held for many years. They also include investments in long-term assets such as land and buildings that are not currently being used in the organization’s operating activities. Intangible assets ...

... Long-term investments are generally investments in debt and equity of other corporations that are normally held for many years. They also include investments in long-term assets such as land and buildings that are not currently being used in the organization’s operating activities. Intangible assets ...

sovereign debt, domestic banks and the provision of public liquidity

... mechanism. The counterfactual exercises indicate that although both channels are economically relevant, the balance-sheet effect is more important as it accounts for 65% of the output cost of default while the remaining 35% is due to the liquidity effect. Additionally, the balancesheet effect explai ...

... mechanism. The counterfactual exercises indicate that although both channels are economically relevant, the balance-sheet effect is more important as it accounts for 65% of the output cost of default while the remaining 35% is due to the liquidity effect. Additionally, the balancesheet effect explai ...

Modeling Sustainable Earnings and P/E Ratios Using Financial

... (1987). Other papers defer to accounting information beyond past earnings for indications of persistence. Our paper is in the latter tradition. Freeman, Ohlson and Penman (1982) show that by adding just one line item – book value – to current earnings, future earnings changes are probabilistically ...

... (1987). Other papers defer to accounting information beyond past earnings for indications of persistence. Our paper is in the latter tradition. Freeman, Ohlson and Penman (1982) show that by adding just one line item – book value – to current earnings, future earnings changes are probabilistically ...

Planning for Retirement Terrance K Martin Jr.* and Michael Finke

... Investment Advisors are regulated by the Securities and Exchange Commission according to the 1940 Investment Advisers Act. Nearly all RIAs are compensated based on asset fees and are required to provide a fiduciary standard of care toward their client. Many who provide comprehensive financial planni ...

... Investment Advisors are regulated by the Securities and Exchange Commission according to the 1940 Investment Advisers Act. Nearly all RIAs are compensated based on asset fees and are required to provide a fiduciary standard of care toward their client. Many who provide comprehensive financial planni ...

Bubbles and Self-enforcing Debt (November 2007, with Guido Lorenzoni)

... by paying upfront in exchange for future state-contingent payments. This other agent therefore basically turns into a borrower, since he accepts a payment today in exchange for future payments. But what guarantees that this agent will fulfill his future obligations? In BR, this question does not ari ...

... by paying upfront in exchange for future state-contingent payments. This other agent therefore basically turns into a borrower, since he accepts a payment today in exchange for future payments. But what guarantees that this agent will fulfill his future obligations? In BR, this question does not ari ...

Objective of Superannuation

... 22 per cent of all assets held by Australian households. Only owner occupied housing is larger, constituting 38 per cent of all assets held by Australian households. Superannuation is also a key component of the financial services industry and the economy more broadly. Superannuation assets have inc ...

... 22 per cent of all assets held by Australian households. Only owner occupied housing is larger, constituting 38 per cent of all assets held by Australian households. Superannuation is also a key component of the financial services industry and the economy more broadly. Superannuation assets have inc ...

Volatility and Fixed Income Asset Class Comparison

... We liken a short volatility exposure to a long bond exposure. Just as a bond issuer is willing to pay (and is in fact required to pay) a rate of interest in excess of the expected rate of inflation, a buyer of volatility is required to pay for an implied volatility level in excess of the expected re ...

... We liken a short volatility exposure to a long bond exposure. Just as a bond issuer is willing to pay (and is in fact required to pay) a rate of interest in excess of the expected rate of inflation, a buyer of volatility is required to pay for an implied volatility level in excess of the expected re ...

annual report 2016 - Asseco Central Europe

... the Asseco Group and the position in the local market and we expanded our business activities over new markets. By the beginning of the year, we succeeded in concluding the first significant commercial contract in the area of comprehensive insurance in Nigeria. We supplied our comprehensive informat ...

... the Asseco Group and the position in the local market and we expanded our business activities over new markets. By the beginning of the year, we succeeded in concluding the first significant commercial contract in the area of comprehensive insurance in Nigeria. We supplied our comprehensive informat ...

Examining the effect of family control on firm value and

... There are many theories about the positive and negative perspective of performance in familyfirms. Dyer (2006) presents family factors affecting high versus low firm performance where the principal-agency theory has a central role (see table 1). If the agents (managers) and the principal (owners) ha ...

... There are many theories about the positive and negative perspective of performance in familyfirms. Dyer (2006) presents family factors affecting high versus low firm performance where the principal-agency theory has a central role (see table 1). If the agents (managers) and the principal (owners) ha ...

Hedge Funds How They Serve Investors in U.S. and Global Markets

... Administration, the media, investors, and others to learn about hedge funds, their role in the U.S. and global economies, and the relevant regulations. It will be incumbent upon our industry to answer questions, for example, about how a new regulatory regime should address systemic risks and operati ...

... Administration, the media, investors, and others to learn about hedge funds, their role in the U.S. and global economies, and the relevant regulations. It will be incumbent upon our industry to answer questions, for example, about how a new regulatory regime should address systemic risks and operati ...

NBER WORKING PAPER SERIES TEMPERATURE, AGGREGATE RISK, AND EXPECTED RETURNS Ravi Bansal

... temperature on expected growth rates, as documented in our empirical results. The model has an important implication, a higher exposure to long-run aggregate growth translates into a higher (more negative) temperature beta as well as a larger risk premium, and a higher compensation for temperature r ...

... temperature on expected growth rates, as documented in our empirical results. The model has an important implication, a higher exposure to long-run aggregate growth translates into a higher (more negative) temperature beta as well as a larger risk premium, and a higher compensation for temperature r ...

Barriers to convert to organic farming and the role of risk

... to organic farming is of great interest for policy makers as well as for academics. In Sweden and in other EU countries, proposed targets of the area in organic farmland have failed to be reached in spite of different kinds of policy measures. Most studies agree that the average profitability seems ...

... to organic farming is of great interest for policy makers as well as for academics. In Sweden and in other EU countries, proposed targets of the area in organic farmland have failed to be reached in spite of different kinds of policy measures. Most studies agree that the average profitability seems ...

Annual report 2015/16

... Core business activity Coloplast develops and markets products and services that make life easier for people with very private and personal medical conditions. Coloplast works closely with users to develop solutions that consider their special needs. Coloplast calls this intimate healthcare. Colopla ...

... Core business activity Coloplast develops and markets products and services that make life easier for people with very private and personal medical conditions. Coloplast works closely with users to develop solutions that consider their special needs. Coloplast calls this intimate healthcare. Colopla ...

Horizons US 7-10 Year Treasury Bond CAD

... Horizons Management does not endeavour to predict market direction generally, or the changes that may occur in global fiscal and monetary policies, the effect of additional geopolitical concerns, or unforeseen other crises. Horizons Management and the ETF are agnostic as to their impact on global eq ...

... Horizons Management does not endeavour to predict market direction generally, or the changes that may occur in global fiscal and monetary policies, the effect of additional geopolitical concerns, or unforeseen other crises. Horizons Management and the ETF are agnostic as to their impact on global eq ...

performance analysis for the two-minute portfolio in both canadian

... care in generalizing from the performance results of a specific mutual fund group and a specific market index. Above findings are important to us because transaction costs are not considered in our evaluation of the Two-Minute Portfolio. Investors must take their brokerage commissions and other mana ...

... care in generalizing from the performance results of a specific mutual fund group and a specific market index. Above findings are important to us because transaction costs are not considered in our evaluation of the Two-Minute Portfolio. Investors must take their brokerage commissions and other mana ...

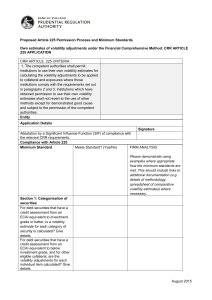

Proposed Article 225 Permission Process and

... scaled up or down to the minimum liquidation periods set out in Article 225(2)(b), using the square root of time formula set out in Article 225(2)(c). Provide detail on which categories of securities the volatility adjustments are calculated for in this manner. The liquidity of lower quality assets ...

... scaled up or down to the minimum liquidation periods set out in Article 225(2)(b), using the square root of time formula set out in Article 225(2)(c). Provide detail on which categories of securities the volatility adjustments are calculated for in this manner. The liquidity of lower quality assets ...