Press release- Bank Performance and Reporting Value

... “A vibrant, well-functioning banking sector is crucial for overcoming the ongoing economic malaise that continues to affect developed world economies. This report focuses on the relationship between market-based indicators of value and risk and bank financial statement information, to reveal fault l ...

... “A vibrant, well-functioning banking sector is crucial for overcoming the ongoing economic malaise that continues to affect developed world economies. This report focuses on the relationship between market-based indicators of value and risk and bank financial statement information, to reveal fault l ...

Midterm 2 Answers PART I: Multiple Choice [39 minutes total, 3

... PART I: Multiple Choice [39 minutes total, 3 points each]. Do NOT explain. 1. Which of the following are reported as liabilities on a bank’s balance sheet? a) Reserves b) Checkable deposits c) Loans d) Deposits with other banks e) Treasury securities 2. Because ________ are less liquid for the depos ...

... PART I: Multiple Choice [39 minutes total, 3 points each]. Do NOT explain. 1. Which of the following are reported as liabilities on a bank’s balance sheet? a) Reserves b) Checkable deposits c) Loans d) Deposits with other banks e) Treasury securities 2. Because ________ are less liquid for the depos ...

Financial Institutions

... Explain the purpose of securities Describe the function of finance companies Explain how insurance companies provide risk-management and investment options to their clients ...

... Explain the purpose of securities Describe the function of finance companies Explain how insurance companies provide risk-management and investment options to their clients ...

Lecture 2

... • Several banks and investment firms were bankrupt (not enough assets to cover their liabilities)- and had to be rescued by taxpayers. • This banking crisis translated into a macroeconomic crisis as banks started to cut back on their lending for new projects. ...

... • Several banks and investment firms were bankrupt (not enough assets to cover their liabilities)- and had to be rescued by taxpayers. • This banking crisis translated into a macroeconomic crisis as banks started to cut back on their lending for new projects. ...

Economics 333

... liquidity. So arguably, in terms of CAMEL rating, Bank of East Asian is doing better than similar US banks. ...

... liquidity. So arguably, in terms of CAMEL rating, Bank of East Asian is doing better than similar US banks. ...

THE CASE AGAINST INTEREST: IS IT COMPELLING?

... discipline more effective More effective discipline will complement the role of regulators and supervisors and help make the financial system healthier and more stable ...

... discipline more effective More effective discipline will complement the role of regulators and supervisors and help make the financial system healthier and more stable ...

Banks lend more as economy grows

... increased, due to higher credit demand for larger working capital to finance growing outputs. A number of them went for fixed investment. Senior bankers say that private sector companies, taking advantage of low interest rates, also kept retiring their old bank debts and regularised their NPLs. “Thi ...

... increased, due to higher credit demand for larger working capital to finance growing outputs. A number of them went for fixed investment. Senior bankers say that private sector companies, taking advantage of low interest rates, also kept retiring their old bank debts and regularised their NPLs. “Thi ...

It`s all explained in

... selling of stock they do not serve for household expenses and are not changed into silver. But if some panic or unforeseen crisis drove the holders to demand silver from the Bank the bomb would burst and it would be seen that these are dangerous operations.’ Of course, at present, much of quantitati ...

... selling of stock they do not serve for household expenses and are not changed into silver. But if some panic or unforeseen crisis drove the holders to demand silver from the Bank the bomb would burst and it would be seen that these are dangerous operations.’ Of course, at present, much of quantitati ...

THE GREEK BANKING SYSTEM

... money markets. Activities, such as asset management, insurance, mortgage lending and consumer credit have also experienced considerable growth and diversification. A wide range of products is now made available to Greek consumers who gradually develop new consumption patterns and new investment habi ...

... money markets. Activities, such as asset management, insurance, mortgage lending and consumer credit have also experienced considerable growth and diversification. A wide range of products is now made available to Greek consumers who gradually develop new consumption patterns and new investment habi ...

Financial Crisis and Fed Policy Actions

... creates the Term Auction Facility (TAF) in which reserves are auctioned to depository institutions against a wide variety of collateral. – “By allowing the Federal Reserve to inject term funds through a broader range of counterparties and against a broader range of collateral than open market operat ...

... creates the Term Auction Facility (TAF) in which reserves are auctioned to depository institutions against a wide variety of collateral. – “By allowing the Federal Reserve to inject term funds through a broader range of counterparties and against a broader range of collateral than open market operat ...

GLOSSARY OF KEY TERMS DISCUSSED IN

... Issued by banks these instruments usually have a maximum life, or maturity, of half a year. They are backed by assets such as debts receivable and are used for short term financing. Base Rate The rate at which the Bank of England lends to financial institutions. Call Account A bank account which all ...

... Issued by banks these instruments usually have a maximum life, or maturity, of half a year. They are backed by assets such as debts receivable and are used for short term financing. Base Rate The rate at which the Bank of England lends to financial institutions. Call Account A bank account which all ...

Answers to Chapter 12 Questions

... 1. The Report of Condition refers to the bank's balance sheet which presents information about the accumulation of assets, liabilities, and equity as of a specific point in time. The Report of Income refers to the bank's income statement which presents information about the flow of revenues and expe ...

... 1. The Report of Condition refers to the bank's balance sheet which presents information about the accumulation of assets, liabilities, and equity as of a specific point in time. The Report of Income refers to the bank's income statement which presents information about the flow of revenues and expe ...

The Republican Presidents of the 1920s and the Causes of the

... 1. Conservative economic policy: Laissez faire, let the market right itself without government intervention 2. main belief: private charities, churches, state and local governments provide relief and assistance to the poor, not the Federal Government ...

... 1. Conservative economic policy: Laissez faire, let the market right itself without government intervention 2. main belief: private charities, churches, state and local governments provide relief and assistance to the poor, not the Federal Government ...

money - MLedford

... Banks use fractional reserve banking- meaning that banks only keep a fraction of funds on hand and lend the remainder. The Federal Reserve establishes the required reserve ratio, or the fraction of deposits that must be held in reserve. Credit Cards- banks issue credit cards (a card entitling it ...

... Banks use fractional reserve banking- meaning that banks only keep a fraction of funds on hand and lend the remainder. The Federal Reserve establishes the required reserve ratio, or the fraction of deposits that must be held in reserve. Credit Cards- banks issue credit cards (a card entitling it ...

OVERVIEW

... Although the ratio of household financial liabilities to GDP increased in recent years, it is still lower than many countries including new members of the EU. The low level of FX-indexed and variable rate portion of household liabilities leaves households in Turkey less vulnerable to unfavorable dev ...

... Although the ratio of household financial liabilities to GDP increased in recent years, it is still lower than many countries including new members of the EU. The low level of FX-indexed and variable rate portion of household liabilities leaves households in Turkey less vulnerable to unfavorable dev ...

download soal

... unit is federally regulated, BankAtlantic eventually might have faced regulatory action if it didn't substantially beef up the unit's capital and reserve levels to cover the bad loans. Because the BankAtlantic subsidiary that holds the bad loans isn't regulated, it doesn't face the same capital requ ...

... unit is federally regulated, BankAtlantic eventually might have faced regulatory action if it didn't substantially beef up the unit's capital and reserve levels to cover the bad loans. Because the BankAtlantic subsidiary that holds the bad loans isn't regulated, it doesn't face the same capital requ ...

short version

... He defrauds the bank’s creditors and shareholders, as a means of optimizing fictional accounting income It pays to seek out bad loans because only those who have no intention of repaying are willing to offer the high loan fees and interest required ...

... He defrauds the bank’s creditors and shareholders, as a means of optimizing fictional accounting income It pays to seek out bad loans because only those who have no intention of repaying are willing to offer the high loan fees and interest required ...

PDF - Treasury Strategies

... with respect to the implementation of the Net Stable Funding Ratio (NSFR). Treasury Strategies is the acknowledged leader in treasury, liquidity and payments issues. We have testified before congressional committees and special agency hearings regarding the impact of post-crisis regulations. For 34 ...

... with respect to the implementation of the Net Stable Funding Ratio (NSFR). Treasury Strategies is the acknowledged leader in treasury, liquidity and payments issues. We have testified before congressional committees and special agency hearings regarding the impact of post-crisis regulations. For 34 ...

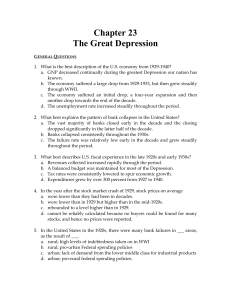

Chapter 23 - Weber State University

... another drop towards the end of the decade. d. The unemployment rate increased steadily throughout the period. 2. What best explains the pattern of bank collapses in the United States? a. The vast majority of banks closed early in the decade and the closing dropped significantly in the latter half o ...

... another drop towards the end of the decade. d. The unemployment rate increased steadily throughout the period. 2. What best explains the pattern of bank collapses in the United States? a. The vast majority of banks closed early in the decade and the closing dropped significantly in the latter half o ...

2011 result: Shareholders restate confidence in Zenith`s management

... Shareholders of Zenith Bank Plc have expressed their pleasure on the financial performance delivered by the bank for the year ended 31st December, 2011, saying that it attested to the doggedness of the management team. A cross section of the shareholders that spoke with Vanguard noted that the resul ...

... Shareholders of Zenith Bank Plc have expressed their pleasure on the financial performance delivered by the bank for the year ended 31st December, 2011, saying that it attested to the doggedness of the management team. A cross section of the shareholders that spoke with Vanguard noted that the resul ...

Presentation - British Institute of International and Comparative Law

... assets at real-economic-value by the bank benefiting from the scheme; aligning incentives for banks to participate in asset relief with public policy objectives, through an enrolment window limited to six months during which the banks would be able to come forward with impaired assets; management of ...

... assets at real-economic-value by the bank benefiting from the scheme; aligning incentives for banks to participate in asset relief with public policy objectives, through an enrolment window limited to six months during which the banks would be able to come forward with impaired assets; management of ...

Speech by Mr. Ivan Iskrov, Governor of the BNB, at the spring

... In addition to the intensifying competition among banks, the banking sector should also anticipate the increasing competition of the non-bank financial intermediaries. This is a global trend, which has gained in strength in Bulgaria in the recent years. The administrative restrictions enforced by th ...

... In addition to the intensifying competition among banks, the banking sector should also anticipate the increasing competition of the non-bank financial intermediaries. This is a global trend, which has gained in strength in Bulgaria in the recent years. The administrative restrictions enforced by th ...

Bank

A bank is a financial intermediary that creates credit by lending money to a borrower, thereby creating a corresponding deposit on the bank's balance sheet. Lending activities can be performed either directly or indirectly through capital markets. Due to their importance in the financial system and influence on national economies, banks are highly regulated in most countries. Most nations have institutionalized a system known as fractional reserve banking under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, known as the Basel Accords.Banking in its modern sense evolved in the 14th century in the rich cities of Renaissance Italy but in many ways was a continuation of ideas and concepts of credit and lending that had their roots in the ancient world. In the history of banking, a number of banking dynasties — notably, the Medicis, the Fuggers, the Welsers, the Berenbergs and the Rothschilds — have played a central role over many centuries. The oldest existing retail bank is Monte dei Paschi di Siena, while the oldest existing merchant bank is Berenberg Bank.