Test 2

... deposits fall and banks have less to lend. Further, under these circumstances banks are probably more cautious about lending. Both of these reactions would tend to decrease the money supply. Open market purchases increase bank reserves and so would have at least made the decrease smaller. The increa ...

... deposits fall and banks have less to lend. Further, under these circumstances banks are probably more cautious about lending. Both of these reactions would tend to decrease the money supply. Open market purchases increase bank reserves and so would have at least made the decrease smaller. The increa ...

Does Size Matter? The Effects of Bank Mergers on Small Firm

... potential borrowers, thereby reducing the problems related to asymmetric information (i.e., moral hazard and adverse selection) and significantly reduce the banks’ credit risk. If the network of branches is capillary the decision making power remains at the local level, therefore valuable, long term ...

... potential borrowers, thereby reducing the problems related to asymmetric information (i.e., moral hazard and adverse selection) and significantly reduce the banks’ credit risk. If the network of branches is capillary the decision making power remains at the local level, therefore valuable, long term ...

Chapter Outlines and Solutions for

... trend should continue with the advent of faster, more customer friendly products and services, and the continued technology education of customers. ...

... trend should continue with the advent of faster, more customer friendly products and services, and the continued technology education of customers. ...

A Gold Standard with Free Banking Would Have Restrained the

... banking system shrinks in response to the smaller interest reward offered. Some theorists have also imagined, fancifully, that commercial banks would respond en masse to an increased demand for loanable funds by expanding loans but not increasing interest rates.2 That outcome is implausible because ...

... banking system shrinks in response to the smaller interest reward offered. Some theorists have also imagined, fancifully, that commercial banks would respond en masse to an increased demand for loanable funds by expanding loans but not increasing interest rates.2 That outcome is implausible because ...

PRESS RELEASE African mining prospects remain intact despite

... combination of slower global economic growth and a stronger US dollar. “Mining has always been a cyclical industry and Standard Bank is of the view that what we are currently experiencing is a cyclical correction, we’re either at the bottom of the cycle or very close to the bottom,” said Mr Kohli. F ...

... combination of slower global economic growth and a stronger US dollar. “Mining has always been a cyclical industry and Standard Bank is of the view that what we are currently experiencing is a cyclical correction, we’re either at the bottom of the cycle or very close to the bottom,” said Mr Kohli. F ...

BANK OF ISRAEL Office of the Spokesperson and Economic

... Turning now to the trickier and thornier issue of the sector's competitiveness, we do not have all the indicators needed to make a perfect assessment of the situation, but we do note that the concentration in the banking sector is substantially higher than that of developed countries. Perhaps even m ...

... Turning now to the trickier and thornier issue of the sector's competitiveness, we do not have all the indicators needed to make a perfect assessment of the situation, but we do note that the concentration in the banking sector is substantially higher than that of developed countries. Perhaps even m ...

FDR and the Banks - Constitutional Rights Foundation

... and many others failed to see: The banking crisis was mainly about people’s lack of confidence in the banks. To restore their confidence, FDR decided to speak to the people directly over the radio. On March 12 at 10 p.m., Roosevelt spoke live from the White House to an estimated 40 million Americans ...

... and many others failed to see: The banking crisis was mainly about people’s lack of confidence in the banks. To restore their confidence, FDR decided to speak to the people directly over the radio. On March 12 at 10 p.m., Roosevelt spoke live from the White House to an estimated 40 million Americans ...

The fundamentals that have been driving the price of gold are still

... The fundamentals that have been driving the price of gold are still intact. While the recent volatility may prolong a recovery in gold prices, the same underlying fundamentals that have been driving the prices higher, are still in place. These forces include a generally-weak U.S. dollar, a potential ...

... The fundamentals that have been driving the price of gold are still intact. While the recent volatility may prolong a recovery in gold prices, the same underlying fundamentals that have been driving the prices higher, are still in place. These forces include a generally-weak U.S. dollar, a potential ...

UK consumer credit

... Sources: Bank of England, Finance & Leasing Association, published accounts and Bank calculations. (a) Banks include monetary financial institutions (MFIs) and, where identified, non-bank subsidiaries of UK MFIs. (b) Excludes income-contingent student loans. (c) Numbers may not sum to totals because ...

... Sources: Bank of England, Finance & Leasing Association, published accounts and Bank calculations. (a) Banks include monetary financial institutions (MFIs) and, where identified, non-bank subsidiaries of UK MFIs. (b) Excludes income-contingent student loans. (c) Numbers may not sum to totals because ...

(Ghana): Ministry of Trade and Industry

... The new Banking Act of 2004 also brought some changes into the banking industry including elimination of secondary reserves and increase in minimum capital requirement among others. The number of Deposit Money Banks (DMBs), Non-Bank Financial Institutions (NBFIs), and the number of Rural and Communi ...

... The new Banking Act of 2004 also brought some changes into the banking industry including elimination of secondary reserves and increase in minimum capital requirement among others. The number of Deposit Money Banks (DMBs), Non-Bank Financial Institutions (NBFIs), and the number of Rural and Communi ...

Microsoft Word - TempDoc1.doc

... settlement may be indicated). V. Overdues position, if any (In the case of derivatives contracts, the negative MTM i.e., amount payable to the Bank under the contract but not yet paid may be indicated) VI. Repayment terms (for demand loans, term loans, corporate loans, project- wise finance). VII. S ...

... settlement may be indicated). V. Overdues position, if any (In the case of derivatives contracts, the negative MTM i.e., amount payable to the Bank under the contract but not yet paid may be indicated) VI. Repayment terms (for demand loans, term loans, corporate loans, project- wise finance). VII. S ...

Financial Intermediaries

... Insurance companies are also divided between mutual and joint-stock corporations. They issue contracts or policies that mature or come due should some contingency occur, which is a mechanism for spreading and sharing risks. Term life insurance policies pay off if the insured dies within the contract ...

... Insurance companies are also divided between mutual and joint-stock corporations. They issue contracts or policies that mature or come due should some contingency occur, which is a mechanism for spreading and sharing risks. Term life insurance policies pay off if the insured dies within the contract ...

Global environment - Financial Stability Report

... (b) Non-financial corporates consists of non-financial public and private sector firms and finance vehicles of industrial and utility firms. ...

... (b) Non-financial corporates consists of non-financial public and private sector firms and finance vehicles of industrial and utility firms. ...

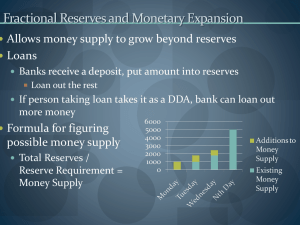

Money and Banking

... Tight Money Policy Restricts growth Increases interest rates Slows economic growth ...

... Tight Money Policy Restricts growth Increases interest rates Slows economic growth ...

Key

... limited amount of funds. This is a reduced money supply, a tight money policy. As a result of this action, other things being equal, do the banks enjoy higher profits, lower profits, or losses? How does the impact on profits/losses differ between a high-risk bank and a low-risk bank as a result of t ...

... limited amount of funds. This is a reduced money supply, a tight money policy. As a result of this action, other things being equal, do the banks enjoy higher profits, lower profits, or losses? How does the impact on profits/losses differ between a high-risk bank and a low-risk bank as a result of t ...

Address to the 2010 Trades Union Congress in

... The fall of the Berlin Wall in 1989 changed both politics and economics. Within a few years, the former Soviet empire, China and other Asian economies, with their combined workforce of over a billion people, entered the world trading system as market economies. Their focus on export-led growth allow ...

... The fall of the Berlin Wall in 1989 changed both politics and economics. Within a few years, the former Soviet empire, China and other Asian economies, with their combined workforce of over a billion people, entered the world trading system as market economies. Their focus on export-led growth allow ...

Competition in Digital Financial Services in Bangladesh

... Bangladesh Bank the mobile money regulator in the country sees the existing bank led model suitable for the country while being open to new investment in innovation and technology Mobile operators are demonstrating the potential for social VAS, while MFS provider are coming up with various VAS in th ...

... Bangladesh Bank the mobile money regulator in the country sees the existing bank led model suitable for the country while being open to new investment in innovation and technology Mobile operators are demonstrating the potential for social VAS, while MFS provider are coming up with various VAS in th ...

Key Role of Financial Sector in Economic Growth

... This chart compares the stability of financial institutions in the main “emerging regions” of the world. It shows that the 29-country Emerging Europe region has the least stable financial institutions of any emerging region. The financial stability indicator represents the average weighted z-score o ...

... This chart compares the stability of financial institutions in the main “emerging regions” of the world. It shows that the 29-country Emerging Europe region has the least stable financial institutions of any emerging region. The financial stability indicator represents the average weighted z-score o ...

OTC Derivatives: Regulation

... MMFs (IOSCO) • General regulatory framework: collective investment schemes (CIS) • Valuation • Liquidity management • MMFs offering stable net asset value (NAV) • Use of credit ratings • Disclosure to investors • MMFs and repos ...

... MMFs (IOSCO) • General regulatory framework: collective investment schemes (CIS) • Valuation • Liquidity management • MMFs offering stable net asset value (NAV) • Use of credit ratings • Disclosure to investors • MMFs and repos ...

4.4 Planning37.38 KB

... Banks will be willing to take more risks in their banking activities, to potentially benefit the bank and the banker, because any negative costs or consequences which result will be felt by someone else, such as the government/ taxpayer or shareholder. The central bank is a lender of last resort: th ...

... Banks will be willing to take more risks in their banking activities, to potentially benefit the bank and the banker, because any negative costs or consequences which result will be felt by someone else, such as the government/ taxpayer or shareholder. The central bank is a lender of last resort: th ...

national securities

... Efforts to restrict costs were not particularly successful, given that personnel and administrative expenses increased by 5.8%, while provision and depreciation charges went up by 9.9% and 19.6% respectively. These expenses vindicate management efforts to restructure and improve both IT and human re ...

... Efforts to restrict costs were not particularly successful, given that personnel and administrative expenses increased by 5.8%, while provision and depreciation charges went up by 9.9% and 19.6% respectively. These expenses vindicate management efforts to restructure and improve both IT and human re ...

OTP Bank Plc. acquires Kulska banka

... Representing the buyer OTP Bank Plc., László Wolf, Deputy CEO and Sándor Móczár, integration advisor, and representing the main owners of Kulska banka a.d. Novi Sad (Kulska banka) – the bank offered for sale -, Zdravko Pavicevic, Chairman of the Board of Directors and Mita Katic, General Manager, ha ...

... Representing the buyer OTP Bank Plc., László Wolf, Deputy CEO and Sándor Móczár, integration advisor, and representing the main owners of Kulska banka a.d. Novi Sad (Kulska banka) – the bank offered for sale -, Zdravko Pavicevic, Chairman of the Board of Directors and Mita Katic, General Manager, ha ...

Patterns in international banking: Key take

... Singapore and the offices of banks located in the region that have a parent institution from a non-BIS reporting country (assuming these are headquartered in Asia). ...

... Singapore and the offices of banks located in the region that have a parent institution from a non-BIS reporting country (assuming these are headquartered in Asia). ...

Liquidity Coverage Ratio ( LCR )

... Denominator : Net Cash Flows Total Cash Outflows payable within 30 day period (Unless mentioned otherwise) ...

... Denominator : Net Cash Flows Total Cash Outflows payable within 30 day period (Unless mentioned otherwise) ...

Bank

A bank is a financial intermediary that creates credit by lending money to a borrower, thereby creating a corresponding deposit on the bank's balance sheet. Lending activities can be performed either directly or indirectly through capital markets. Due to their importance in the financial system and influence on national economies, banks are highly regulated in most countries. Most nations have institutionalized a system known as fractional reserve banking under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, known as the Basel Accords.Banking in its modern sense evolved in the 14th century in the rich cities of Renaissance Italy but in many ways was a continuation of ideas and concepts of credit and lending that had their roots in the ancient world. In the history of banking, a number of banking dynasties — notably, the Medicis, the Fuggers, the Welsers, the Berenbergs and the Rothschilds — have played a central role over many centuries. The oldest existing retail bank is Monte dei Paschi di Siena, while the oldest existing merchant bank is Berenberg Bank.