Banking Sector Performance in Latin America: Market Power versus

... implications for regulation, particularly in relation to mergers and antitrust policies. If the evidence favors the efficient structure hypothesis, then mergers (and market concentration in general) are motivated by efficiency considerations, which should increase consumer and producer’s surplus. If ...

... implications for regulation, particularly in relation to mergers and antitrust policies. If the evidence favors the efficient structure hypothesis, then mergers (and market concentration in general) are motivated by efficiency considerations, which should increase consumer and producer’s surplus. If ...

jyske bank group credit profile - Information for investors and

... branches throughout Denmark. The Jyske Bank Group is a Danish SIFI. With a CET1 ratio of 15.3 % as per 31 December 2014 the Jyske Bank Group is strongly capitalized and already compliant with the fully loaded CET1 requirements of the CRD IV and the Danish SIFI regulation. The Group remains well posi ...

... branches throughout Denmark. The Jyske Bank Group is a Danish SIFI. With a CET1 ratio of 15.3 % as per 31 December 2014 the Jyske Bank Group is strongly capitalized and already compliant with the fully loaded CET1 requirements of the CRD IV and the Danish SIFI regulation. The Group remains well posi ...

Word

... Businesses withhold cash and are not investing, which in turn raises balances on their current accounts. Despite the fact that in 2011 the slump of business deposits with notice period was viewed as dramatic – from CZK 28.2 billion to 1.7 billion, which almost annulled their balances – against the t ...

... Businesses withhold cash and are not investing, which in turn raises balances on their current accounts. Despite the fact that in 2011 the slump of business deposits with notice period was viewed as dramatic – from CZK 28.2 billion to 1.7 billion, which almost annulled their balances – against the t ...

financial stability - European Commission

... – Particularly vital for emerging economies with high share of foreign capital in the financial sector ...

... – Particularly vital for emerging economies with high share of foreign capital in the financial sector ...

The Great Depression Lesson 2 - What Do People Say?

... People couldn’t withdraw their money or get loans, lost their savings and lost confidence in the banking system, which caused bank panics. Homeowners couldn’t make payments, and builders couldn’t sell new houses. Banks were forced to foreclose on consumer loans. Banks could not resell the houses tha ...

... People couldn’t withdraw their money or get loans, lost their savings and lost confidence in the banking system, which caused bank panics. Homeowners couldn’t make payments, and builders couldn’t sell new houses. Banks were forced to foreclose on consumer loans. Banks could not resell the houses tha ...

Family Offices - SchulthessZimmermann Executive Search

... be a powerful incentive to draw in the wealthy, especially in emerging markets where foreign players may have a leg up; Switzerland’s powerful banking brand is evidence of this. That effectively means that advisors and other experts who face clients become the brand – they are the reason that wealth ...

... be a powerful incentive to draw in the wealthy, especially in emerging markets where foreign players may have a leg up; Switzerland’s powerful banking brand is evidence of this. That effectively means that advisors and other experts who face clients become the brand – they are the reason that wealth ...

Large American Banks and Economic Recovery

... sustain payments on houses. The ratio of individuals’ mortgage debt to income peaked in the 4th quarter of 2007, which corresponds to the Great Recession (Gelain, Lansing, and Natvik). The prices of houses increased, inflation took effect, and people were not earning money at the same rate as inflat ...

... sustain payments on houses. The ratio of individuals’ mortgage debt to income peaked in the 4th quarter of 2007, which corresponds to the Great Recession (Gelain, Lansing, and Natvik). The prices of houses increased, inflation took effect, and people were not earning money at the same rate as inflat ...

Financial Volatility and Growth

... moral hazard. Financial instability (or volatility) generally will worsen the problems of adverse selection and moral hazard and thus drive up the possibility of lending bad credits. Consequently, lenders will be reluctant to make more loans, thereby possibly leading to a steep decline in lending an ...

... moral hazard. Financial instability (or volatility) generally will worsen the problems of adverse selection and moral hazard and thus drive up the possibility of lending bad credits. Consequently, lenders will be reluctant to make more loans, thereby possibly leading to a steep decline in lending an ...

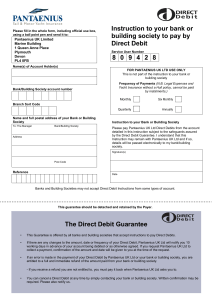

WAYS TO PAY FOR YOUR INSURANCE

... instruction is cancelled by you before the end of the Insurance Period, or if any direct debits are rejected by your bank, all the remaining premiums for the insurance year will immediately become payable in full. ...

... instruction is cancelled by you before the end of the Insurance Period, or if any direct debits are rejected by your bank, all the remaining premiums for the insurance year will immediately become payable in full. ...

- CIMB Group

... Overview of SMC Group Philippines’ most diversified conglomerate and one of the largest publicly listed companies Total revenue in 2011 is PHP536 bil (RM38.8 bil) contributed about 5% to the country’s GDP Subsidiaries and affiliates have very strong industryleading positions in key sectors of ...

... Overview of SMC Group Philippines’ most diversified conglomerate and one of the largest publicly listed companies Total revenue in 2011 is PHP536 bil (RM38.8 bil) contributed about 5% to the country’s GDP Subsidiaries and affiliates have very strong industryleading positions in key sectors of ...

Assessing financial stability in Poland Grzegorz Bielicki

... central banks to deal with banking crisis On EU level Memorandum of Understanding on high level principles of cooperation between the banking supervisors and central banks of the European Union in financial crisis situation (sign in 2003, Poland entered the MoU in July 2004) Memorandum of Unders ...

... central banks to deal with banking crisis On EU level Memorandum of Understanding on high level principles of cooperation between the banking supervisors and central banks of the European Union in financial crisis situation (sign in 2003, Poland entered the MoU in July 2004) Memorandum of Unders ...

Lecture 4

... Confusion #1: “Crowding Out” • Will increased capital requirements force banks to reduce lending and lead to a credit crunch? “Demands to increase capital will require the UK‘s banking industry to hold an extra 600bn pounds of capital that might otherwise have been deployed as loans to businesses o ...

... Confusion #1: “Crowding Out” • Will increased capital requirements force banks to reduce lending and lead to a credit crunch? “Demands to increase capital will require the UK‘s banking industry to hold an extra 600bn pounds of capital that might otherwise have been deployed as loans to businesses o ...

What Should Banks Do? - Levy Economics Institute of Bard College

... External finance in the form of shares and bonds financed the ownership of capital assets. This leads to the second type of bank, the investment bank. The function of an investment bank is to provide the external finance needed to put the produced capital goods into the hands of the entrepreneur. U ...

... External finance in the form of shares and bonds financed the ownership of capital assets. This leads to the second type of bank, the investment bank. The function of an investment bank is to provide the external finance needed to put the produced capital goods into the hands of the entrepreneur. U ...

The Challenge of Regulatory Implementation

... promising areas such as shared services or process effectiveness. Current headcount levels are unsustainable at projected revenues, and banks have engaged in multiple rounds of layoffs, damaging to internal morale and external reputation. Organizations should, instead identify a structure that is ap ...

... promising areas such as shared services or process effectiveness. Current headcount levels are unsustainable at projected revenues, and banks have engaged in multiple rounds of layoffs, damaging to internal morale and external reputation. Organizations should, instead identify a structure that is ap ...

Banking competition, risk, and regulation

... higher maximum mortgage in 1998 compared to 1994. The higher lending capacity by itself has had a upward effect on housing prices. This development has resulted in an increased vulnerability of certain categories of Dutch home-owners with respect to a possible decline in housing prices. As a consequ ...

... higher maximum mortgage in 1998 compared to 1994. The higher lending capacity by itself has had a upward effect on housing prices. This development has resulted in an increased vulnerability of certain categories of Dutch home-owners with respect to a possible decline in housing prices. As a consequ ...

E

... competitive operating environment, and potential consolidation with large state-owned or state-controlled enterprises and benefit within the industry. Indeed, according to a survey conducted by from economies of scale. Even in a fully liberalized interest China Banking Association and Pricewaterhous ...

... competitive operating environment, and potential consolidation with large state-owned or state-controlled enterprises and benefit within the industry. Indeed, according to a survey conducted by from economies of scale. Even in a fully liberalized interest China Banking Association and Pricewaterhous ...

22 - The Citadel

... 45. Discuss the advantages and disadvantages of a central bank. 46. Given the consequences of a loss in business confidence for factors influencing the money multiplier, be able to calculate the change in base money necessary to keep the money supply on target. Be able to determine exactly what the ...

... 45. Discuss the advantages and disadvantages of a central bank. 46. Given the consequences of a loss in business confidence for factors influencing the money multiplier, be able to calculate the change in base money necessary to keep the money supply on target. Be able to determine exactly what the ...

bank recapitalization and market concentration in ghana`s banking

... disadvantages. Between 1975 and 1997, the U.S banking industry experienced significant structural changes as a result of intense process of consolidation (mergers).The number of commercial banks decreased about 35% from 14,318 to 9, 215 (Cetorelli, 2000). Consolidation leads to larger banks and that ...

... disadvantages. Between 1975 and 1997, the U.S banking industry experienced significant structural changes as a result of intense process of consolidation (mergers).The number of commercial banks decreased about 35% from 14,318 to 9, 215 (Cetorelli, 2000). Consolidation leads to larger banks and that ...

Regulation of Islamic banks: Basel III capital framework and profit

... & Youssef, 2000; Muljawan et al., 2004), especially about banking regulation: to the best of our knowledge, academic literature does not provide a theoretical investigation between Basel III capital requirements and Islamic banking. To better understand implications of BCBC/IFSB capital requirements ...

... & Youssef, 2000; Muljawan et al., 2004), especially about banking regulation: to the best of our knowledge, academic literature does not provide a theoretical investigation between Basel III capital requirements and Islamic banking. To better understand implications of BCBC/IFSB capital requirements ...

The Argentine banking crises of 1995 and 2001: An exploration into

... 1. Background. From hyperinflation to price stability: the Convertibility plan of 1991. Ever since permanently abandoning the gold standard after the Great Depression, the Argentine economy exhibited chronically high inflation relative to the US or Europe. But extremely high inflation became a d ...

... 1. Background. From hyperinflation to price stability: the Convertibility plan of 1991. Ever since permanently abandoning the gold standard after the Great Depression, the Argentine economy exhibited chronically high inflation relative to the US or Europe. But extremely high inflation became a d ...

Belarus in recession, banking sector in difficulties

... held back by price controls. Under the impact of subdued credit demand, lending behaved similarly, although the rates of contraction in 2015 and early 2016 were somewhat less pronounced. In order to rein in excessive FX demand the NBRB implemented countermeasures in early 2015, including a ban on th ...

... held back by price controls. Under the impact of subdued credit demand, lending behaved similarly, although the rates of contraction in 2015 and early 2016 were somewhat less pronounced. In order to rein in excessive FX demand the NBRB implemented countermeasures in early 2015, including a ban on th ...

Evolution of bank and non-bank corporate funding in Peru

... The domestic bond market remains relatively small, even though it has a well functioning Treasury bond segment that provides a benchmark yield curve for the pricing of private sector issuances, and although the private pension funds (AFPs) have sufficient resources to encourage its development. The ...

... The domestic bond market remains relatively small, even though it has a well functioning Treasury bond segment that provides a benchmark yield curve for the pricing of private sector issuances, and although the private pension funds (AFPs) have sufficient resources to encourage its development. The ...

2. Overview of the Financial System

... example, Asser, 200l; Garcia, 2000). In the Guide, it is recommended that financial institutions in distress that otherwise meet the definition of a deposit taker continue to be included in the deposit-taking reporting population for calculating FSIs. Their assets and liabilities exist in the deposi ...

... example, Asser, 200l; Garcia, 2000). In the Guide, it is recommended that financial institutions in distress that otherwise meet the definition of a deposit taker continue to be included in the deposit-taking reporting population for calculating FSIs. Their assets and liabilities exist in the deposi ...

Banking in Spain - IESE Blog Network

... Similarly, deposits taken by the private sector account for 51.3 per cent of the balance sheet in Spain, which is 15 pp more than is the case for Europe’s banks as a whole. By contrast, there is less interbank activity in Spain, on both the asset and liability sides. The predominance of deposits as ...

... Similarly, deposits taken by the private sector account for 51.3 per cent of the balance sheet in Spain, which is 15 pp more than is the case for Europe’s banks as a whole. By contrast, there is less interbank activity in Spain, on both the asset and liability sides. The predominance of deposits as ...

Bank

A bank is a financial intermediary that creates credit by lending money to a borrower, thereby creating a corresponding deposit on the bank's balance sheet. Lending activities can be performed either directly or indirectly through capital markets. Due to their importance in the financial system and influence on national economies, banks are highly regulated in most countries. Most nations have institutionalized a system known as fractional reserve banking under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, known as the Basel Accords.Banking in its modern sense evolved in the 14th century in the rich cities of Renaissance Italy but in many ways was a continuation of ideas and concepts of credit and lending that had their roots in the ancient world. In the history of banking, a number of banking dynasties — notably, the Medicis, the Fuggers, the Welsers, the Berenbergs and the Rothschilds — have played a central role over many centuries. The oldest existing retail bank is Monte dei Paschi di Siena, while the oldest existing merchant bank is Berenberg Bank.