4-_chap013_ppt_edited

... 1 should not effect Bank 2 in below MBHC if it does then this is affiliate risk – Creditors of failed affiliate may lay claim to surviving bank’s resources – Effects of source of strength doctrine (Bank 1 sources can be used for Bank2 but courts do not want that) ...

... 1 should not effect Bank 2 in below MBHC if it does then this is affiliate risk – Creditors of failed affiliate may lay claim to surviving bank’s resources – Effects of source of strength doctrine (Bank 1 sources can be used for Bank2 but courts do not want that) ...

pedagogical concerns with reserve ratios and the new tool of the fed

... less than the currencies issued by a bank that was more conservative in printing money. It was difficult for merchants to know which currency was inflated and which was not given the many hundreds of banks in existence. Counterfeit currency was another problem that existed at the time. Although the ...

... less than the currencies issued by a bank that was more conservative in printing money. It was difficult for merchants to know which currency was inflated and which was not given the many hundreds of banks in existence. Counterfeit currency was another problem that existed at the time. Although the ...

Download attachment

... 2. Principle of risk in Islam Man generally believes that the future is uncertain and worries that exposure to uncertainties will lead to loss and personal injury. The exposure to such uncertainties constitutes risk that is defined by Elgari (2003) based on the Arabic word mutakharah, as the situati ...

... 2. Principle of risk in Islam Man generally believes that the future is uncertain and worries that exposure to uncertainties will lead to loss and personal injury. The exposure to such uncertainties constitutes risk that is defined by Elgari (2003) based on the Arabic word mutakharah, as the situati ...

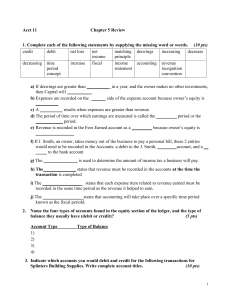

Acct 11 Chapter 5 Review

... a) If drawings are greater than ___________in a year, and the owner makes no other investments, then Capital will ___________ b) Expenses are recorded on the _______ side of the expense account because owner’s equity is __________ c) A __________ results when expenses are greater than revenue. d) Th ...

... a) If drawings are greater than ___________in a year, and the owner makes no other investments, then Capital will ___________ b) Expenses are recorded on the _______ side of the expense account because owner’s equity is __________ c) A __________ results when expenses are greater than revenue. d) Th ...

Senator Robert Owen of Oklahoma and the Federal Reserve`s

... In addition to the economic depression, credit had become increasingly tight at regular seasonal intervals in the quickly expanding agricultural regions of the Midwest, with limited access to credit during both the spring planting and fall harvest seasons. At these times of year, needed funds were s ...

... In addition to the economic depression, credit had become increasingly tight at regular seasonal intervals in the quickly expanding agricultural regions of the Midwest, with limited access to credit during both the spring planting and fall harvest seasons. At these times of year, needed funds were s ...

FREE Sample Here - We can offer most test bank and

... the United States. However, no one bank can control more than 30 percent of the deposits in any one state or more than 10 percent of the deposits across the country. Answer: Riegle-Neal Interstate Banking Act ...

... the United States. However, no one bank can control more than 30 percent of the deposits in any one state or more than 10 percent of the deposits across the country. Answer: Riegle-Neal Interstate Banking Act ...

A bankable future - Emerald Group Publishing

... First Mekong Financial Inclusion Forum in conjunction with several development partners. The Forum was aimed at strengthening the level of cooperation and knowledge exchange between countries and institutions in a drive towards financial inclusion within the Greater Mekong Subregion. Prior to the Fo ...

... First Mekong Financial Inclusion Forum in conjunction with several development partners. The Forum was aimed at strengthening the level of cooperation and knowledge exchange between countries and institutions in a drive towards financial inclusion within the Greater Mekong Subregion. Prior to the Fo ...

January 2017 Monetary Policy Statement

... arrears to the Fund in October 2016, are also expected to go a long way in reducing Zimbabwe’s country risk, thus attracting the much needed foreign investment. ...

... arrears to the Fund in October 2016, are also expected to go a long way in reducing Zimbabwe’s country risk, thus attracting the much needed foreign investment. ...

Jan Kregel and Leonardo Burlamaqui, Finance, Competition

... innovation diffusion, while the latter could be long lasting if organizational advantages can be protected from imitation. The innovations and innovative strategies that differentiate each firm from its competitors and create Schumpeterian rents will be protected from erosion by imitation only if at ...

... innovation diffusion, while the latter could be long lasting if organizational advantages can be protected from imitation. The innovations and innovative strategies that differentiate each firm from its competitors and create Schumpeterian rents will be protected from erosion by imitation only if at ...

Introduction to Business

... Checking accounts are tools that many people use to make payments. A checking account provides a way for consumers to manage their spending, make payments easily, and keep track of their funds. When they have a checking account, customers can access information online through the bank’s Web site. ...

... Checking accounts are tools that many people use to make payments. A checking account provides a way for consumers to manage their spending, make payments easily, and keep track of their funds. When they have a checking account, customers can access information online through the bank’s Web site. ...

mmi13 Zimmermann 19075478 en

... In the model economy, there is a continuum of measure one of households, each maximizing their expected discounted lifetime utility by choosing an optimal consumptionsavings path. A household can either be productive or retired, and the probability of a productive household retiring τ is exogenous.6 ...

... In the model economy, there is a continuum of measure one of households, each maximizing their expected discounted lifetime utility by choosing an optimal consumptionsavings path. A household can either be productive or retired, and the probability of a productive household retiring τ is exogenous.6 ...

Economic Policy Reactions

... from the counterparty – to be returned after a specified period; The transaction is treated as a ‘sale’ in which case the assets pledged, more than was necessary, can be removed from the balance sheet; Lehman Brothers would report its obligation to repurchase the securities at a fraction of the ...

... from the counterparty – to be returned after a specified period; The transaction is treated as a ‘sale’ in which case the assets pledged, more than was necessary, can be removed from the balance sheet; Lehman Brothers would report its obligation to repurchase the securities at a fraction of the ...

Pricing Bank Stocks: The Contribution of Bank Examinations

... one or more commercial banks and often has controlling interest in nonbank financial subsidiaries as well. It is the most common type of organizational structure in the industry; virtually all large banks have an affiliation with a BHC. The analysis focuses on the holding company because market data ...

... one or more commercial banks and often has controlling interest in nonbank financial subsidiaries as well. It is the most common type of organizational structure in the industry; virtually all large banks have an affiliation with a BHC. The analysis focuses on the holding company because market data ...

The usage of surveys to overrun data gaps: Bank Indonesia`s

... years, such as India, China, and some ASEAN countries including Indonesia. It seems that although central banks and governments have used wide-ranging policy tools to support the economy, no rigorous improvement of sentiment signal has yet been given. However, it is also realized that the restoratio ...

... years, such as India, China, and some ASEAN countries including Indonesia. It seems that although central banks and governments have used wide-ranging policy tools to support the economy, no rigorous improvement of sentiment signal has yet been given. However, it is also realized that the restoratio ...

The Instruments of Macroprudential Policy

... private sector were therefore vulnerable to a reversal in property prices, higher interest rates or an adverse shock prior to the global financial crisis. Since the crisis, credit dynamics have been weak as both banks and the private sector continue to engage in deleveraging. Volatile movements in t ...

... private sector were therefore vulnerable to a reversal in property prices, higher interest rates or an adverse shock prior to the global financial crisis. Since the crisis, credit dynamics have been weak as both banks and the private sector continue to engage in deleveraging. Volatile movements in t ...

Fast-growing Ghana and Cote d`Ivoire: Similarities and Differences

... important issue in Ghana given the current high interest rate environment. 3. Increases in minimum capital requirements: The current requirement for new entrants is GHS130mn ($65 mil) compared to GHS100mn ($50 mil) for the existing banks. This strengthens the banking system, but makes it harder for ...

... important issue in Ghana given the current high interest rate environment. 3. Increases in minimum capital requirements: The current requirement for new entrants is GHS130mn ($65 mil) compared to GHS100mn ($50 mil) for the existing banks. This strengthens the banking system, but makes it harder for ...

Key facts on central bank balance sheets in Asia and the Pacific

... macroeconomy and financial system, regardless of the particular policies driving the burgeoning balance sheets. The imbalances arise because the financial sector’s balance sheets are the natural counterparts to that of the central bank. In other words, the size and structure of a central bank balanc ...

... macroeconomy and financial system, regardless of the particular policies driving the burgeoning balance sheets. The imbalances arise because the financial sector’s balance sheets are the natural counterparts to that of the central bank. In other words, the size and structure of a central bank balanc ...

2 GOVERNMENT BORROWING FROM THE BANKING SYSTEM

... Perhaps the most important objective of TSA is effective control of cash which is a key element in monetary and budget management. It also aids efficient cash management which is necessary for reducing the need for borrowing by the government to meet its expenditure. Moreover, effective aggregate co ...

... Perhaps the most important objective of TSA is effective control of cash which is a key element in monetary and budget management. It also aids efficient cash management which is necessary for reducing the need for borrowing by the government to meet its expenditure. Moreover, effective aggregate co ...

Chapter 4 DEPOSITS IN BANKS

... Basic economic principles of supply and demand for goods and services push money through banks. The economy at large plays a far greater role in determining how money is moving than does the government. Slide 20 ...

... Basic economic principles of supply and demand for goods and services push money through banks. The economy at large plays a far greater role in determining how money is moving than does the government. Slide 20 ...

Mark Gertler Bernanke Working

... government deposit insurance does exist, it is usually accompanied by regulations which establish minimum capital requirements for a given amount of intermediation. We expect to address the effects of deposit insurance more directly in later research. The ability to provide liquidity insurance is no ...

... government deposit insurance does exist, it is usually accompanied by regulations which establish minimum capital requirements for a given amount of intermediation. We expect to address the effects of deposit insurance more directly in later research. The ability to provide liquidity insurance is no ...

Financial liberalization, market structure and credit

... Consider a small, closed and capital constrained economy, so that under a competitive domestic financial market, the internal deposit rate is higher than the world rate. When the economy liberalizes, the entry of foreign banks does not change the competitive situation of the internal financial syste ...

... Consider a small, closed and capital constrained economy, so that under a competitive domestic financial market, the internal deposit rate is higher than the world rate. When the economy liberalizes, the entry of foreign banks does not change the competitive situation of the internal financial syste ...

Bank Bailouts and Moral Hazard?

... default), the banks increase the loan investment as the ex post net worth is getting smaller; when the banks’ ex post net worth is below a certain level, they decrease the amount of loans as they are closer to the default. On the other hand, the risky debt amount shows a monotonically decreasing pa ...

... default), the banks increase the loan investment as the ex post net worth is getting smaller; when the banks’ ex post net worth is below a certain level, they decrease the amount of loans as they are closer to the default. On the other hand, the risky debt amount shows a monotonically decreasing pa ...

federally-insured money market funds and narrow

... The principal argument made for insuring only term-mismatched bank deposits – i.e., denying government insurance to all other cash management vehicles – is that insurance is necessary to entice savers to commit their short-term assets to long-term ventures, which creates liquidity that promotes econ ...

... The principal argument made for insuring only term-mismatched bank deposits – i.e., denying government insurance to all other cash management vehicles – is that insurance is necessary to entice savers to commit their short-term assets to long-term ventures, which creates liquidity that promotes econ ...

Bank capital and Risk-Taking: Old and New

... sector and does not exist elsewhere. Indeed, in the case of a collective failure, a bank is much more likely to be rescued than in the case of an isolated failure. It is therefore in the shareholders’ interests not only to take risks but also to take risks which are highly correlated with those of o ...

... sector and does not exist elsewhere. Indeed, in the case of a collective failure, a bank is much more likely to be rescued than in the case of an isolated failure. It is therefore in the shareholders’ interests not only to take risks but also to take risks which are highly correlated with those of o ...

Russian Banking System – the Current State and Prospects for the

... During the last decade the Russian banking system passed through the several stages of its development, including its establishments, a period of a rapid growth, an acute crisis and the recovery. The growth of the national banking system was predetermined by the demand for the banking services in th ...

... During the last decade the Russian banking system passed through the several stages of its development, including its establishments, a period of a rapid growth, an acute crisis and the recovery. The growth of the national banking system was predetermined by the demand for the banking services in th ...

Bank

A bank is a financial intermediary that creates credit by lending money to a borrower, thereby creating a corresponding deposit on the bank's balance sheet. Lending activities can be performed either directly or indirectly through capital markets. Due to their importance in the financial system and influence on national economies, banks are highly regulated in most countries. Most nations have institutionalized a system known as fractional reserve banking under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, known as the Basel Accords.Banking in its modern sense evolved in the 14th century in the rich cities of Renaissance Italy but in many ways was a continuation of ideas and concepts of credit and lending that had their roots in the ancient world. In the history of banking, a number of banking dynasties — notably, the Medicis, the Fuggers, the Welsers, the Berenbergs and the Rothschilds — have played a central role over many centuries. The oldest existing retail bank is Monte dei Paschi di Siena, while the oldest existing merchant bank is Berenberg Bank.