Banking System Notes

... lends money to banks • It is made up of 12 Federal Reserve Banks • The main job of the Fed is to enact policies to keep the economy of our country strong. • The president and the senate appoint the Chairman of the Fed ...

... lends money to banks • It is made up of 12 Federal Reserve Banks • The main job of the Fed is to enact policies to keep the economy of our country strong. • The president and the senate appoint the Chairman of the Fed ...

Lender of last resort

... market funding of capital market lending” and to focus on it as a means of financing assets, because at present by far the most important use of shadow banking instruments is to provide wholesale funding for investment banks and through them indirect financing of assets that sit on their balance she ...

... market funding of capital market lending” and to focus on it as a means of financing assets, because at present by far the most important use of shadow banking instruments is to provide wholesale funding for investment banks and through them indirect financing of assets that sit on their balance she ...

open market operations

... When banks need to borrow reserves from other banks they go to the Fed Funds Market. Banks offer their excess funds to other banks for overnight lending to meet their reserve requirements. The Federal Reserve does not decree this interest rate, but they use bonds to add or take from this pool of mon ...

... When banks need to borrow reserves from other banks they go to the Fed Funds Market. Banks offer their excess funds to other banks for overnight lending to meet their reserve requirements. The Federal Reserve does not decree this interest rate, but they use bonds to add or take from this pool of mon ...

Document

... Abstract: Defining financial stability is very difficult, and it is even harder to measure it. Generally speaking, a financial system can be characterized as stable in the absence of excessive volatility, stress or crises. This paper tries to give a clearer definition of financial stability and its ...

... Abstract: Defining financial stability is very difficult, and it is even harder to measure it. Generally speaking, a financial system can be characterized as stable in the absence of excessive volatility, stress or crises. This paper tries to give a clearer definition of financial stability and its ...

Lender of last resort: Put it on the agenda!

... devaluations is likely to be more severe. Policymakers will likely find it harder to ignore them, because their effects will become easily apparent to the general public. ...

... devaluations is likely to be more severe. Policymakers will likely find it harder to ignore them, because their effects will become easily apparent to the general public. ...

Slide 1

... Microcredit sector assets in 2008 amounted to KM 1.21 billion, which is by 28% bigger than in 2007. The largest part of MCOs assets is related to the loans (92.1%). and in the loans structure even 97.3% are loans to the ...

... Microcredit sector assets in 2008 amounted to KM 1.21 billion, which is by 28% bigger than in 2007. The largest part of MCOs assets is related to the loans (92.1%). and in the loans structure even 97.3% are loans to the ...

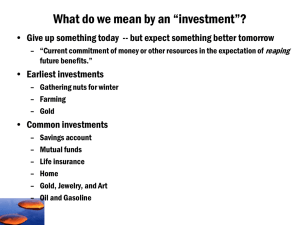

Chap001_overview

... • All financial assets (owner of the claim) are offset by a financial liability (issuer of the claim). • When we aggregate over all balance sheets, only real assets remain. • Hence the net wealth of an economy is the sum of its real assets. ...

... • All financial assets (owner of the claim) are offset by a financial liability (issuer of the claim). • When we aggregate over all balance sheets, only real assets remain. • Hence the net wealth of an economy is the sum of its real assets. ...

The Risk and Term Structure of Interest Rates

... (mortgage-backed securities), corporate loans, and other ABSs (assetbacked securities). CDOs are typically issued by investment banks. • Products of CDOs are popular among asset managers and investors, including insurance companies, mutual fund companies, investment trusts, commercial banks, investm ...

... (mortgage-backed securities), corporate loans, and other ABSs (assetbacked securities). CDOs are typically issued by investment banks. • Products of CDOs are popular among asset managers and investors, including insurance companies, mutual fund companies, investment trusts, commercial banks, investm ...

Australia Singapore Hong Kong Taiwan Leading

... system, achieved high customer satisfaction rate in its savings and online transaction ...

... system, achieved high customer satisfaction rate in its savings and online transaction ...

Christina Romer, Chair Council of Economic Advisors

... • When government debt loses value, bank net worth down . ...

... • When government debt loses value, bank net worth down . ...

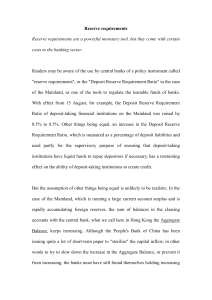

Reserve requirements

... is no reserve requirements for banks in Hong Kong, although our Banking Ordinance specifies a clearly defined statutory liquidity ratio for authorized institutions. ...

... is no reserve requirements for banks in Hong Kong, although our Banking Ordinance specifies a clearly defined statutory liquidity ratio for authorized institutions. ...

Topics in economic theory

... In the final chapter we extend the Walrasian model to a non-Walrasian formulation so as to be able to describe feasible and consistent allocations also when prices are not market-clearing due to imperfect flexibility. In the second part of the course we shall study, using formal microeconomics model ...

... In the final chapter we extend the Walrasian model to a non-Walrasian formulation so as to be able to describe feasible and consistent allocations also when prices are not market-clearing due to imperfect flexibility. In the second part of the course we shall study, using formal microeconomics model ...

Capital Markets Briefing (Lothar Mentel, CIO)

... nations which now include Italy, the world’s third largest debt issuer. So this time around it may not be so ...

... nations which now include Italy, the world’s third largest debt issuer. So this time around it may not be so ...

the PDF - The Clearing House

... the shadow banking system, not the traditional banking system. Like banks, the shadow banking system financed loans with deposits, but it did so through a chain of intermediation rather than within a bank. On the one side, “deposits” were provided by investors in money funds, eager to have a safe an ...

... the shadow banking system, not the traditional banking system. Like banks, the shadow banking system financed loans with deposits, but it did so through a chain of intermediation rather than within a bank. On the one side, “deposits” were provided by investors in money funds, eager to have a safe an ...

The Traditional Securitization Process Bank

... Banks are unable to securitize or syndicate these loans due to the decreased volume of new deals Even if they could sell off these unwanted loans, the prices would be low as spreads increase. SO: Banks did not really remove the risks from their balance sheets. Underestimate correlation between on an ...

... Banks are unable to securitize or syndicate these loans due to the decreased volume of new deals Even if they could sell off these unwanted loans, the prices would be low as spreads increase. SO: Banks did not really remove the risks from their balance sheets. Underestimate correlation between on an ...

Diapositiva 1 - European Parliament

... A EUROPEAN RECOVERY AND RESOLUTION FUND BASED ON A PRIVATELY FUNDED EQUITY BASE AND PUBLIC GUARANTEES TO ISSUE DEBT ON THE INTERNATIONAL MARKETS. FUNCTIONING OF THE FUND: Provides: finance and covered loans, guarantees and recapitalisation. Collateral can be accepted. All assistance should b ...

... A EUROPEAN RECOVERY AND RESOLUTION FUND BASED ON A PRIVATELY FUNDED EQUITY BASE AND PUBLIC GUARANTEES TO ISSUE DEBT ON THE INTERNATIONAL MARKETS. FUNCTIONING OF THE FUND: Provides: finance and covered loans, guarantees and recapitalisation. Collateral can be accepted. All assistance should b ...

1 - Massey University

... are only two goods: a nonstorable physical good used for consumption and production, and a capital good (land) used as collateral by borrowers and also as a productive asset. There are two classes of agents: entrepreneurs who own the technology and the productive asset (land), and lenders who receiv ...

... are only two goods: a nonstorable physical good used for consumption and production, and a capital good (land) used as collateral by borrowers and also as a productive asset. There are two classes of agents: entrepreneurs who own the technology and the productive asset (land), and lenders who receiv ...