monetary policy force effect by means of banks money creation

... lead to expected effects, the causes of failure can be foundnot only in the policy requirements, but also in banking activity, namely in the ...

... lead to expected effects, the causes of failure can be foundnot only in the policy requirements, but also in banking activity, namely in the ...

Financial Stability review January

... influence financial markets as well. Over the period the peripheries of the EU were in the epicenter of ongoing incremental stress in the financial market. The financial and political crisis in Greece and the banking system problems in Spain contributed to this tension. The problems that cause volat ...

... influence financial markets as well. Over the period the peripheries of the EU were in the epicenter of ongoing incremental stress in the financial market. The financial and political crisis in Greece and the banking system problems in Spain contributed to this tension. The problems that cause volat ...

THE IMPORTANCE OF THE BANKING SYSTEM

... citizens and to impose different policies. The entire Greek system (all the government parties, bankers, business interests, Media) wish for the aforementioned development, their goal being to perpetuate the existing situation, because, it quite simply benefits their interests. At the same time, the ...

... citizens and to impose different policies. The entire Greek system (all the government parties, bankers, business interests, Media) wish for the aforementioned development, their goal being to perpetuate the existing situation, because, it quite simply benefits their interests. At the same time, the ...

Opt for short-term debt funds as an alternative to FDs

... lending rates (IDBI and State Radhakrishnan said. Bank of Travancore cut them Investors who do not need last Friday), fixed-deposit rates their money for three years could fall further, given that may opt for short-term debt liquidity in the banking sys- funds, whose average maturitem is likely to r ...

... lending rates (IDBI and State Radhakrishnan said. Bank of Travancore cut them Investors who do not need last Friday), fixed-deposit rates their money for three years could fall further, given that may opt for short-term debt liquidity in the banking sys- funds, whose average maturitem is likely to r ...

Beyond Libor: The Evolution of `Risk-Free` Benchmarks

... Seidlstr. 24-24a, 80335 Munich, Germany) is authorised and regulated by the German Federal Financial Supervisory Authority (BaFin) (Marie-Curie-Str. 24-28, 60439 Frankfurt am Main) in Germany in accordance with Section 32 of the German Banking Act (KWG). The services and products provided by PIMCO D ...

... Seidlstr. 24-24a, 80335 Munich, Germany) is authorised and regulated by the German Federal Financial Supervisory Authority (BaFin) (Marie-Curie-Str. 24-28, 60439 Frankfurt am Main) in Germany in accordance with Section 32 of the German Banking Act (KWG). The services and products provided by PIMCO D ...

CVCFO Fund Administration

... foreign exchange and other brokerage activities, and principal investing as well as providing investment, corporate and private banking, asset and investment management, financing and strategic advisory services and other commercial services and products to a wide range of corporations, governments ...

... foreign exchange and other brokerage activities, and principal investing as well as providing investment, corporate and private banking, asset and investment management, financing and strategic advisory services and other commercial services and products to a wide range of corporations, governments ...

Third, it explores the evolution of market power in MENA countries

... frontier approach. Journal of Banking & Finance, 34(8), 1808–1817. [7] Carbó, S., Humphrey, D., Maudos, J., & Molyneux, P. 2009. Cross-country comparisons of competition and pricing power in European banking. Journal of International Money and Finance, 28(1), 115–134. [8] Claessens, S., Laeven, L., ...

... frontier approach. Journal of Banking & Finance, 34(8), 1808–1817. [7] Carbó, S., Humphrey, D., Maudos, J., & Molyneux, P. 2009. Cross-country comparisons of competition and pricing power in European banking. Journal of International Money and Finance, 28(1), 115–134. [8] Claessens, S., Laeven, L., ...

Economics

... Money Multiplier = 1/reserve ratio = The amount of money the banking system generates with each $1 of reserves This is the most money the system could generate, recall the assumptions: • Assume banks hold 10 percent of deposits as reserves. • Assume individuals hold no currency. ...

... Money Multiplier = 1/reserve ratio = The amount of money the banking system generates with each $1 of reserves This is the most money the system could generate, recall the assumptions: • Assume banks hold 10 percent of deposits as reserves. • Assume individuals hold no currency. ...

In search of Yield - Insight Investment

... October of this year, prime funds have converted to variable net asset values (NAVs) causing $1 trillion of assets to switch out of them into government MMFs, which have maintained a constant NAV. In Europe, MMF regulation is being finalised and is expected to be issued in early 2017. The seismic sh ...

... October of this year, prime funds have converted to variable net asset values (NAVs) causing $1 trillion of assets to switch out of them into government MMFs, which have maintained a constant NAV. In Europe, MMF regulation is being finalised and is expected to be issued in early 2017. The seismic sh ...

The Political Economy of Shadow Banking

... money manager mutual funds (or MMMFs, for short), who came to dominate an ever-growing share of financial flows after the elimination of interest rate ceilings on demand deposits in 1982. According to the Investment Company Institute (or ICI, for short), MMMFs comprise 17% of total assets held in mu ...

... money manager mutual funds (or MMMFs, for short), who came to dominate an ever-growing share of financial flows after the elimination of interest rate ceilings on demand deposits in 1982. According to the Investment Company Institute (or ICI, for short), MMMFs comprise 17% of total assets held in mu ...

GFSR Market Update

... resulted in a synchronized tightening of global monetary policies, and perceived downside risks for growth, triggering selling in global equity markets and an unwinding of leveraged carry-trade positions. The fall in investor risk appetite is a normal and healthy market adjustment that should better ...

... resulted in a synchronized tightening of global monetary policies, and perceived downside risks for growth, triggering selling in global equity markets and an unwinding of leveraged carry-trade positions. The fall in investor risk appetite is a normal and healthy market adjustment that should better ...

provisional agenda - RULG-Ukrainian Legal Group, PA

... circumstances. Euromoney Conferences accepts no responsibility for statements made orally or in written material distributed by any of its speakers at its conferences. In addition, Euromoney Conferences are not responsible for any copying, republication or redistribution of such ...

... circumstances. Euromoney Conferences accepts no responsibility for statements made orally or in written material distributed by any of its speakers at its conferences. In addition, Euromoney Conferences are not responsible for any copying, republication or redistribution of such ...

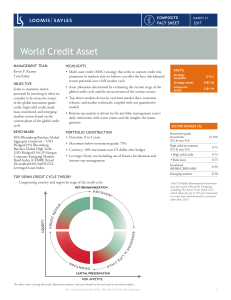

World Credit Asset

... The World Credit Asset Composite includes all discretionary accounts with market values greater than $75 million managed by Loomis Sayles that seek to maximize risk-adjusted returns by allocating across the credit spectrum based on macro analysis of economic regimes and the global credit cycle. Acce ...

... The World Credit Asset Composite includes all discretionary accounts with market values greater than $75 million managed by Loomis Sayles that seek to maximize risk-adjusted returns by allocating across the credit spectrum based on macro analysis of economic regimes and the global credit cycle. Acce ...

Supplement

... • Bank Liabilities can be divided into two parts. 1. Core Deposits – Demand Deposits, Savings Accounts, Small Time Deposits (Retail Funds) 2. Managed Liabilities – Borrowings from Other Banks, Securities, Large CD’s and Time Deposits (Wholesale Funds) • Retail funds have lower interest costs and are ...

... • Bank Liabilities can be divided into two parts. 1. Core Deposits – Demand Deposits, Savings Accounts, Small Time Deposits (Retail Funds) 2. Managed Liabilities – Borrowings from Other Banks, Securities, Large CD’s and Time Deposits (Wholesale Funds) • Retail funds have lower interest costs and are ...

Read more

... ivision in the United Kingdom as of 1 January 2017 . She will become a member of the Group Management Committee. Sadia will continue to develop the Bank in the United Kingdom where Societe Generale has a longstanding presence serving its UK and international clients. The Group’s expertise in the UK ...

... ivision in the United Kingdom as of 1 January 2017 . She will become a member of the Group Management Committee. Sadia will continue to develop the Bank in the United Kingdom where Societe Generale has a longstanding presence serving its UK and international clients. The Group’s expertise in the UK ...

Sudden stop of international capital inflows

... Kingdom and the United States faced a banking crisis (but not a currency or sovereign debt crisis). Iceland is now experiencing a twin crisis. Sovereign debt will be severely affected also, but due to a low initial debt ratio, sovereign debt should remain manageable, assuming fiscal consolidation in ...

... Kingdom and the United States faced a banking crisis (but not a currency or sovereign debt crisis). Iceland is now experiencing a twin crisis. Sovereign debt will be severely affected also, but due to a low initial debt ratio, sovereign debt should remain manageable, assuming fiscal consolidation in ...

Thursday, April 18

... In the years leading up to the most recent crisis, many nonbank financial insGtuGons adopted strategies that shared these basic elements: ...

... In the years leading up to the most recent crisis, many nonbank financial insGtuGons adopted strategies that shared these basic elements: ...

Mahesh Krishnamoorthy Chief Business Officer, Mahindra Integrated

... Mahindra Integrated Business Solutions (A Mahindra Group Entity) Over 15 years post qualification as a Chartered Accountant, in the Financial Services Industry with exposure at senior profiles in Insurance, Capital Markets, NBFC, Banking and Captive BPO, Mahesh has been the key resource in setting u ...

... Mahindra Integrated Business Solutions (A Mahindra Group Entity) Over 15 years post qualification as a Chartered Accountant, in the Financial Services Industry with exposure at senior profiles in Insurance, Capital Markets, NBFC, Banking and Captive BPO, Mahesh has been the key resource in setting u ...