(2005). “Deposit insurance and financial crises: Investigation

... when distinguishing between limited and unlimited deposit insurance coverage, they find that systems with limited coverage are strongly associated with a smaller probability of crisis. Chu (2003) uses contingency table analysis to test whether there is an association between the system of deposit in ...

... when distinguishing between limited and unlimited deposit insurance coverage, they find that systems with limited coverage are strongly associated with a smaller probability of crisis. Chu (2003) uses contingency table analysis to test whether there is an association between the system of deposit in ...

The Macro-Economic Effects of Directed Credit Policies: A Real

... massive expansion of priority lending up to 1988 and an appreciable reduction since 1991, when India began its process of structural reforms. The bulk of the priority lending accrues to farmers and small-scale industrialists. The aim of the priority lending scheme for agriculture was to facilitate t ...

... massive expansion of priority lending up to 1988 and an appreciable reduction since 1991, when India began its process of structural reforms. The bulk of the priority lending accrues to farmers and small-scale industrialists. The aim of the priority lending scheme for agriculture was to facilitate t ...

CAM Government Securities Investment Fund ANNUAL REPORT

... Government Securities issued by the Republic of Armenia or securities issued or fully guaranteed by the Central Bank of Armenia. The Fund is suitable for conservative investors who seek to achieve high returns and take advantage of the fund’s liquidity while not taking high risk. Class A is aimed fo ...

... Government Securities issued by the Republic of Armenia or securities issued or fully guaranteed by the Central Bank of Armenia. The Fund is suitable for conservative investors who seek to achieve high returns and take advantage of the fund’s liquidity while not taking high risk. Class A is aimed fo ...

PDF - Deutsche Bank

... Numbers may not add up due to rounding Includes exposure reductions related to NCOU across all other categories Comprised of EUR 75 bn from trade compression, tear-up, re-striking and process enhancements as well as EUR 30 bn from enhanced regulatory netting Comprised of cash and deposits with banks ...

... Numbers may not add up due to rounding Includes exposure reductions related to NCOU across all other categories Comprised of EUR 75 bn from trade compression, tear-up, re-striking and process enhancements as well as EUR 30 bn from enhanced regulatory netting Comprised of cash and deposits with banks ...

Outside Liquidity, Rollover Risk, and Government Bonds

... public claims are free from such risk. Satisfying liquidity needs by selling government securities in exchange for outside liquidity (referred to as public outside liquidity) may thus enhance efficiency and stability. We derive our results from a banking model in the tradition of Diamond and Dybvig ...

... public claims are free from such risk. Satisfying liquidity needs by selling government securities in exchange for outside liquidity (referred to as public outside liquidity) may thus enhance efficiency and stability. We derive our results from a banking model in the tradition of Diamond and Dybvig ...

The Corporate Governance Movement, Banks, and the Financial Crisis

... C.K. Prahalad and Yves Doz captured an important part of what was going on in a 2000 article on CEOs and wealth creation. They remarked upon “a new style of corporate leadership — one that includes a public persona for the CEO.”16 They asked whether “a more visible corporate leadership reflect[ed] a ...

... C.K. Prahalad and Yves Doz captured an important part of what was going on in a 2000 article on CEOs and wealth creation. They remarked upon “a new style of corporate leadership — one that includes a public persona for the CEO.”16 They asked whether “a more visible corporate leadership reflect[ed] a ...

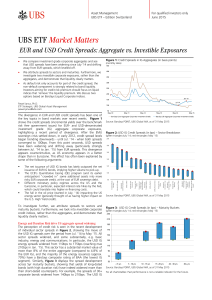

Market Matters EUR and USD Credit Spreads

... domicile of risk. Figure 4 shows USD IG credit spreads vs. liquidity, where liquidity is measured by the Liquidity Cost Score (LCS is the Barclays measure for liquidity in credit markets representing the round-trip cost, as a percent of a bond's price, of immediately executing a standard institution ...

... domicile of risk. Figure 4 shows USD IG credit spreads vs. liquidity, where liquidity is measured by the Liquidity Cost Score (LCS is the Barclays measure for liquidity in credit markets representing the round-trip cost, as a percent of a bond's price, of immediately executing a standard institution ...

Pathways PDS - North Online

... for each asset class to ensure they remain appropriate in light of any changes to the medium to long term risk and return expectations for each asset class. These reviews may lead to changes in the target allocations, which ipac may implement without notice to investors. ipac will not deviate outsid ...

... for each asset class to ensure they remain appropriate in light of any changes to the medium to long term risk and return expectations for each asset class. These reviews may lead to changes in the target allocations, which ipac may implement without notice to investors. ipac will not deviate outsid ...

Diversification, Pricing, Policy and Credit Union Risk

... With the deregulation of the financial system, globalisation of financial markets, a trend towards disintermediation and funds management, and technological advances, Australian depository institutions faced a highly competitive environment in the 1990s. This placed pressure on interest margins and ...

... With the deregulation of the financial system, globalisation of financial markets, a trend towards disintermediation and funds management, and technological advances, Australian depository institutions faced a highly competitive environment in the 1990s. This placed pressure on interest margins and ...

Emergency Economic Stabilization Act of 2008

... funds and private equity funds from the definition of “financial institution” on the basis that they are not “regulated,” even though, in some but not all cases, their investment advisers may be subject to regulatory supervision. Also, many hedge funds and at least some private equity funds are orga ...

... funds and private equity funds from the definition of “financial institution” on the basis that they are not “regulated,” even though, in some but not all cases, their investment advisers may be subject to regulatory supervision. Also, many hedge funds and at least some private equity funds are orga ...

Prospectus SEB Alternative Investment

... The Management Company, SEB Asset Management S.A., was established on 15 July 1988 with subsequent publication of the articles of incorporation in the Mémorial C on 16 August 1988. The articles of incorporation were amended for the last time on 6 March 2013 with subsequent publication in the Mémoria ...

... The Management Company, SEB Asset Management S.A., was established on 15 July 1988 with subsequent publication of the articles of incorporation in the Mémorial C on 16 August 1988. The articles of incorporation were amended for the last time on 6 March 2013 with subsequent publication in the Mémoria ...

Basel Committee guidance on accounting for IFRS 9 expected credit

... the use of the ‘low credit risk’ exemption and the ‘more than 30 days past due’ rebuttable presumption in relation to assessing significant increases in credit risk. We would encourage banks to talk to their local regulator about the extent to which their regulator expects the guidance to apply to t ...

... the use of the ‘low credit risk’ exemption and the ‘more than 30 days past due’ rebuttable presumption in relation to assessing significant increases in credit risk. We would encourage banks to talk to their local regulator about the extent to which their regulator expects the guidance to apply to t ...

Managing The Leverage Cycle

... Then leverage drastically curtailed by nervous lenders wanting more collateral ...

... Then leverage drastically curtailed by nervous lenders wanting more collateral ...

Systemic Risk in Hedge Funds

... topic. Also, systemic risk will be studied including the relevant factors and systems that this type of risk could bear. Next, secondary literature will help to determine the relationship that systemic risk factors have with hedge funds and hedge funds’ decisions. The in-depth investigation on hedge ...

... topic. Also, systemic risk will be studied including the relevant factors and systems that this type of risk could bear. Next, secondary literature will help to determine the relationship that systemic risk factors have with hedge funds and hedge funds’ decisions. The in-depth investigation on hedge ...

ESBies: Safety in the tranches

... First, in Section 4, simulations gauge ESBies’ safety. With a subordination level of 30%, ESBies have an expected loss rate slightly lower than German bunds. At the same time, they would approximately double the supply of safe assets relative to the status quo. The corresponding junior securities wo ...

... First, in Section 4, simulations gauge ESBies’ safety. With a subordination level of 30%, ESBies have an expected loss rate slightly lower than German bunds. At the same time, they would approximately double the supply of safe assets relative to the status quo. The corresponding junior securities wo ...

Federal Republic of Nigeria: Assessment of Community Banks

... creation of mini-commercial banks, low levels of market penetration, poor credit recovery performance, low degrees of financial intermediation and a concentration on clients without risks. As the NBCB did not introduce and enforce provisioning for bad debts, a superficial view of the balance sheets ...

... creation of mini-commercial banks, low levels of market penetration, poor credit recovery performance, low degrees of financial intermediation and a concentration on clients without risks. As the NBCB did not introduce and enforce provisioning for bad debts, a superficial view of the balance sheets ...

2010 Financial Report

... combined basis to focus on the University as a whole, including all of its relevant activities. Accordingly, consistent with the GASB principles, the Wayne State University Housing Authority (the “Housing Authority”) and the Wayne State University Foundation (the “Foundation”), as controlled corpora ...

... combined basis to focus on the University as a whole, including all of its relevant activities. Accordingly, consistent with the GASB principles, the Wayne State University Housing Authority (the “Housing Authority”) and the Wayne State University Foundation (the “Foundation”), as controlled corpora ...

Risky Banks and Macroprudential Policy for Emerging Economies Gabriel Cuadra Victoria Nuguer

... and speed at which these financial flows move raised some financial stability concerns in the recipient economies, Sánchez (2013) and Powell (2013). Overall, capital flows can be allocated to different markets and assets, with different implications for the development of financial imbalances. For ...

... and speed at which these financial flows move raised some financial stability concerns in the recipient economies, Sánchez (2013) and Powell (2013). Overall, capital flows can be allocated to different markets and assets, with different implications for the development of financial imbalances. For ...

mutual fund strategy

... Money market funds invest in money market instruments, which are fixed income securities with a very short time to maturity and high credit quality. Investors often use money market funds as a substitute for bank savings accounts, though money market funds are not insured by the government, unlike b ...

... Money market funds invest in money market instruments, which are fixed income securities with a very short time to maturity and high credit quality. Investors often use money market funds as a substitute for bank savings accounts, though money market funds are not insured by the government, unlike b ...

2014 results - Lloyds Banking Group

... current goals and expectations relating to its future financial condition and performance. Statements that are not historical facts, including statements about Lloyds Banking Group’s or its directors’ and/or management’s beliefs and expectations, are forward looking statements. By their nature, forw ...

... current goals and expectations relating to its future financial condition and performance. Statements that are not historical facts, including statements about Lloyds Banking Group’s or its directors’ and/or management’s beliefs and expectations, are forward looking statements. By their nature, forw ...

Collateral versus project screening: a model of lazy banks

... (1997) analyze how cross-state differences in U.S. personal bankruptcy rules affect the supply and demand for household credit, using data from the 1983 Survey of Consumer Finances. They find that generous state-level bankruptcy exemptions reduce the amount of credit available to low-asset household ...

... (1997) analyze how cross-state differences in U.S. personal bankruptcy rules affect the supply and demand for household credit, using data from the 1983 Survey of Consumer Finances. They find that generous state-level bankruptcy exemptions reduce the amount of credit available to low-asset household ...

Success of the 2014-2016 Business Development Plan

... synergies. Forward-looking statements are not guarantees of future performance and are subject to inherent risks, uncertainties and assumptions about BNP Paribas and its subsidiaries and investments, developments of BNP Paribas and its subsidiaries, banking industry trends, future capital expenditur ...

... synergies. Forward-looking statements are not guarantees of future performance and are subject to inherent risks, uncertainties and assumptions about BNP Paribas and its subsidiaries and investments, developments of BNP Paribas and its subsidiaries, banking industry trends, future capital expenditur ...

Mutual funds

... • A variant of index funds that are traded on an exchange. • The advantage of an ETF is that it can be traded throughout the day at continuously updated prices. • ETFs can be purchased on margin and sold short, unlike index funds. • There are no capital gains distributions to add to tax liabilitiy i ...

... • A variant of index funds that are traded on an exchange. • The advantage of an ETF is that it can be traded throughout the day at continuously updated prices. • ETFs can be purchased on margin and sold short, unlike index funds. • There are no capital gains distributions to add to tax liabilitiy i ...

When and how US dollar shortages evolved into the full crisis

... have taken this type of aggregate approach (Basel Committee on Banking Supervision, 2008). Financial institutions that had counted on an ability to transform their domestic currency into USD liquidity found themselves able to fund their USD assets only at a very high costs. The functioning of money ...

... have taken this type of aggregate approach (Basel Committee on Banking Supervision, 2008). Financial institutions that had counted on an ability to transform their domestic currency into USD liquidity found themselves able to fund their USD assets only at a very high costs. The functioning of money ...