Inflation vs Deflation

... However, according to Bussolo, De Hoyos and Medvedev (2008) from the World Bank, there is something changing right now, i.e. the emergence of a global middle class: “… a group of consumers who demand access to, and have the means to purchase, international goods and services. The results [from thei ...

... However, according to Bussolo, De Hoyos and Medvedev (2008) from the World Bank, there is something changing right now, i.e. the emergence of a global middle class: “… a group of consumers who demand access to, and have the means to purchase, international goods and services. The results [from thei ...

Document

... a. finance companies b. securities firms c. credit unions d. pension funds e. insurance companies © 2010 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or ot ...

... a. finance companies b. securities firms c. credit unions d. pension funds e. insurance companies © 2010 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or ot ...

Where Did All The Borrowing Go? Philip R. Lane

... International Monetary Fund and CEPR January 2008 Abstract The deterioration in the U.S. net external position in recent years has been much smaller than the extensive net borrowing associated with large current account deficits would have suggested. This paper examines the sources of discrepancies ...

... International Monetary Fund and CEPR January 2008 Abstract The deterioration in the U.S. net external position in recent years has been much smaller than the extensive net borrowing associated with large current account deficits would have suggested. This paper examines the sources of discrepancies ...

download

... within a 2-year period beginning January 1, 2008, if the grantee is still employed by the company at the time of the exercise. On the grant date, Nichols’ stock was trading at $25 per share, and a fair value option-pricing model determines total compensation to be $400,000. On May 1, 2008, 8,000 opt ...

... within a 2-year period beginning January 1, 2008, if the grantee is still employed by the company at the time of the exercise. On the grant date, Nichols’ stock was trading at $25 per share, and a fair value option-pricing model determines total compensation to be $400,000. On May 1, 2008, 8,000 opt ...

THE FINANCIAL SERVICES COMMISSION

... If yes, please supply details At any time in the previous 7 years, has an application been made for the bankruptcy or compulsory winding up of the Applicant/ Beneficial Owner or has the Applicant’s property been seized or Applicant’s property been seized or forfeited or relinquished by any other sim ...

... If yes, please supply details At any time in the previous 7 years, has an application been made for the bankruptcy or compulsory winding up of the Applicant/ Beneficial Owner or has the Applicant’s property been seized or Applicant’s property been seized or forfeited or relinquished by any other sim ...

Dreyfus Variable Investment Fund: International Value Portfolio

... The fund seeks long-term capital growth. To pursue its goal, the fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in stocks. The fund normally invests substantially all of its assets in the stocks of foreign companies, including those located in emer ...

... The fund seeks long-term capital growth. To pursue its goal, the fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in stocks. The fund normally invests substantially all of its assets in the stocks of foreign companies, including those located in emer ...

Working Paper 29: Overcoming barriers to institutional investment in

... Commercial property is regarded as a hybrid having both fixed interest investment characteristics, by virtue of its long leases and upward only rent reviews, and equity characteristics as rental growth can increase capital values. These characteristics, together with the low correlation with other a ...

... Commercial property is regarded as a hybrid having both fixed interest investment characteristics, by virtue of its long leases and upward only rent reviews, and equity characteristics as rental growth can increase capital values. These characteristics, together with the low correlation with other a ...

Transition Risk Toolbox - 2° Investing Initiative

... objectives may be more or less relevant to different market players. ‘Pricing’ concerns will likely be particularly relevant for companies, analysts, and investors. ‘Resilience’ concerns are likely more relevant for financial regulators with financial stability as part of their mandate, though may b ...

... objectives may be more or less relevant to different market players. ‘Pricing’ concerns will likely be particularly relevant for companies, analysts, and investors. ‘Resilience’ concerns are likely more relevant for financial regulators with financial stability as part of their mandate, though may b ...

Macroprudential Policy Frameworks and Tools

... is mixed.7 The Report highlights several themes that appear in the literature. Aggregate and sectoral capital-based tools appear to support financial system resilience and promote credit growth in economic downturns, though there is only limited evidence that these tools dampen the pace of credit gr ...

... is mixed.7 The Report highlights several themes that appear in the literature. Aggregate and sectoral capital-based tools appear to support financial system resilience and promote credit growth in economic downturns, though there is only limited evidence that these tools dampen the pace of credit gr ...

THE POLITICS OF FINANCIAL DEVELOPMENT: EVIDENCE FROM

... industries may weigh differently the benefits of easier access to credit associated with a more developed financial system against the costs of more intense competition. Using industry level data for a large cross section of countries we exploit the de-facto heterogeneous impact of cross-country fi ...

... industries may weigh differently the benefits of easier access to credit associated with a more developed financial system against the costs of more intense competition. Using industry level data for a large cross section of countries we exploit the de-facto heterogeneous impact of cross-country fi ...

Examiners` commentaries 2015

... discounted cash flow model is the present value of the end-of-year book value of equity in the terminal year. Explain. [5 marks] Reading for this question Penman, Chapter 5 (Accrual Accounting and Valuation: Pricing Book Values) provides a discussion of terminal (also known as continuing) value assu ...

... discounted cash flow model is the present value of the end-of-year book value of equity in the terminal year. Explain. [5 marks] Reading for this question Penman, Chapter 5 (Accrual Accounting and Valuation: Pricing Book Values) provides a discussion of terminal (also known as continuing) value assu ...

Systemic Risk: A New Trade-off for Monetary Policy?

... Taken together these frictions and their interaction with the real economy generate systemic risks: a fall in asset prices that induces a sufficiently large decline in the return on financial intermediaries’ equity renders them unable to raise equity. As a result, their portfolio becomes riskier, pr ...

... Taken together these frictions and their interaction with the real economy generate systemic risks: a fall in asset prices that induces a sufficiently large decline in the return on financial intermediaries’ equity renders them unable to raise equity. As a result, their portfolio becomes riskier, pr ...

Corporate Investments and Stock Returns: International Evidence*

... stocks with low book to market equity and that this book-to-market effect cannot be explained by the CAPM. For example, Fama and French (1992) find that the value premium is significantly positive in the U.S. stock market (see also Rosenberg, Reid, and Lanstein (1985) and others). Furthermore, Fama ...

... stocks with low book to market equity and that this book-to-market effect cannot be explained by the CAPM. For example, Fama and French (1992) find that the value premium is significantly positive in the U.S. stock market (see also Rosenberg, Reid, and Lanstein (1985) and others). Furthermore, Fama ...

SAP NetWeaver

... SAP ERP delivers a comprehensive set of integrated, cross-functional business processes. With SAP ERP, we can gain the following benefits: Improve alignment of strategies and operations Improve productivity and insight Reduce costs through increased flexibility Support changing industry requirements ...

... SAP ERP delivers a comprehensive set of integrated, cross-functional business processes. With SAP ERP, we can gain the following benefits: Improve alignment of strategies and operations Improve productivity and insight Reduce costs through increased flexibility Support changing industry requirements ...

Investment Strategy Statement

... qualified person in undertaking such a review. If, at any time, investment in a security or product not previously known to the Committee is proposed, appropriate advice is sought and considered to ensure its suitability and diversification. The Fund’s target investment strategy is set out below. Th ...

... qualified person in undertaking such a review. If, at any time, investment in a security or product not previously known to the Committee is proposed, appropriate advice is sought and considered to ensure its suitability and diversification. The Fund’s target investment strategy is set out below. Th ...

OPP 704 - Preliminary AD/ID/SC Assessment April 22, 2010

... then the market participant may include those start-up costs in the operating costs to be recovered in accordance with subsection 12(2). (4) The ISO must include as a line item in a power pool statement any charge to a pool participant under subsection 8 of section 103.6 of the ISO rules, ISO Fees a ...

... then the market participant may include those start-up costs in the operating costs to be recovered in accordance with subsection 12(2). (4) The ISO must include as a line item in a power pool statement any charge to a pool participant under subsection 8 of section 103.6 of the ISO rules, ISO Fees a ...

Angels, Entrepreneurship, and Employment

... suggesting complementarity between angels and financial markets geographically. Further, we provide evidence on how competitors and workers are affected by the resulting decline in business entry, demonstrating the importance of angels in the economy beyond the companies they directly fund. Our mea ...

... suggesting complementarity between angels and financial markets geographically. Further, we provide evidence on how competitors and workers are affected by the resulting decline in business entry, demonstrating the importance of angels in the economy beyond the companies they directly fund. Our mea ...

Chapter 11

... Why do we use the overall cost of capital for investment decisions even when only one source of capital will be used (e.g., debt)? Though an investment financed by low-cost debt might appear acceptable at first glance, the use of debt could increase the overall risk of the firm and eventually make a ...

... Why do we use the overall cost of capital for investment decisions even when only one source of capital will be used (e.g., debt)? Though an investment financed by low-cost debt might appear acceptable at first glance, the use of debt could increase the overall risk of the firm and eventually make a ...

Diversification, Pricing, Policy and Credit Union Risk

... This placed pressure on interest margins and profitability of traditional lines of business and generated pressures for institutions to cut costs, outsource back office functions, diversify into new activities, eliminate cross-subsidies, and increase non-interest income. Australian credit unions wer ...

... This placed pressure on interest margins and profitability of traditional lines of business and generated pressures for institutions to cut costs, outsource back office functions, diversify into new activities, eliminate cross-subsidies, and increase non-interest income. Australian credit unions wer ...

MSN Money Articles By Michael Burry 2000/2001

... diversification among industries and cyclicals vs. non-‐cyclicals? How much should one let tax implications affect investment decision-‐making? Is low turnover a goal? In large part this is a skill and perso ...

... diversification among industries and cyclicals vs. non-‐cyclicals? How much should one let tax implications affect investment decision-‐making? Is low turnover a goal? In large part this is a skill and perso ...

IAS33 suggestions

... understanding of users who do not have English as mother tongue. Besides, on 11A, I included the note you put on exposure draft. The idea is to simplify the text, to facilitate the understanding of users who do not have English as mother tongue. (b) profit or loss attributable to the parent entity 2 ...

... understanding of users who do not have English as mother tongue. Besides, on 11A, I included the note you put on exposure draft. The idea is to simplify the text, to facilitate the understanding of users who do not have English as mother tongue. (b) profit or loss attributable to the parent entity 2 ...

The Stoever Glass Municipal Bond Portfolio Planning Kit

... other out. If they didn’t, some bonds would never sell. For example, if a bond has a low coupon, the yield to maturity will have to be higher to make it saleable. Bonds with higher coupons are saleable at higher prices. Longer bonds need higher returns to compensate for their increased vulnerability ...

... other out. If they didn’t, some bonds would never sell. For example, if a bond has a low coupon, the yield to maturity will have to be higher to make it saleable. Bonds with higher coupons are saleable at higher prices. Longer bonds need higher returns to compensate for their increased vulnerability ...

How does investor sentiment affect stock market crises

... October 1987, for instance, remains enigmatic for researchers. During the crash, stock prices dropped an average of 22.6%, a decrease much larger than what can be explained by changes in economic variables (Black, 1988; Fama, 1989; Siegel, 1992). The view about the market "personality", the market b ...

... October 1987, for instance, remains enigmatic for researchers. During the crash, stock prices dropped an average of 22.6%, a decrease much larger than what can be explained by changes in economic variables (Black, 1988; Fama, 1989; Siegel, 1992). The view about the market "personality", the market b ...

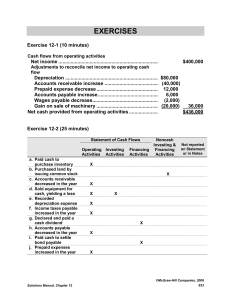

Cash flows from operating activities

... Cost of equipment sold ................................................................................. Accumulated depreciation of equipment sold ............................................. Book value of equipment sold ...................................................................... Gain o ...

... Cost of equipment sold ................................................................................. Accumulated depreciation of equipment sold ............................................. Book value of equipment sold ...................................................................... Gain o ...

Macquarie True Index Global Infrastructure Securities Fund

... invested and whether your investment portfolio will be appropriately diversified after making the investment. The value of your investment and the returns from your investment will vary over time. Future returns may differ from past returns. We do not guarantee the performance or returns of the Fund ...

... invested and whether your investment portfolio will be appropriately diversified after making the investment. The value of your investment and the returns from your investment will vary over time. Future returns may differ from past returns. We do not guarantee the performance or returns of the Fund ...