the neoliberal (counter)revolution

... example, Citigroup comprises more than 3000 corporations located in many countries, and its total assets amounted to 400 billion dollars in 2000). They combine the traditional banking and insurance activities with new functions, for example asset management, at an unprecedented scale. In the United ...

... example, Citigroup comprises more than 3000 corporations located in many countries, and its total assets amounted to 400 billion dollars in 2000). They combine the traditional banking and insurance activities with new functions, for example asset management, at an unprecedented scale. In the United ...

Answers to Midterm Test - November 1st, 2008

... Including the value of home production, the total well-being of the single parent family will be $43,000; the total well-being of the single-earner family will be $68,000; and the total well-being of the two-earner family will be $46,000. Horizontal equity says that individuals (or perhaps families) ...

... Including the value of home production, the total well-being of the single parent family will be $43,000; the total well-being of the single-earner family will be $68,000; and the total well-being of the two-earner family will be $46,000. Horizontal equity says that individuals (or perhaps families) ...

MARKETS - Man Group

... indices are shown for illustrative purposes only, may not be available for direct investment, are unmanaged, assume reinvestment of income, do not reflect the impact of any management incentive fees and have limitations when used for comparison or other purposes because they may have different volat ...

... indices are shown for illustrative purposes only, may not be available for direct investment, are unmanaged, assume reinvestment of income, do not reflect the impact of any management incentive fees and have limitations when used for comparison or other purposes because they may have different volat ...

How innovative financial products affect financial stability

... No matter whether we are fund raisers, investors, financial intermediaries or financial authorities, I think we all agree that financial stability is in the public interest, although occasionally we hear the contrary, and probably minority, view that, at least for traders in financial markets, stabi ...

... No matter whether we are fund raisers, investors, financial intermediaries or financial authorities, I think we all agree that financial stability is in the public interest, although occasionally we hear the contrary, and probably minority, view that, at least for traders in financial markets, stabi ...

franchise - McGraw Hill Higher Education

... • Cooperatives -- Businesses owned and controlled by the people who use it – producers, consumers, or workers with similar needs who pool their resources for mutual gain. ...

... • Cooperatives -- Businesses owned and controlled by the people who use it – producers, consumers, or workers with similar needs who pool their resources for mutual gain. ...

Competitiveness Solvency Wall

... rate. This desire to redistribute income can still be achieved using the personal tax system. That approach is better targeted than taxing corporate income, since many low and moderate income households own corporations via their pensions and 401(k)s. The true burden of corporation taxation falls no ...

... rate. This desire to redistribute income can still be achieved using the personal tax system. That approach is better targeted than taxing corporate income, since many low and moderate income households own corporations via their pensions and 401(k)s. The true burden of corporation taxation falls no ...

Financial Consulting Group, Inc.

... Currently taxpayers can convert traditional IRA’s and qualified retirement accounts, such as 401(k) accounts, to a Roth IRA as long as their adjusted gross income is under $100,000. In 2010 and for all subsequent tax years, the $100,000 limit is eliminated and all taxpayers will be permitted to conv ...

... Currently taxpayers can convert traditional IRA’s and qualified retirement accounts, such as 401(k) accounts, to a Roth IRA as long as their adjusted gross income is under $100,000. In 2010 and for all subsequent tax years, the $100,000 limit is eliminated and all taxpayers will be permitted to conv ...

Morgan Stanley Newsletter

... credit risk of the issuer. This is the risk that the issuer might be unable to make interest and/or principal payments on a timely basis. Bonds are also subject to reinvestment risk, which is the risk that principal and/or interest payments from a given investment may be reinvested at a lower intere ...

... credit risk of the issuer. This is the risk that the issuer might be unable to make interest and/or principal payments on a timely basis. Bonds are also subject to reinvestment risk, which is the risk that principal and/or interest payments from a given investment may be reinvested at a lower intere ...

Data Sources and Methods

... investment in way and structures. Investment expenditures, as defined by the ICC and STB, are found in reported expenditures for additions during the year (Schedule 330 in the R1 Reports) for road and equipment. Following Caves, Christensen, and Swanson (CCS) we add operating expenses associated wit ...

... investment in way and structures. Investment expenditures, as defined by the ICC and STB, are found in reported expenditures for additions during the year (Schedule 330 in the R1 Reports) for road and equipment. Following Caves, Christensen, and Swanson (CCS) we add operating expenses associated wit ...

Preparing for a Post-Year 15 LIHTC Property Re

... Careful planning is essential. Owners should strategically plan major capital improvements for the re-syndication in order to (1) meet the minimum requirements and long-term physical and financial needs; assess reserve for per-unit rehab costs to qualify for a new allocation of fund balances; review ...

... Careful planning is essential. Owners should strategically plan major capital improvements for the re-syndication in order to (1) meet the minimum requirements and long-term physical and financial needs; assess reserve for per-unit rehab costs to qualify for a new allocation of fund balances; review ...

Macroeconomic overview

... Strong growth in the market share to 7.9% (IQ 2004) from 6.9% in the end of June 2003 ...

... Strong growth in the market share to 7.9% (IQ 2004) from 6.9% in the end of June 2003 ...

Signs of Life - People Search Directory

... in SC pay the corporate income tax. Of those 11 percent, 68 percent were international corporations. Focusing on the corporate income tax is shortsighted and will do very little to encourage business location in South Carolina. However, property tax reform could significantly impact business locatio ...

... in SC pay the corporate income tax. Of those 11 percent, 68 percent were international corporations. Focusing on the corporate income tax is shortsighted and will do very little to encourage business location in South Carolina. However, property tax reform could significantly impact business locatio ...

Summer B 2015 Practice Test #1 - MDC Faculty Web Pages

... A) deciding whether a second burger is worth the extra $2 B) deciding whether your overtime pay is worth working on Saturday (your day off) C) deciding whether to pay a fine for polluting the local harbor or installing antipollution machinery D) All of these are examples of “thinking at the margin.” ...

... A) deciding whether a second burger is worth the extra $2 B) deciding whether your overtime pay is worth working on Saturday (your day off) C) deciding whether to pay a fine for polluting the local harbor or installing antipollution machinery D) All of these are examples of “thinking at the margin.” ...

The origins of the financial crisis: Crash course | The Economist

... of wholesale funding began to withhold short-term credit, causing those most reliant on it to founder. Northern Rock, a British mortgage lender, was an early casualty in the autumn of 2007. Complex chains of debt between counterparties were vulnerable to just one link breaking. Financial instruments ...

... of wholesale funding began to withhold short-term credit, causing those most reliant on it to founder. Northern Rock, a British mortgage lender, was an early casualty in the autumn of 2007. Complex chains of debt between counterparties were vulnerable to just one link breaking. Financial instruments ...

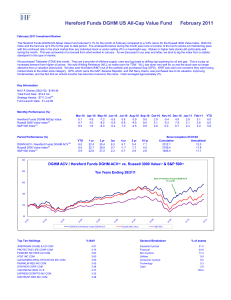

Click to download DGHM ACV FEBRUARY 2011

... (e) Share Class A is German tax registered from 27/5/10 and has applied for UK Reporting Fund Status for the year to September 2011. (f) Share Class D is German tax registered from 1/10/10. This document is for information purposes and internal use only. It is neither an advice nor a recommendation ...

... (e) Share Class A is German tax registered from 27/5/10 and has applied for UK Reporting Fund Status for the year to September 2011. (f) Share Class D is German tax registered from 1/10/10. This document is for information purposes and internal use only. It is neither an advice nor a recommendation ...

Capital components: debt, preferred stock, and common stock

... Any increase in total assets must be financed by an increase in one or more of these capital components Kd: the interest rate on the firm’s new debt Kps: the cost of preferred stock Ks: the cost of retained earnings Ke:the cost of common equity (equity obtained by issuing new common stock as app ...

... Any increase in total assets must be financed by an increase in one or more of these capital components Kd: the interest rate on the firm’s new debt Kps: the cost of preferred stock Ks: the cost of retained earnings Ke:the cost of common equity (equity obtained by issuing new common stock as app ...

ECCU_en.pdf

... marginally, by 0.9%, to 47.4% of GDP following the restructuring of some commercial bank debt in Antigua and Barbuda. The debt to GDP ratios were in excess of 100% in Grenada (113%) and Saint Kitts and Nevis (179%) and ranged from 70% to 90% in Antigua and Barbuda, Dominica, Saint Lucia and Saint Vi ...

... marginally, by 0.9%, to 47.4% of GDP following the restructuring of some commercial bank debt in Antigua and Barbuda. The debt to GDP ratios were in excess of 100% in Grenada (113%) and Saint Kitts and Nevis (179%) and ranged from 70% to 90% in Antigua and Barbuda, Dominica, Saint Lucia and Saint Vi ...

TIAA-CREF Congress Economic Stabilization Package 10-7

... Congress a proposal for recouping any losses incurred under the asset purchase program from those institutions that benefited from the program. This could take the form of some sort of tax or fee on the financial industry as a whole. ...

... Congress a proposal for recouping any losses incurred under the asset purchase program from those institutions that benefited from the program. This could take the form of some sort of tax or fee on the financial industry as a whole. ...

Press Release

... of non-recurrent item, repayment from Slovenská Inkasná (SI), the net profit grew by 17% y-o-y to CZK8.1 bn. The main earning drivers were further acquisitions of Retail, Corporate, and SME clients, growth of the mortgage business and growing volumes of AUM. The year 2005 was marked by further stren ...

... of non-recurrent item, repayment from Slovenská Inkasná (SI), the net profit grew by 17% y-o-y to CZK8.1 bn. The main earning drivers were further acquisitions of Retail, Corporate, and SME clients, growth of the mortgage business and growing volumes of AUM. The year 2005 was marked by further stren ...

Priorités de recherche et d`Analyse post-Hong Kong: le

... In the near-totality of services sectors, export capacities remain limited; opportunities for expansion exist but are not exploited Limited access to updated and targeted information Large number of services sub-sectors Difficulties in measuring the contribution of services sectors to development Ne ...

... In the near-totality of services sectors, export capacities remain limited; opportunities for expansion exist but are not exploited Limited access to updated and targeted information Large number of services sub-sectors Difficulties in measuring the contribution of services sectors to development Ne ...

How might bond finance expand affordable housing in Australia?

... of any specialist intermediary and the proposed social housing guarantee fund. Governments would have an important regulatory role ensuring funds raised are only allocated to registered organisations providing housing services; the housing is of a certain standard and not above a certain cost; and r ...

... of any specialist intermediary and the proposed social housing guarantee fund. Governments would have an important regulatory role ensuring funds raised are only allocated to registered organisations providing housing services; the housing is of a certain standard and not above a certain cost; and r ...

Current Developments in the Euro Area

... the threat of deflation, which is to say an expectations-driven downward wage-price spiral. Financial market participants seem to have a similar take on it: the probability, derived from inflation options, that the inflation rate will be negative in the next five years is now at its lowest point sin ...

... the threat of deflation, which is to say an expectations-driven downward wage-price spiral. Financial market participants seem to have a similar take on it: the probability, derived from inflation options, that the inflation rate will be negative in the next five years is now at its lowest point sin ...

Poverty concepts and measures

... Implications of Dutch Disease Increased Dependence on Boom and Non-Tradable (NT) Sectors Increased vulnerability to price shocks World commodity markets are very volatile NT sector adjusts through prices more than quantities Higher risks of macro instability Rising NT prices means infla ...

... Implications of Dutch Disease Increased Dependence on Boom and Non-Tradable (NT) Sectors Increased vulnerability to price shocks World commodity markets are very volatile NT sector adjusts through prices more than quantities Higher risks of macro instability Rising NT prices means infla ...

CommonSenseEconomics

... 22. An indexed equity mutual fund will provide shareholders with a return each year that is exactly equal to the change in the consumer price index during that year. False. The stockholdings of an indexed fund mirror the S&P 500 or another broad stock market index. Neither the return nor the compos ...

... 22. An indexed equity mutual fund will provide shareholders with a return each year that is exactly equal to the change in the consumer price index during that year. False. The stockholdings of an indexed fund mirror the S&P 500 or another broad stock market index. Neither the return nor the compos ...

Slovakia Czech Republic

... Their premium revenues that can invest transferred mostly to the treasury and they were not acting as a institutional investors. In case of social and health insurance the payments flowed directly into the government treasury and these flows were included directly into budget revenues and expenditur ...

... Their premium revenues that can invest transferred mostly to the treasury and they were not acting as a institutional investors. In case of social and health insurance the payments flowed directly into the government treasury and these flows were included directly into budget revenues and expenditur ...